AltayCap

@altaycapitial

Long / Short equities. Value investor. Istanbul. Nothing I post is investment advice. altaycap.substack.com

ID: 2257446044

http://altayscap.substack.com 22-12-2013 08:11:48

64 Tweet

168 Followers

4,4K Following

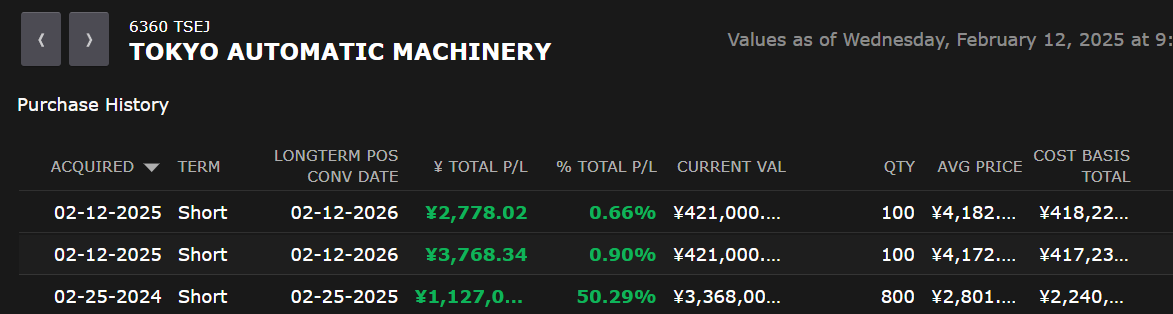

It's cheap and could stay cheap for a lot longer. The bet here is that management eventually just takes it private. Originally found the name through Value Trapped 🇸🇬 x.com/TheLongHappy/s…