Convex Value

@convexvalue

A financial analytics browser with a powerful suite of live options data and tools for 99/mo. Download it Now 👇

ID: 1263506738021531648

http://ConvexValue.com 21-05-2020 16:28:06

12,12K Tweet

11,11K Takipçi

0 Takip Edilen

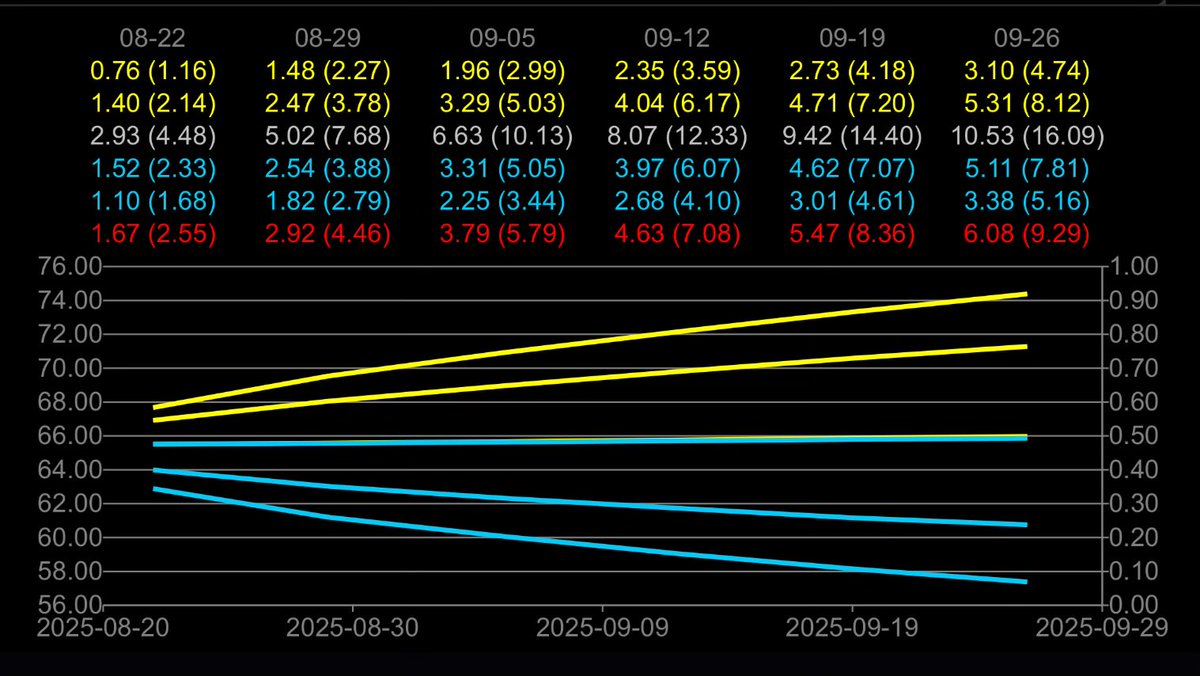

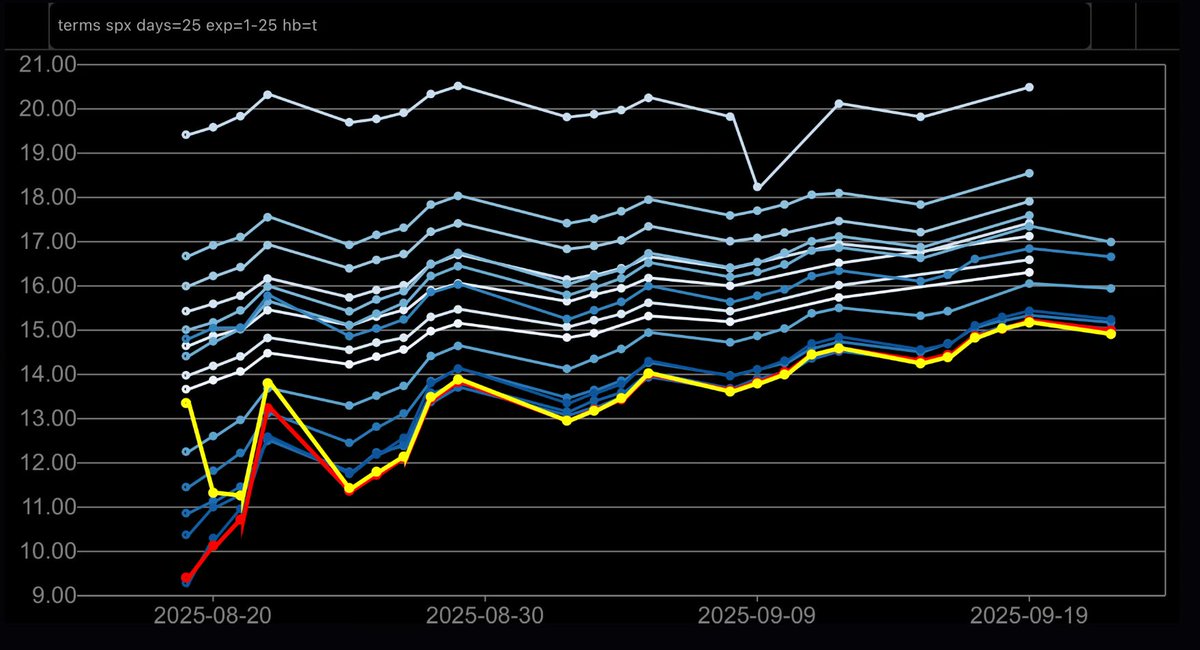

$SPX Market Data from Convex Value -Term structure increased a bit but remains at the low end of the past month. -23pt daily straddle and using 6443reference at 745 gives us a range of [6420, 6466] -Weekly Straddle is [6370,6529] -POLR as of close shows 6460 close -Overnight

![Yamco (@yam_trades) on Twitter photo $SPX

Market Data from <a href="/ConvexValue/">Convex Value</a>

-Term structure increased a bit but remains at the low end of the past month.

-23pt daily straddle and using 6443reference at 745 gives us a range of [6420, 6466]

-Weekly Straddle is [6370,6529]

-POLR as of close shows 6460 close

-Overnight $SPX

Market Data from <a href="/ConvexValue/">Convex Value</a>

-Term structure increased a bit but remains at the low end of the past month.

-23pt daily straddle and using 6443reference at 745 gives us a range of [6420, 6466]

-Weekly Straddle is [6370,6529]

-POLR as of close shows 6460 close

-Overnight](https://pbs.twimg.com/media/Gyon0GdacAA77RH.jpg)

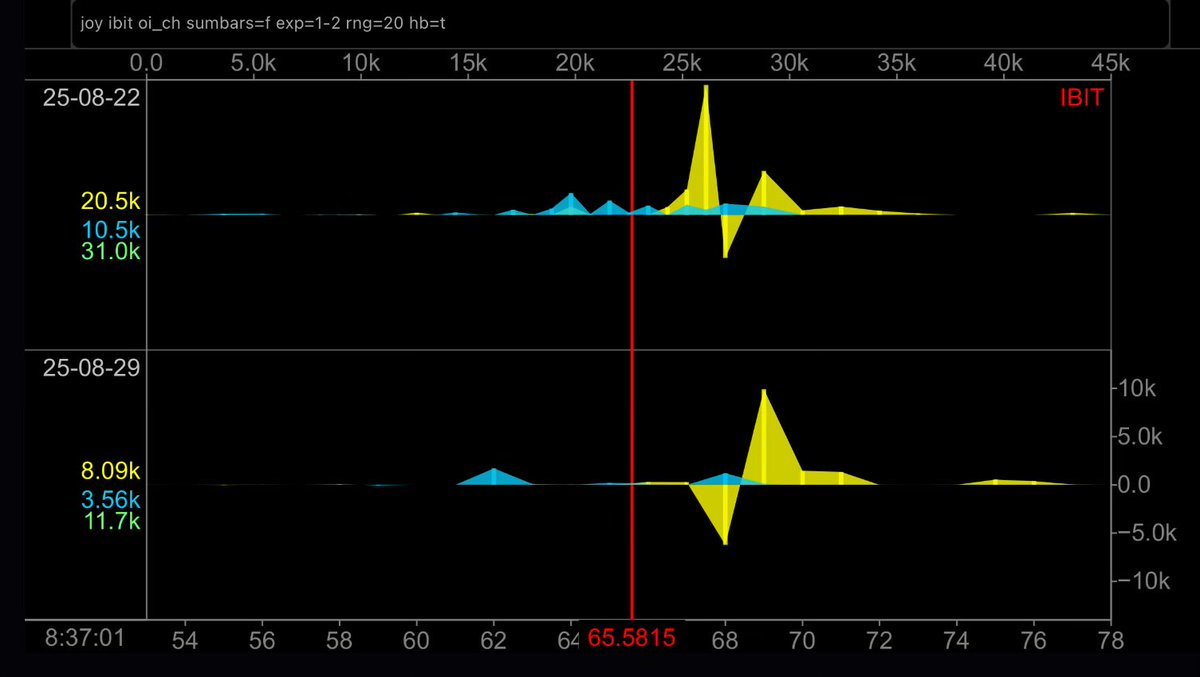

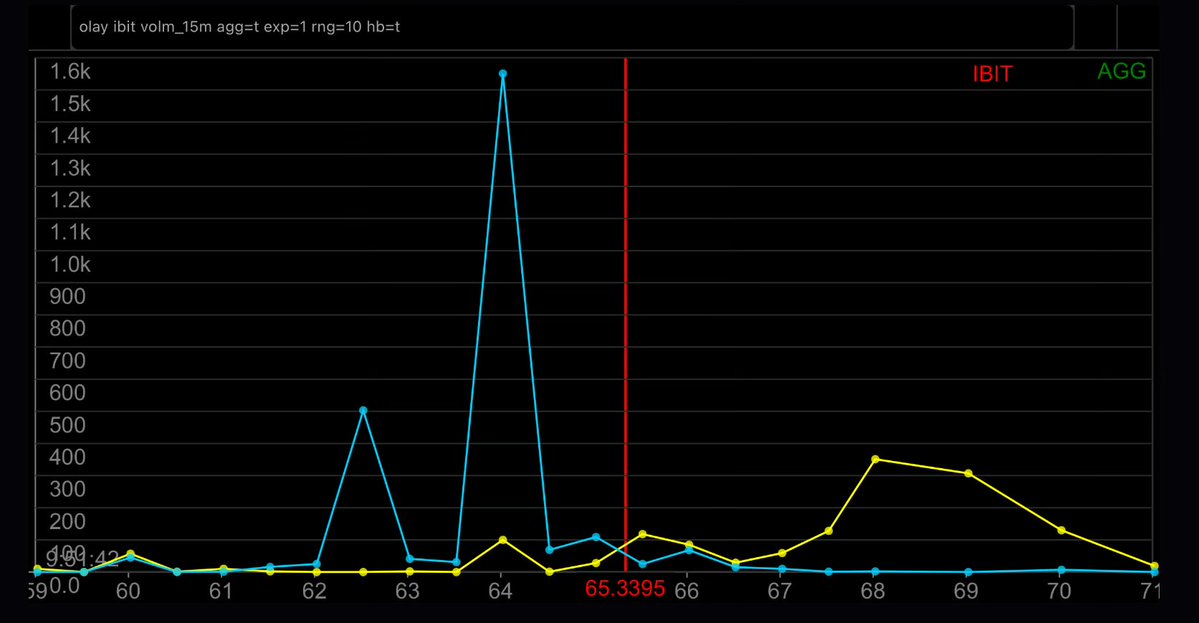

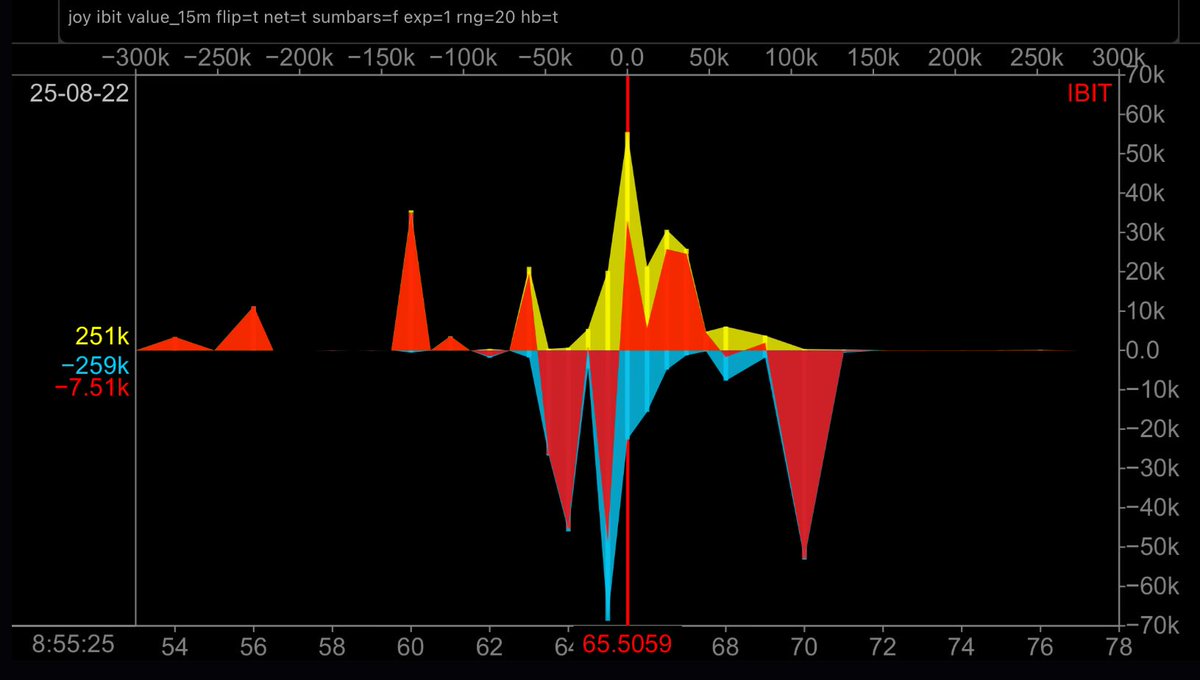

IBIT Open Interest Change lotsa calls moved around 67.5-68-69 while puts added on at 66-65-64. 8/22 & 8/29 expiry overnight OI change 🔵puts 🟡calls 🎬 Convex Value $ibit $btc 🎧

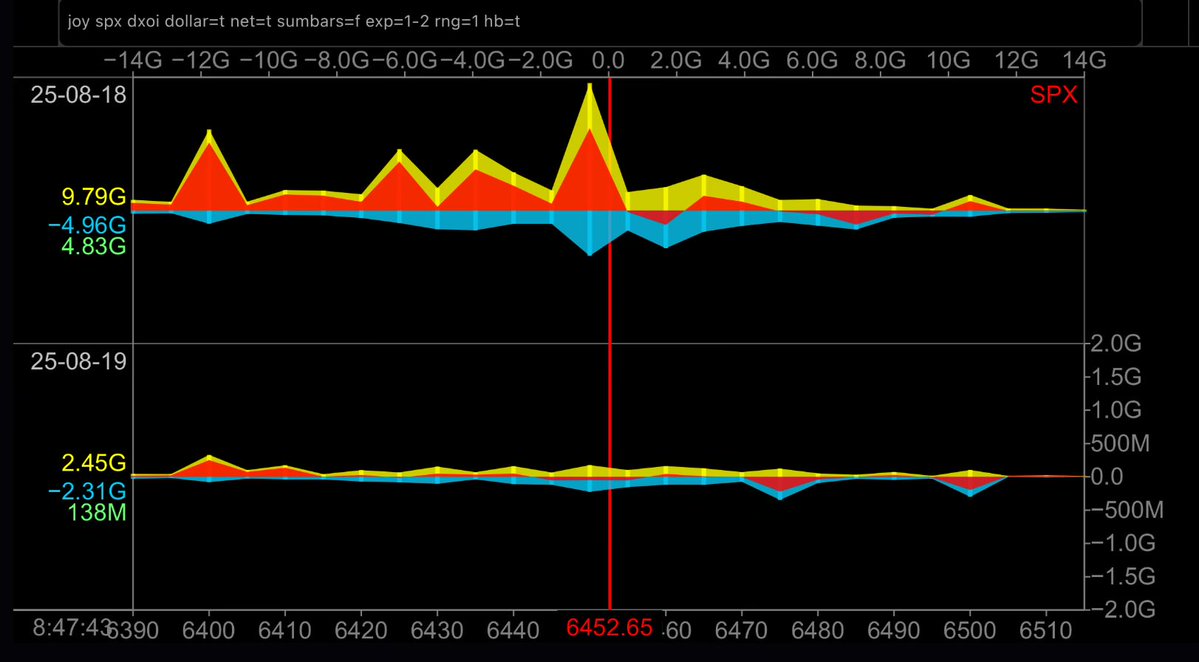

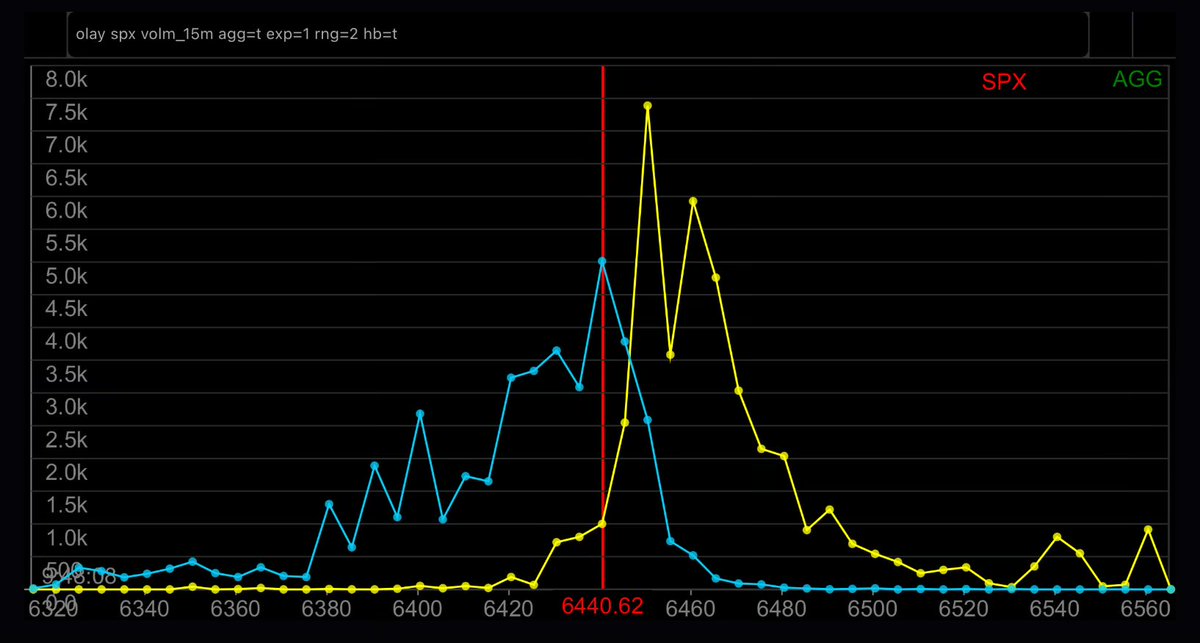

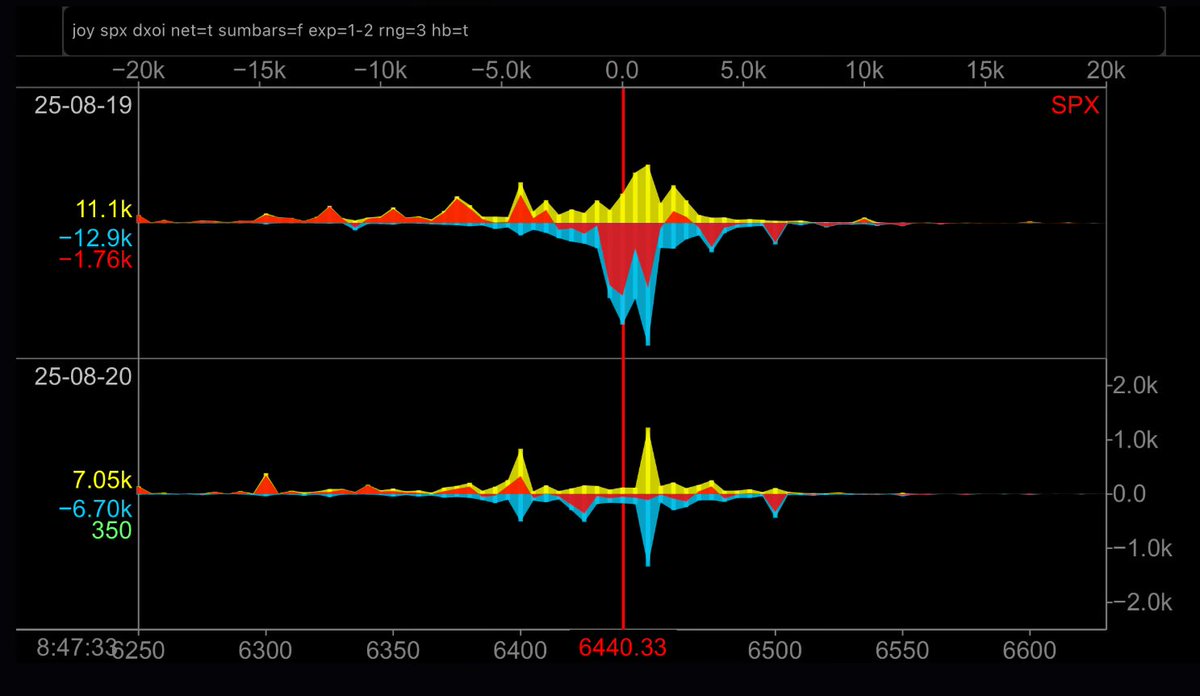

SPX Delta Notional 0dte & 1dte 6460 & 6480-85 are prominent itm put strikes with 6450-45–25 standout call strikes for today. tomorrow, 6475 is the dominant itm put strike as puts edge near the money. 6440 & 6460 main calls. 🟡call 🔵put 🔴 (call-put) 🏌🏽♂️Convex Value $spx

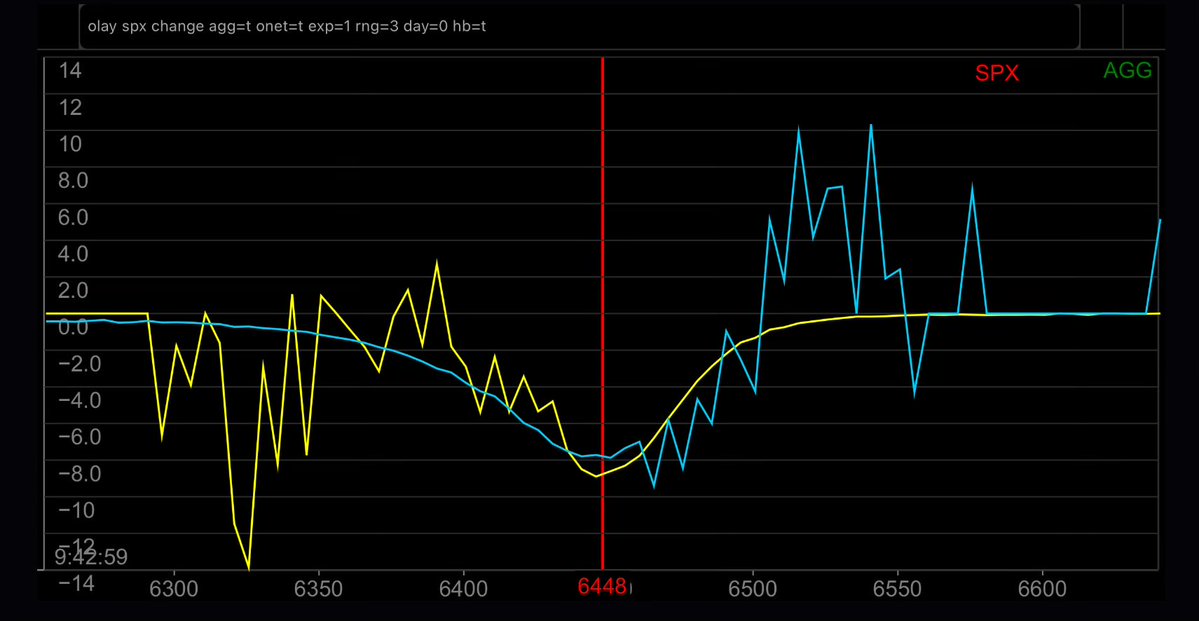

SPX Change in Contract Price pretty much everything between 6395-6505 lost value thus far into the sesh. above 6505 puts gained 0dte Cumulative Change 🔵Puts 🟡Calls 🥥 Convex Value $spx $spy 🥊

SPX 0dte Volume prior 15min aggregate volume in today’s session 6450-60 standout call strikes 6440-30-20 dominant put strikes 🟡calls 🔵puts 🥍 Convex Value $spx $spy 🛝

IBIT Volume prior 15min 8/22 expiry aggregate volume, today’s session 68-69 standout call strikes 64 & 62.5 dominant put strikes 🟡calls 🔵puts ⛱️ Convex Value $ibit $btc 🚦

$SPX Flow chart from Convex Value - Deltas flattened until end of day when we saw an uptick -Much of the oscillations were due to movements in VIX.... -My best read is more compression tomorrow Term Structure -Volatility expectations are near multi-month relative lows... An

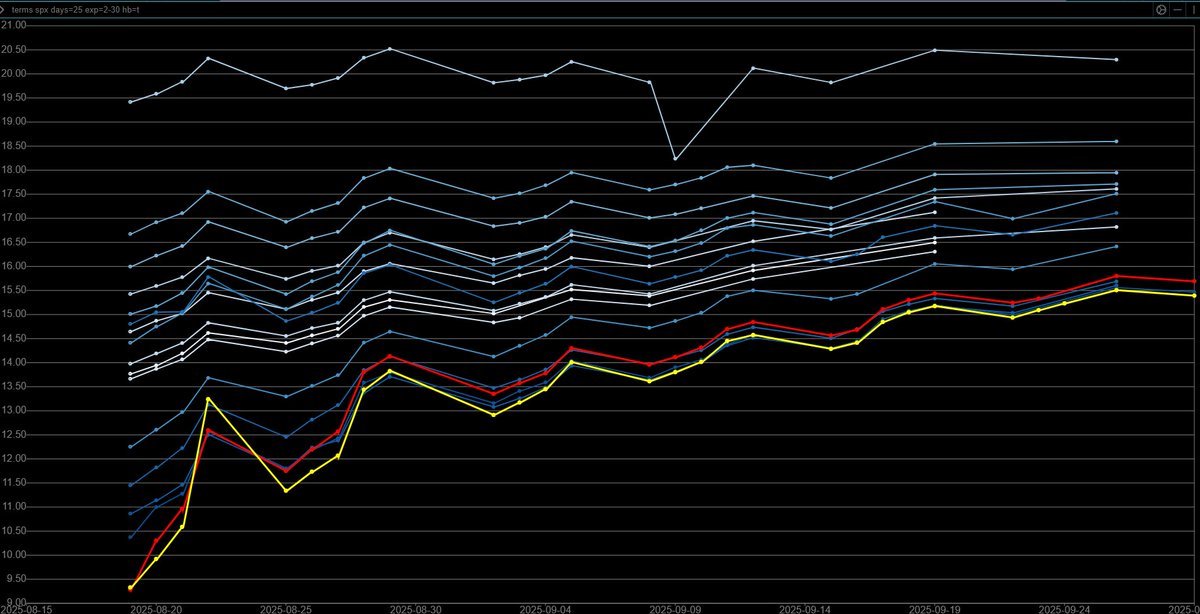

SPX Implied Volatility Term Structure iv jumps 8/21 into 8/22 for jackson hole news, setting up contango thru september into the next fomc rate decision. next 25 expiry, previous 25 days 🟡today🔴yesterday 🔵⚪️previous days 🎱 Convex Value $spx $spy

$SPX -I'm seeing a decent probability of another flat close. IC buyer thinks otherwise.... Market Data from Convex Value -Term Structure is about to be buried - You can only compress volatility so much for so long before it pops -20 pt straddle from SPX reference 6444 gives us

SPX Delta Notional 0dte & 1dte 15min off the open & 0dte put delta is piled up above & below spot. itm calls takeover from 6410 & below. for tomorrow, similar scenario with the 6425–20 puts favored over calls. 🟡call 🔵put 🔴 (call-put) 🛟 Convex Value $spx $spy 🚧

IBIT Premium prior 15min 8/22 expiry puts flipped for display 🟡calls 🔵puts 🔴(call-put) 🍊Convex Value $btc $ibit

IBIT Implied Move 📆 8/22 expiry 70% likely range: 62.74-67.52 (btc 109,230-117,552) 9/26 expiry 70% likely range: 56.87-73.77 (btc 99,010-128,433) 🔴 atm straddle 🔶 Convex Value $ibit $btc 🟧