Ryan Detrick, CMT

@RyanDetrick

Chief Market Strategist at @CarsonGroupLLC

🔎 for the perfect BBQ and host to the Facts vs Feelings podcast

Advisory services through CWM, LLC, RIA

ID:21232827

https://www.carsongroup.com/insights/blog/ 18-02-2009 19:45:42

56,1K Tweets

149,0K Followers

1,3K Following

Thanks again to Carol Massar and Tim Stenovec for having me on Bloomberg Radio yesterday!

A fast nine minutes, packed with a lot of great discussion.

We start at the 32:00 mark.

open.spotify.com/episode/00KPaL…

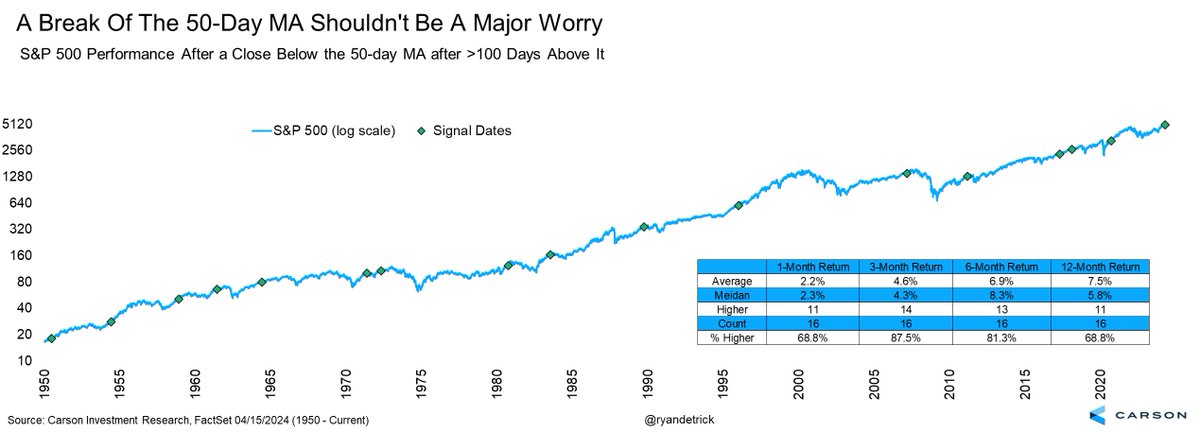

The March peak near SPX 5250 was attended by breadth & momentum readings not typical of cyclical tops. This doesn’t preclude a scary drawdown, however, perhaps into late May per election-year seasonality. Great perspective from Ryan Detrick, CMT

Thanks again to Katie Greifeld for having me on Bloomberg TV today!

It was fun as always and appreciate the opportunity.

I start at the 4:40 mark.

bloomberg.com/news/videos/20…

Fun lunch in NYC with some great friends.

Frank Cappelleri Matt Cerminaro Josh Schafer caleb silver Sonu Varghese Jay Woods

Great to chat with Phil Rosen today!

Be sure to sign up for his new newsletter Opening Bell Daily🔔. A great way to start each day.

Sonu Varghese

Retail sales 🔥

+0.7% in March, despite lower auto sales

+3.2% in Q1 (annualized)

Thanks to surging online sales.

Control group sales +1.1% in March

+5.6% in Q1 💪

Meanwhile ...

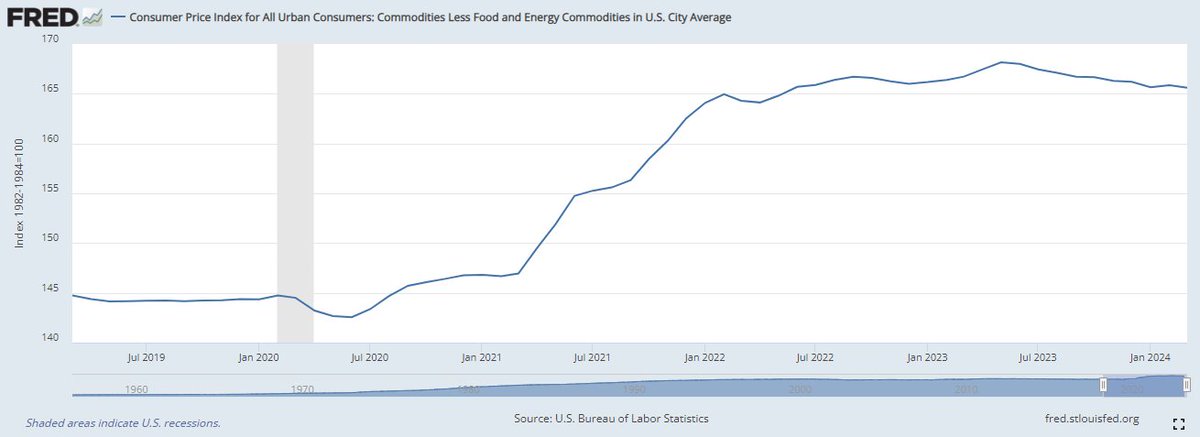

CPI - commodities ex food and energy: -1.4% in Q1 (annualized)

Carson Investment Research Ryan Detrick, CMT

“Of the 31 companies that have reported so far (6% of the S&P 500): Overall, 84% are beating estimates, and those that “beat” are beating by a median of 10%.” Thomas (Tom) Lee (not drummer) FSInsight.com