Joseph Lavorgna

@Lavorgnanomics

Former Chief Economist of The White House National Economic Council under President Trump

ID:617381538

24-06-2012 17:18:39

810 Tweets

33,2K Followers

62 Following

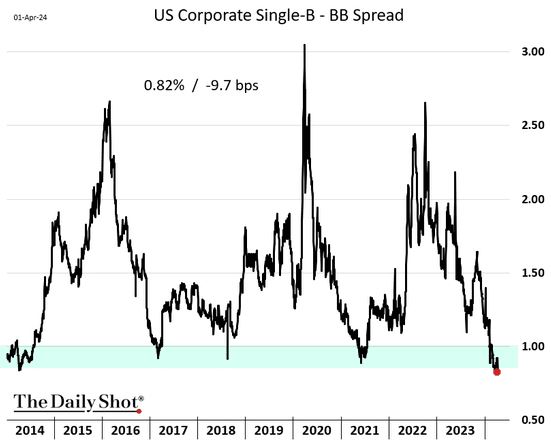

US 10-year Treasuries are having their worst day since May 2023, with yields surging after the one-two punch of a hot CPI and a bad auction. Peter Boockvar: '10 yr auction was bad...Dealers were left with 24% of the auction, which is the most since Nov. 2022.'

.Federal Reserve is in a serious but it can’t cut rates with high and rising #inflation rate so the only way the yield curve can normalize is if term premium surges which it could given record large budget deficits. Soaring long term interest rates would depress risk assets