Roni Israelov

@RoniIsraelov

Quant researcher, Ph.D. Views presented are my own and are not investment advice

ID:228726871

https://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=437885 20-12-2010 14:19:31

653 Tweets

3,4K Followers

984 Following

Corey Hoffstein 🏴☠️ Roni Israelov HULK’S FAVORITE PAPER TO SEND TO FOOLS THAT DON’T REALLY UNDERSTAND HOW BUY-WRITE STRATS WORK.

𝓩* Jon Arnell åh nästa intricacy.

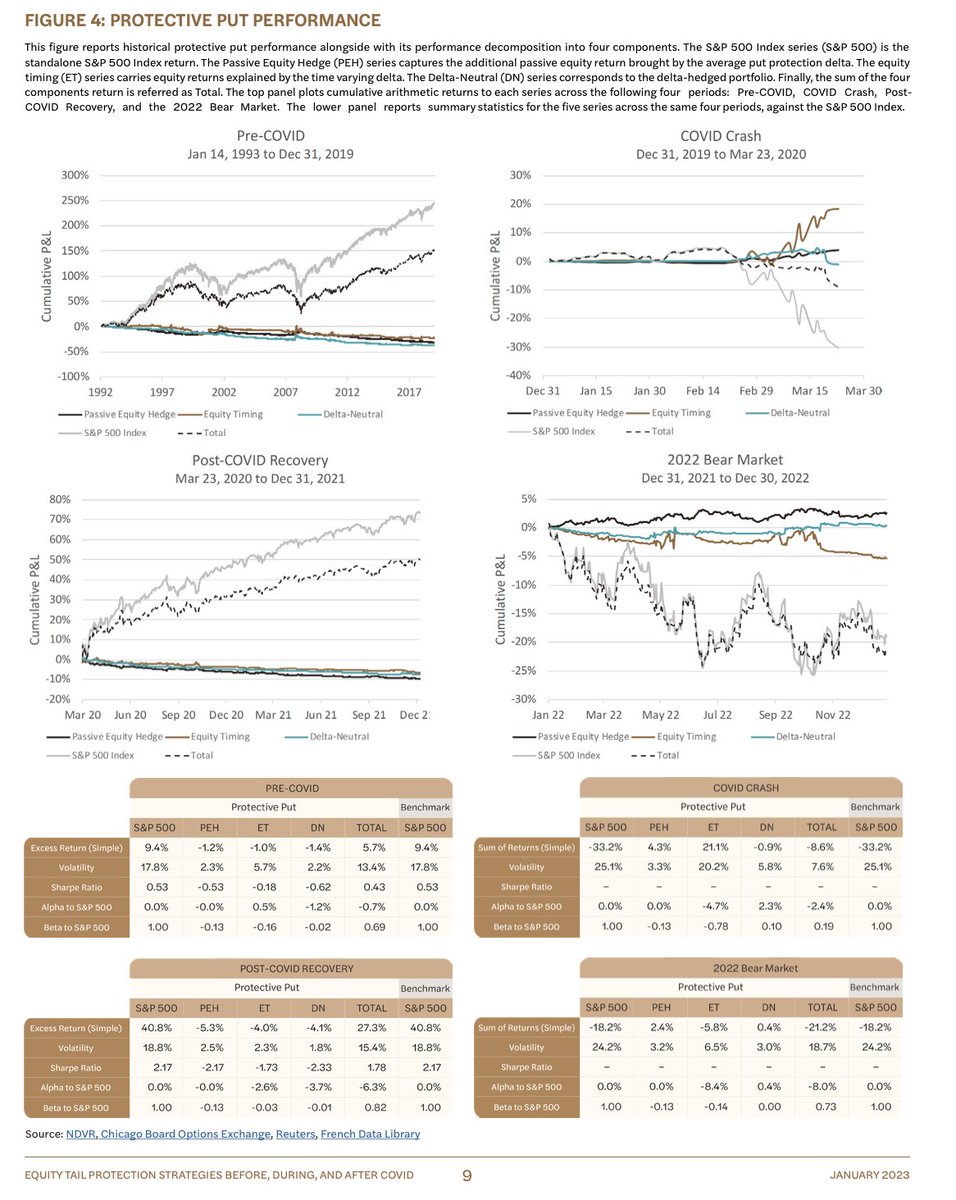

Som Roni Israelov visat, optioner skyddar inte alltid på det sättet man väntar sig.

Om man hade en delta neutral optionsstruktur under covid krashen hade begränsad lönsamhet.

Hela lönsamheten under denna period fanns i deltan i optionerna.

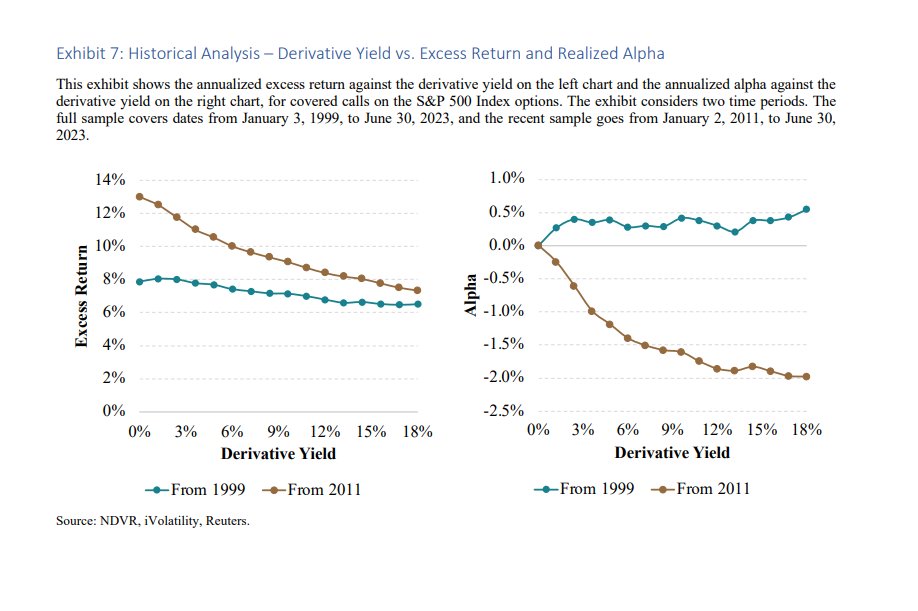

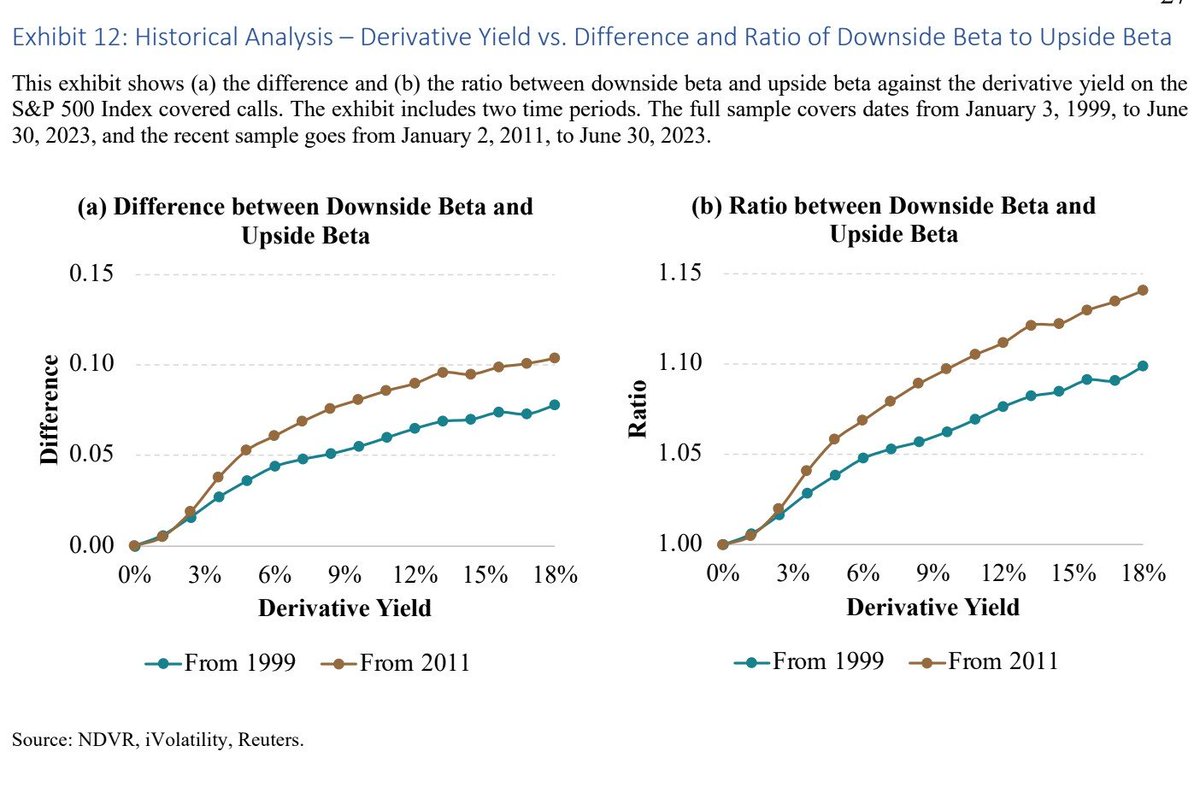

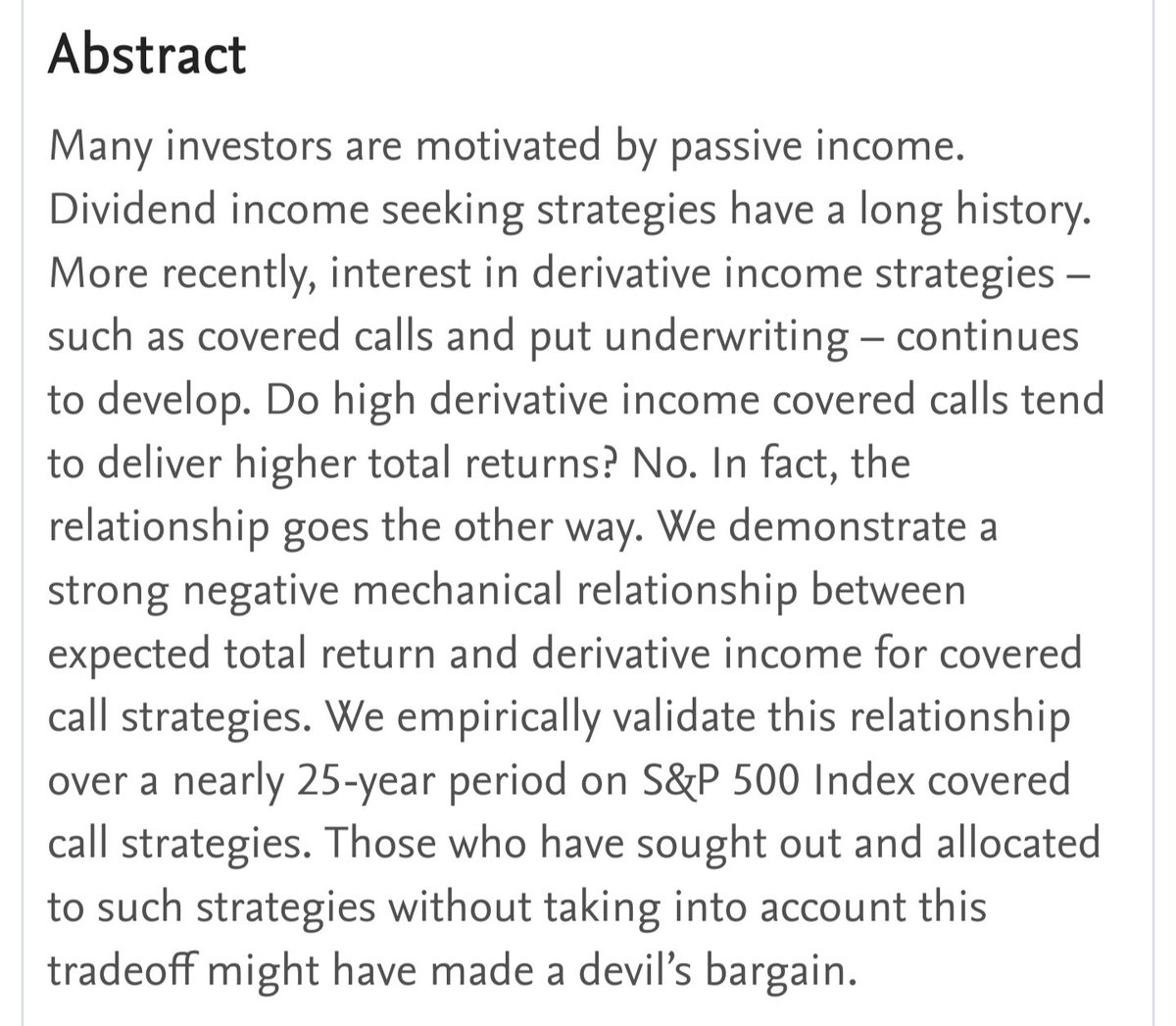

Focus on Income Can Undermine Returns: The Case of Covered Calls--

Covered calls implemented to deliver higher derivative income should be expected to have lower total returns, more tax-drag, more negative skew. Yuck.

by Larry Swedroe

cc Roni Israelov

alphaarchitect.com/?p=89562

Buying options-enhanced funds for the express purpose of pocketing the extra money is a mistake, according to the latest research from quant veteran Roni Israelov bloomberg.com/news/articles/… via Bloomberg Markets with Isabelle Lee

Roni Israelov has a gift for making option strategies simple and transparent.

Anyone investing in option strategies for income should read this.

papers.ssrn.com/sol3/papers.cf…

Deciding how to space out your investments? The latest NDVR analysis explores why lump-sum investing can often outperform dollar-cost averaging for better outcomes. #InvestmentStrategy #QuantitativeAnalysis #PortfolioConstruction

hubs.ly/Q026LwxQ0

Paper by Roni Israelov and Ndong on covered call strategies. 'We demonstrate a strong negative mechanical relationship between expected total return and derivative income for covered call strategies.'

Covered call strategies harvest the equity risk premium and the volatility