Simon French

@Frencheconomics

Chief Economist & Head of Research @panmuregordon Former @cabinetofficeuk @dwp. 🏏 @hmtreasury. @thetimes columnist. 🚴♀️ tours & 🐝-keeping. Views are my own

ID:480342247

01-02-2012 11:42:44

12,2K Tweets

12,7K Followers

1,4K Following

The UK stock market is shrinking. Why does that matter, how do we turn things around and crucially, does Labour get it? The latest #MerrynTalksMoney podcast. bloomberg.com/news/newslette…

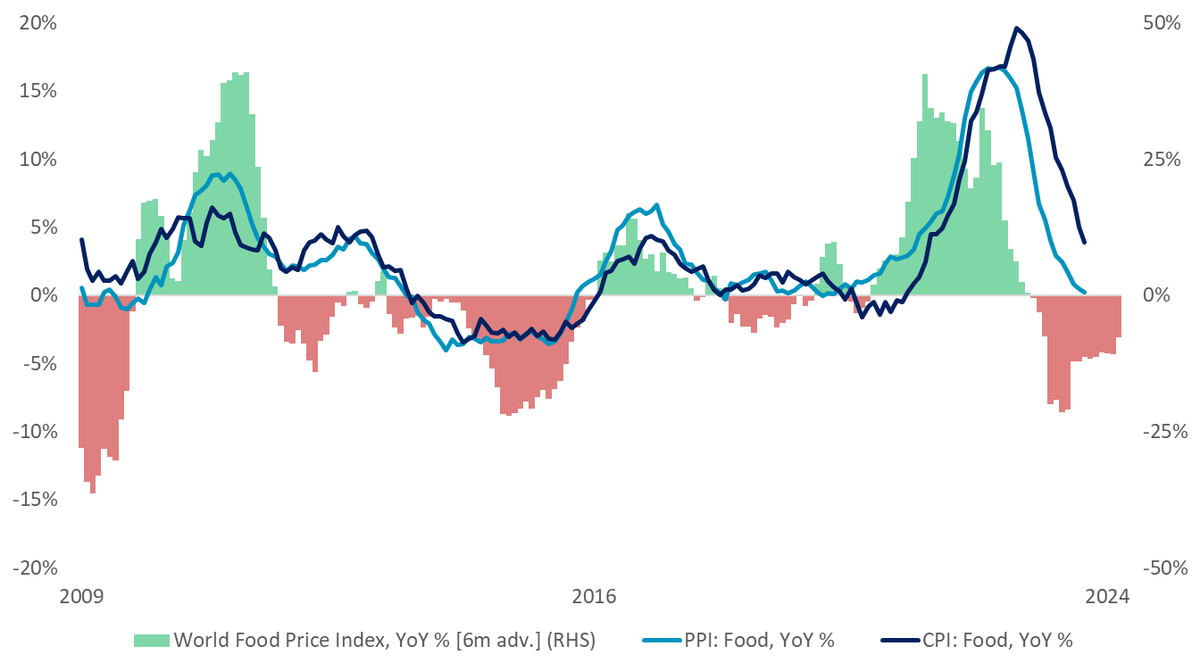

Still some UK food disinflation to come (3.9% YoY is 29-month low). Food PPI now flat, and whilst concern in pockets (El Nino) the world food price index remains down YoY. I spoke with Sean Farrington on BBC Radio 4 Today this AM speculating whether GBP weakness mutes this passthrough

Exciting news! Join #RECLive24 for a dynamic Panel Discussion on 'The 2024 Business Context' featuring experts Simon French, Lennie Higgs, Tiger Tyagarajan & Neil Carberry. Gain valuable insights into economic forecasts & their impact on recruitment. 🎟️ bit.ly/4a263eL