GlobalData.TSLombard

@TS_Lombard

Independent macro, strategy and political research. Request a trial (investment professionals only) https://t.co/BHxLsWw5qE

ID:510529116

http://tslombard.com 01-03-2012 17:01:12

7,3K Tweets

8,0K Followers

775 Following

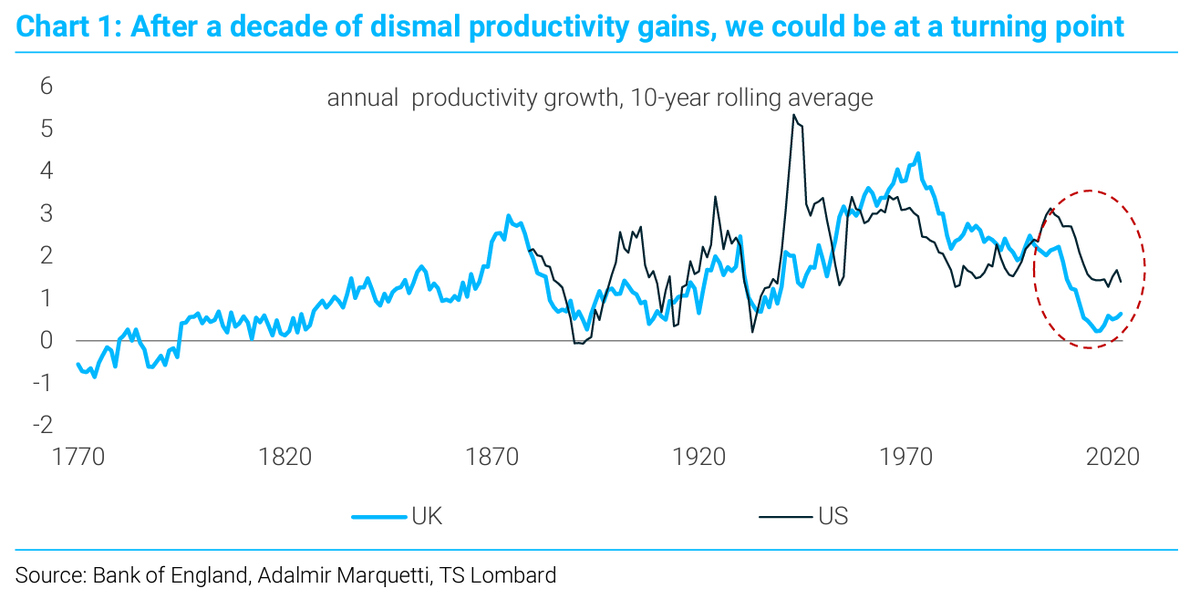

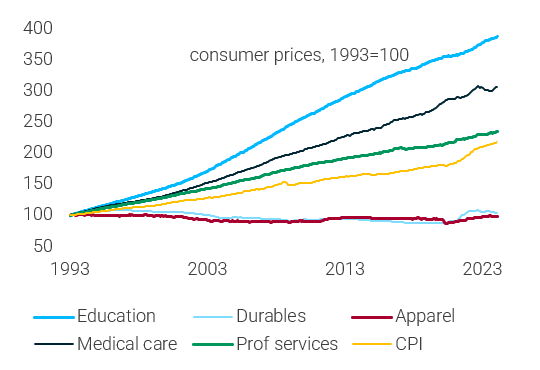

Fascinating chart from Dario Perkins The global economy continues to defy gloomy expectations. Inflation is back to tolerable levels, activity looks resilient, and nothing has broken in the financial system. But what about the longer-term trend for GDP and inflation? Our...

Great points (and chart) from Dario Perkins:

'...when you combine new technologies, a reflationary policy mix, rapid cost-reductions in green technologies, and high-pressure labour markets...I think you start to reverse the Great Mediocre of the 2010s'

GlobalData.TSLombard

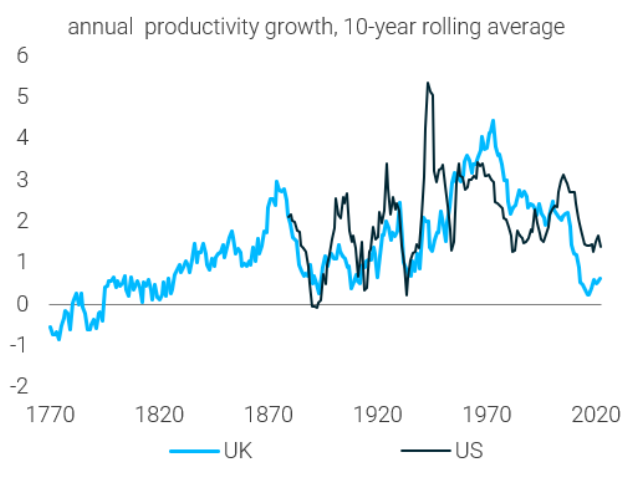

'Past technologies were good at creating GOODS deflation. The service sector was the Achilles' heel because it had mediocre productivity and there were bottlenecks of 'expensive decisions makers'. AI could ease these problems.'

Dario Perkins GlobalData.TSLombard

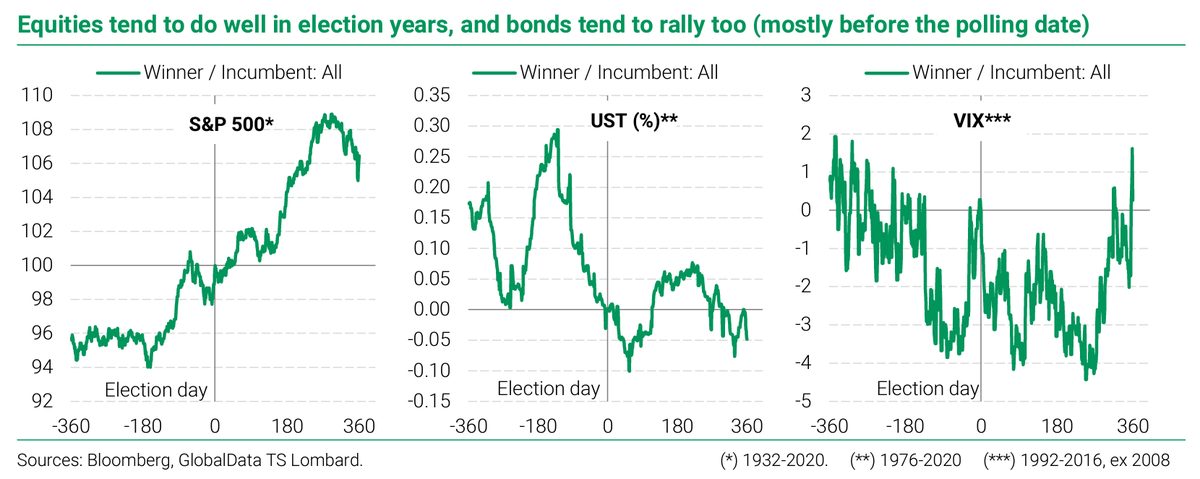

DO US ELECTIONS MATTER? Elections have historically been benign for asset markets. Since 1932, stocks have rallied fairly consistently on average during the period starting 3 months before the election and ending 9 months after the polling date. Bond yields fell Andrea Cicione

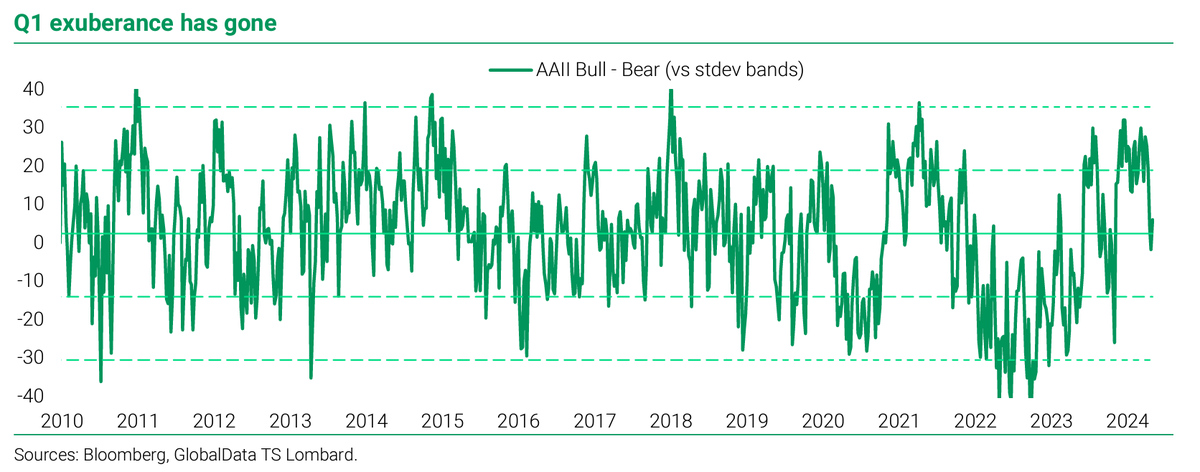

Equities:The market exuberance of Q1 is over: investors have turned more cautious, but they have mostly just rotated from US Tech to S&P 500. Earnings are expected to grow in all major equity markets. Valuations remain expensive in the US and a few other markets, Andrea Cicione

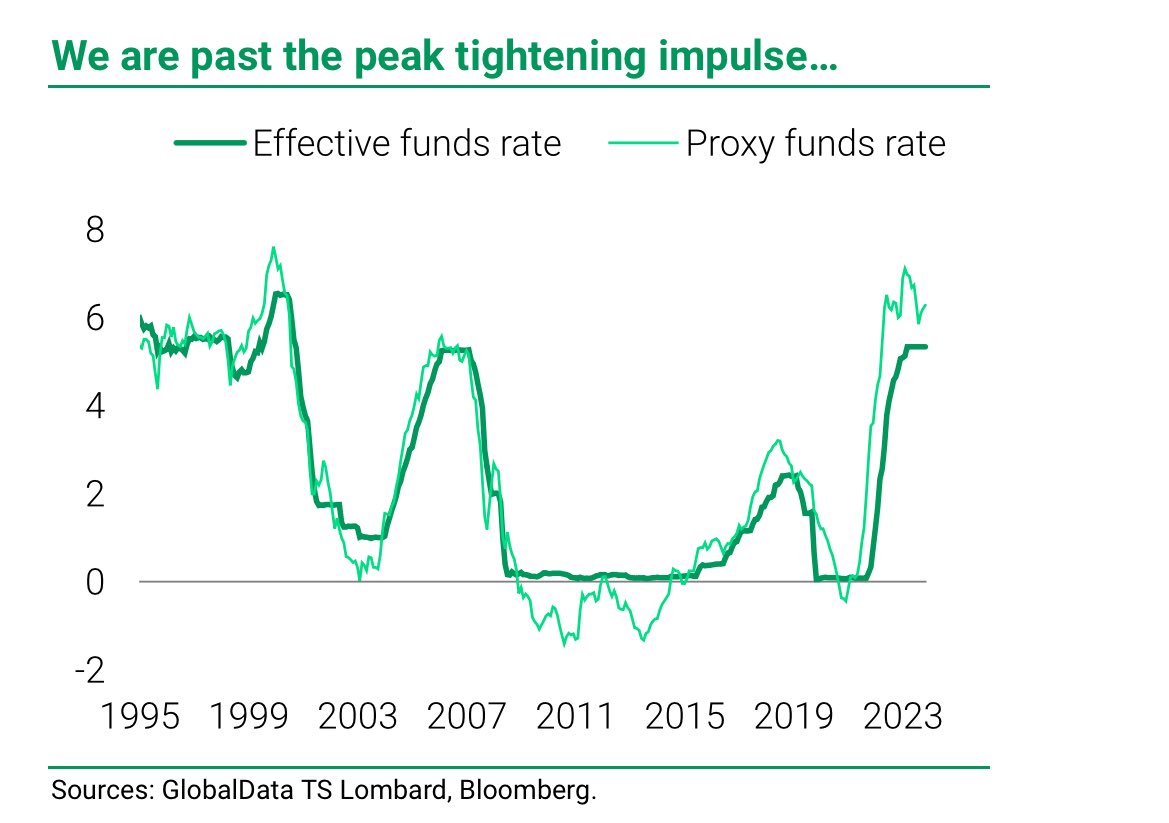

TS LOMBARD: “.. Goldilocks is wobbling .. a large miss on NFP .. weak PMI numbers .. but the fat-left tail of Fed hikes has been removed. .. The next policy move is a cut; and even if that cut is still months away, we are already past the peak tightening impulse ..”

GlobalData.TSLombard