Ryan Detrick, CMT

@ryandetrick

Chief Market Strategist at @CarsonGroupLLC

🔎 for the perfect BBQ and host to the Facts vs Feelings podcast

Advisory services through CWM, LLC, RIA

ID: 21232827

https://www.carsongroup.com/research 18-02-2009 19:45:42

62,62K Tweet

176,176K Followers

1,1K Following

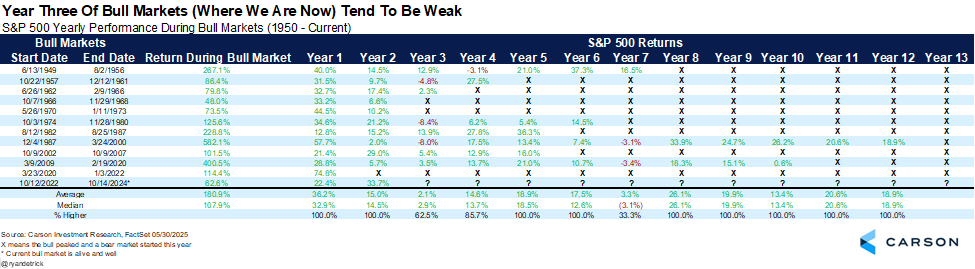

Have you ever seen a bull smile? Turns out a huge gain in May will do the trick. I take a look at why this strong month is a clue the 🐂 s are back in our latest Carson Investment Research blog. carsongroup.com/insights/blog/…

A sign that the tariff mess is still here 🤔 In May S&P 500: +6.15% Russell 2000: +5.20% But R2k was outperforming S&P 500 by ~ 270 bps after the China tariff pause. Completely reversed by month-end S&P 500 ended up out-performing by 95 bps! Ryan Detrick, CMT Carson Investment Research

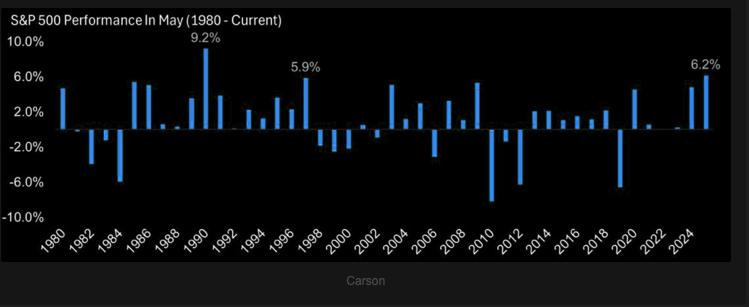

The S&P 500 just had its best month of May since 1990. Tariffs won't derail a century of up and to the right. (h/t Ryan Detrick, CMT)

🇺🇸 S&P 500 Historically, the first two years of a bull market tend to deliver robust returns. While the third year may test investors' patience, historical trends suggest that better times often follow 👉 isabelnet.com/?s=S%26P+500 h/t Ryan Detrick, CMT $spx #spx

Single Best Month of May for Stocks in the last 35 years h/t Carson Investment Research