Steven Engle, CFP®

@stevenengle22

Founder, Asbury Capital | Financial Planner for Gen Z's, Millennials, and Gen X'rs with equity compensation. Fintech Enthusiast @holistiplan

ID: 1358859703607042054

http://www.asbury-capital.com 08-02-2021 19:26:29

65 Tweet

246 Followers

111 Following

Hey Google Business Profile I need to submit a new verification video because the first one didn’t work. Can your team send me a link to do so? I’ve already asked multiple times and have yet to get a helpful response on how to fix it.

If I'm ever in a business partnership with someone, I hope we'd be able to part ways the way the co-founders of Holistiplan have. Very cool, very personal, very authentic video. vimeo.com/909276619

📈 Should you hire a financial advisor who charges an asset-based fee? Get to know financial advisors featured on Wealthtender. Currently in the Spotlight: 1️⃣ L. McKinley 2️⃣ Steven Engle, CFP® 3️⃣ @ewplanner #financialadvisors #financialplanning bit.ly/3Us5k2b

A new article with 💬 from Rebecca J. Conner, Theodore Joseph van Gerven, Ryan Furlong, Paul Monax, Steven Engle, and Eric Rodriguez published on Star Local Media. @seedsafer T.J. van Gerven, CFP® Ryan Furlong, CFP® Steven Engle, CFP® WealthBuilders LLC #wealthtenderquotes bit.ly/3wHsiYZ

We're so ready for the 2024 Tax Planning Summit, happening on 🗓️ April 23rd! Featuring experts like Jeff Levine, CPA/PFS, CFP®, Taylor Financial Group, Meaghan Dowd, and more! 🌟 Which session are you looking forward to the most? Learn more at hubs.ly/Q02rwtMC0

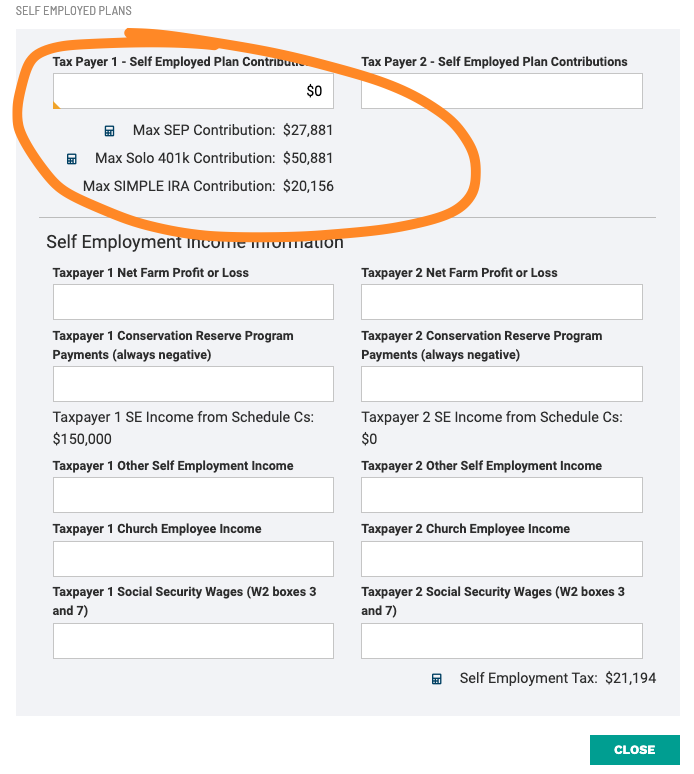

Great planning addition for my self-employed and small business clients. Holistiplan with some 🔥 updates. Automatic QBI adjustments and allowable self-employed retirement plan calculations (without manual adjustments or spreadsheet calculators!)