Rich Abrahams

@rich_abrahams

Co-Founder & Co-CEO of @viasprout | VC | PE

ID: 927866825886584832

https://www.linkedin.com/in/richabrahams 07-11-2017 11:54:25

102 Tweet

59 Takipçi

68 Takip Edilen

Awesome to hear from SaaS guru Christoph Janz 🕊 about his key SaaS learning at #TechBBQ #SaaS #vc #startup

.Balderton Capital raises new $400M fund to back European tech startups at Series A 💰 techcrunch.com/2019/11/11/bal…

An Italian may have discovered America, but US VCs did not uncover European tech. Financial Times Letters: US venture capital is late to the party of Europe’s tech revival on.ft.com/3Bd8k6R

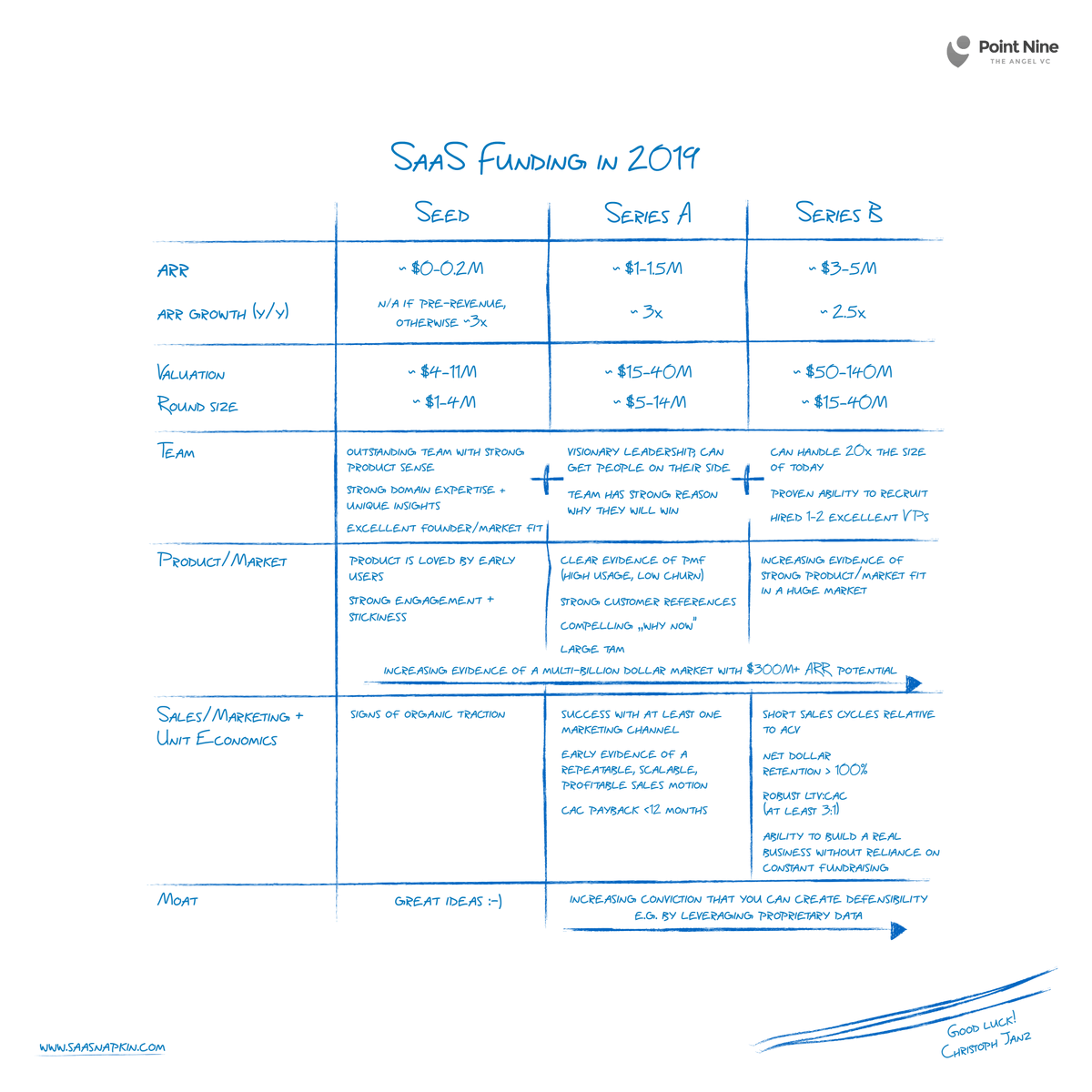

Since we're back to 2019 valuations, may as well bring back the #SaaS Funding Napkin via Christoph Janz 🕊 of Point Nine 🇺🇦 #vc

If you're a #SaaS founder this is an absolute must. Christoph Janz 🕊 knows his stuff, and the SaaS napkin is a staple in the VC ecosystem

Great to see the announcement of Speedinvest’s new €500m fundraise! Sprout is proud to have partnered on the flagship fund, Speedinvest IV, and to support as an LP. Looking forward to seeing the amazing businesses Speedinvest unearths. Congratulations to the whole team.