GlobalData.TSLombard

@ts_lombard

Independent macro, strategy and political research. Request a trial (investment professionals only) info.tslombard.com/request-a-free…

ID: 510529116

http://tslombard.com 01-03-2012 17:01:12

7,7K Tweet

8,8K Followers

770 Following

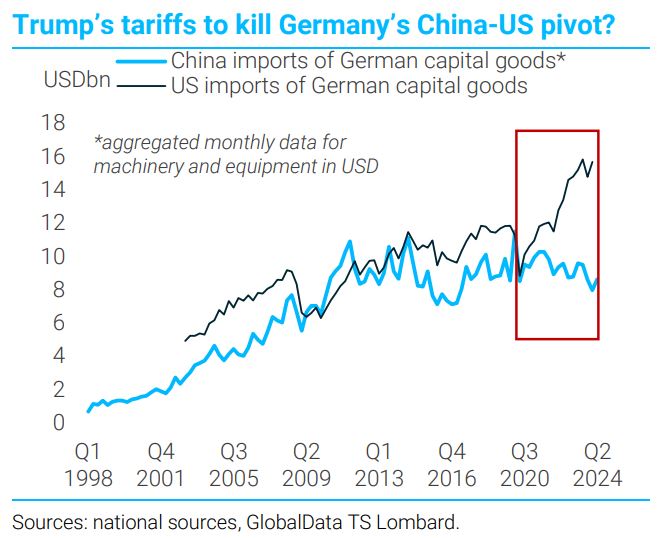

BROKEN CHINA. Today's stimulus will not be enough. Recession incoming Freya Beamish Rory Green with a high conviction call last week. "Alarm bells in China are ringing – This is the worst we've seen it for over 20 years." We project a nominal...

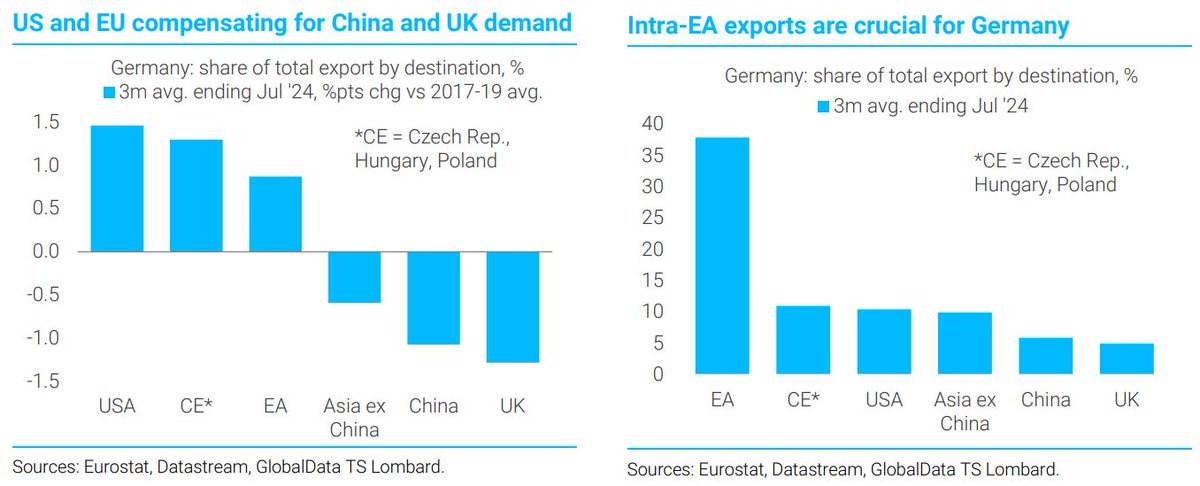

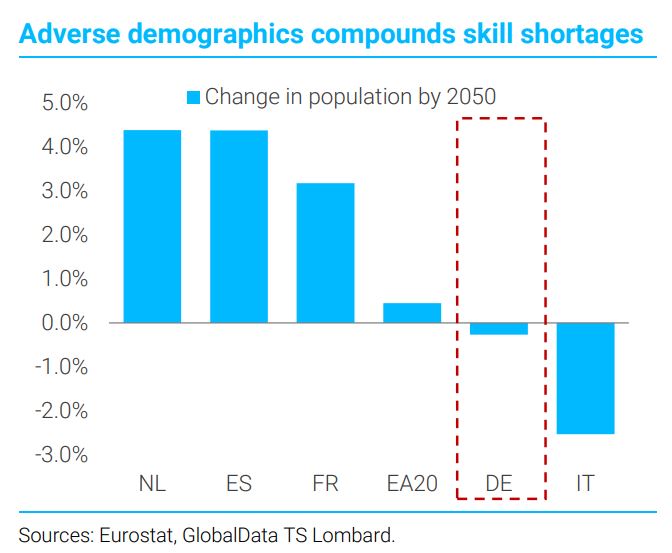

This is a tectonic shift, impacting many economies in Asia and Europe. The implications are way underreported. Ht GlobalData.TSLombard