Mark Brownridge

@markeisadg

This account will no longer carry tweets from EISA from 1st February 2022 onwards. Please follow @EISAssociation for all current and future EISA tweets.

ID: 558739849

http://www.eisa.org.uk 20-04-2012 15:48:12

5,5K Tweet

1,1K Takipçi

631 Takip Edilen

How to invest in EIS investment opportunities as a first-time investor - a guide from Growth Capital Ventures: bit.ly/3nSxUZr #EIS #Investment

Attention high-net-worth investors! Our friend Mark Bower-Easton (Mark Bower-Easton), Business Development Manager at Oxford Capital, has put together a guide to #investing in the Enterprise Investment Scheme. The guide is published here in UK Investor Magazine ⬇️ bit.ly/3qWlfXf

London based at-home beauty and wellness service #SecretSpa has secured £1.5 million in funding. Love Ventures led the round along with angel investors: bit.ly/3nL57pB via Tech Funding News #investment #growth

Nine places to look for equity investment for your business - a guide from Oliver Woolley Envestors: bit.ly/32sNFi5 via North East Connected #business #investsment

Expert-led technology platform that connects users to parenting experts, bloss.life has raised £1million in a pre-seed round. The round was led by Antler and backed by angel investors: bit.ly/343ldDO via GoDealLITE #investment

London-based contract automation platform Juro has raised $23m in a Series B funding round. The funding was led by Eight Roads Ventures. It will use the capital injection to expand its business into the US and Europe: bit.ly/3446Uii via Business Matters

Why now is the time to invest in data driven tech for the UK’s health and social care system - especially those businesses who are Seed Enterprise Investment Scheme and Enterprise Investment Scheme registered: bit.ly/3rV6ovm via Investors' Chronicle #investment #SEIS #EIS

Tech jobs platform Otta has raised $20m in Series A financing in a round led by Tiger Global alongside LocalGlobe, Founder Collective – Seed Stage Venture Capital and 14 angel investors: bit.ly/3o2CLaB via Sifted #tech #investment #startup

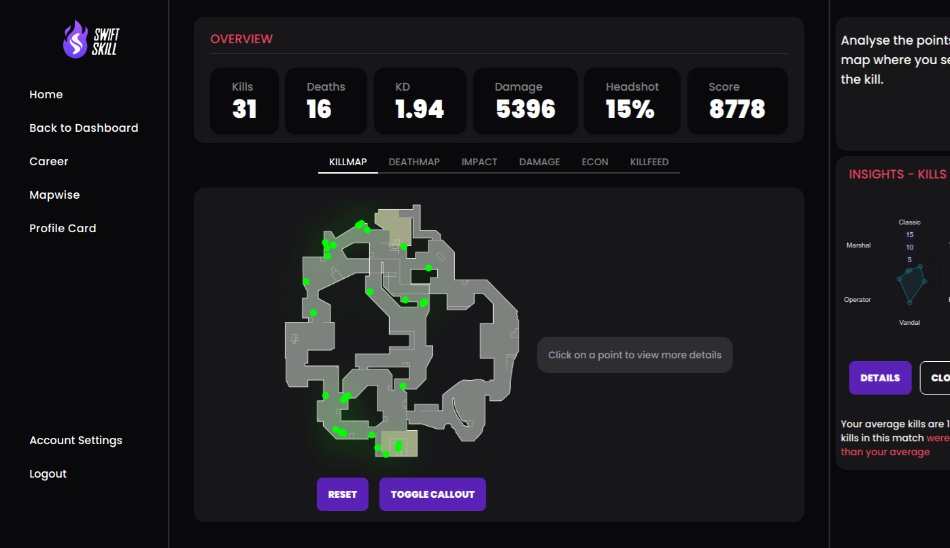

.@swiftskillggs, the digital platform that allows aspiring esports professionals to assess, track and improve their performance, has raised a £150,000 pre-seed round from Jenson Funding Partners:bit.ly/32Ftz4q via UK Business Angels #investment #growth

Online live training platform Skiller Whale has raised a $2.9M seed round to scale up their on-job learning offer. The round was led by Brighteye Ventures 🇪🇺, along with a group of VCs and angel investors: bit.ly/3ga14i8 via Angel

Tech IPOs in the UK raised £6.6bn, more than double 2020’s figures of £3.1bn, according to data from London Stock Exchange. In 2021, tech companies made up 29% of listings on the LSE: bit.ly/342j6Rb via @BLeaderNews #tech #investment