S3 Partners

@s3partners

Real-time short interest data and analytics for investment processes, risk management and counterparty insights. FinTech solutions. Not investment advice.

ID: 2964381029

http://www.s3partners.com 06-01-2015 15:50:03

5,5K Tweet

37,37K Followers

1,1K Following

🚨 We've cracked the code on the market's most volatile stocks. Our Long-to-Short Ratio reveals "Battleground Stocks" where longs/shorts are at war. Don't get caught on the wrong side: tinyurl.com/5347xnmp Email us at [email protected] 👈👈 #Battlegroundstocks

Kohl’s stock skyrocketed today. Ihor Dusaniwsky🇺🇦 of S3 Partners describes it as a classic battleground stock marketwatch.com/story/kohls-st… via MarketWatch #Kohls $KSS

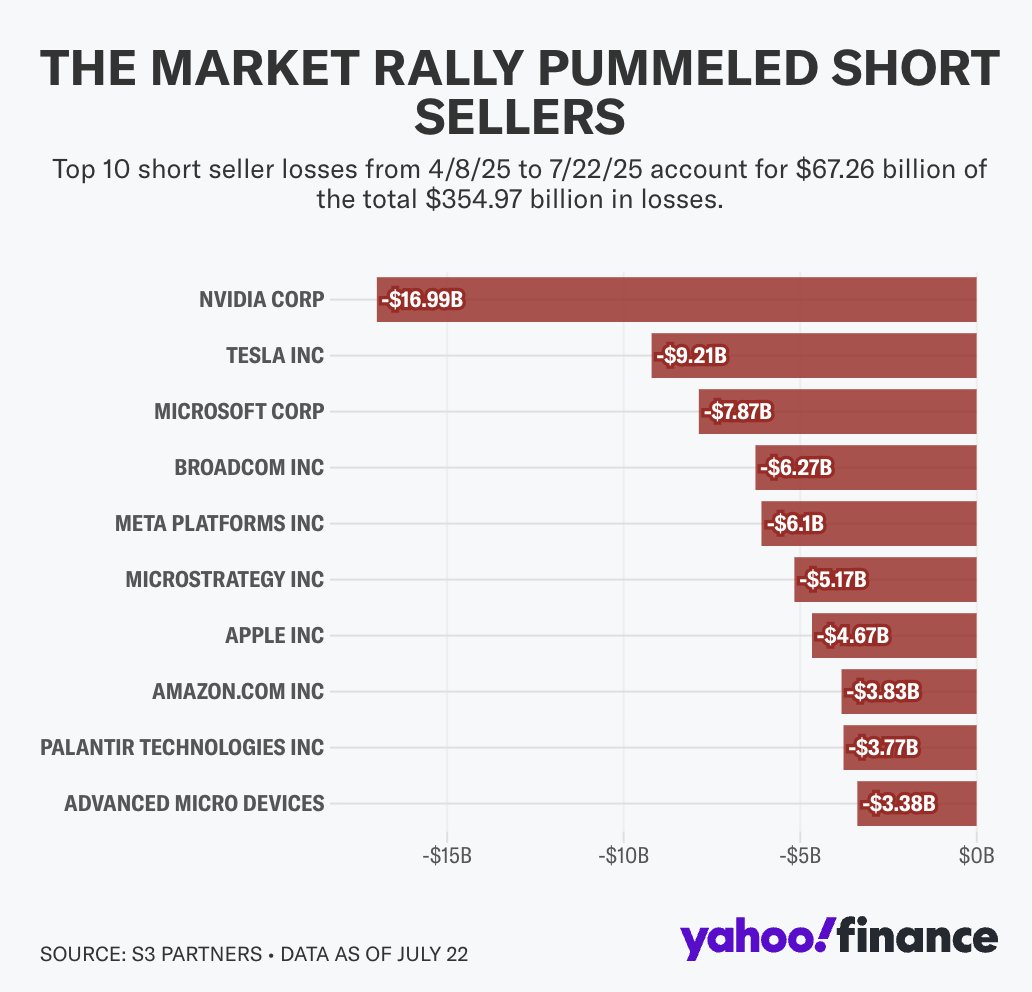

Meme stocks are just the latest example of shorts getting whacked since Apr. 8. "Expect continued short side losses as the economy grows, despite increased tariffs, and interest rates finally decline later this year," S3 Partners managing director Ihor Dusaniwsky told us.

Meme stocks are just the latest example of shorts getting whacked since Apr. 8. "Expect continued short side losses as the economy grows, despite increased tariffs, and interest rates finally decline later this year," S3 Partners managing director Ihor Dusaniwsky told us.