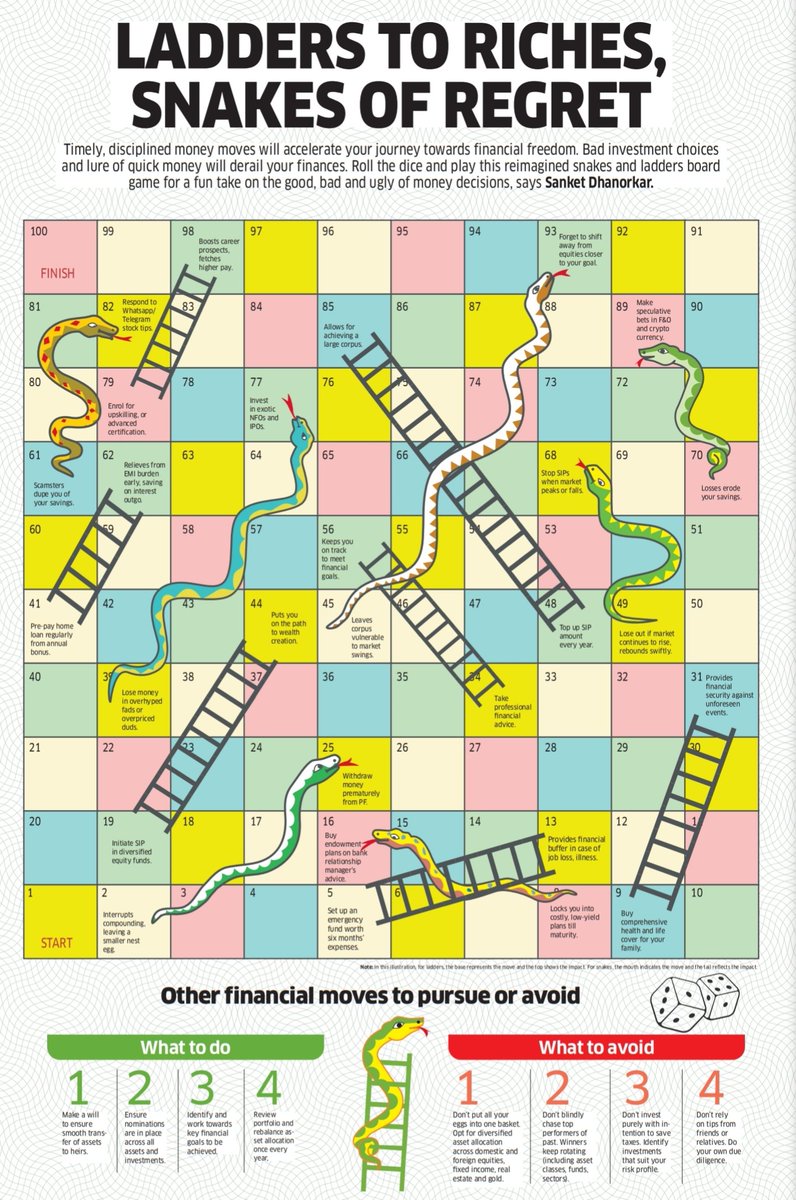

Sanket Dhanorkar

@sanketd_et

Senior Assistant Editor at The Economic Times. Covers personal finance for ET Wealth. Views personal.

ID: 4044171432

28-10-2015 07:42:34

3,3K Tweet

3,3K Followers

269 Following

NRIs are no longer Non Returning Indians! Many are actively pursuing a way back home🏠 But a tricky transition awaits returning NRIs: financial, logistical & behavioral. In this week's ET Wealth cover, we untangle the many complexities of this journey. economictimes.indiatimes.com/wealth/save/nr…

What makes Ajit Menon confident enough to retire at 55, when his career is at its peak and his salary is also expected to grow from here until his retirement age? He engaged with a financial planner years ago and has diligently stuck to his financial plan. But hold on. Does

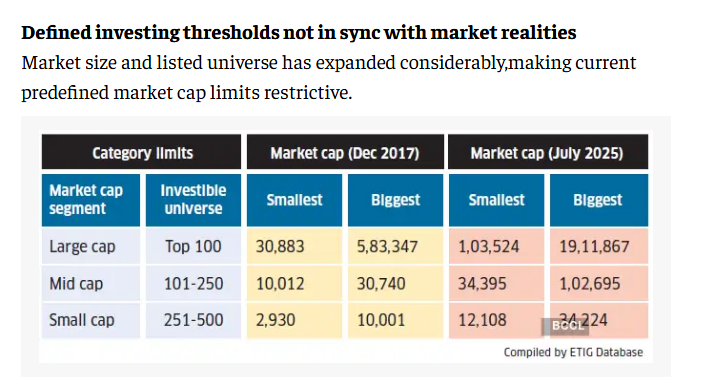

Nice data in the ET Sanket Dhanorkar Market cap universe need to be relooked at. It is already late. We have only 100 LC and 150 MC stocks Stocks are several times beigger than 7-8 yrs ago when a tight universe created. This has to be thought out well

If Donald Trump can negotiate a truce between Wasim Jaffer and Michael Vaughan he surely deserves a Nobel Peace Prize. What say?