Adelaide Timbrell

@AdelaideTimbrel

Senior #Economist, ANZ Bank | Researcher, Speaker, Forecaster.

MS Economics, Bachelor Economics

Expertise: Aus households, housing, retail

Views are my own.

ID:1112936885054169089

https://www.linkedin.com/in/adelaidetimbrell/ 02-04-2019 04:36:45

777 Tweets

3,5K Followers

425 Following

ANZ-Roy Morgan Australian Consumer Confidence rose despite an expected rate rise at the today's RBA meeting. Household inflation expectations rose to 5.5%, with petrol prices up, but overall inflation expectations seem well anchored. #ausecon Adelaide Timbrell Arindam Chakraborty

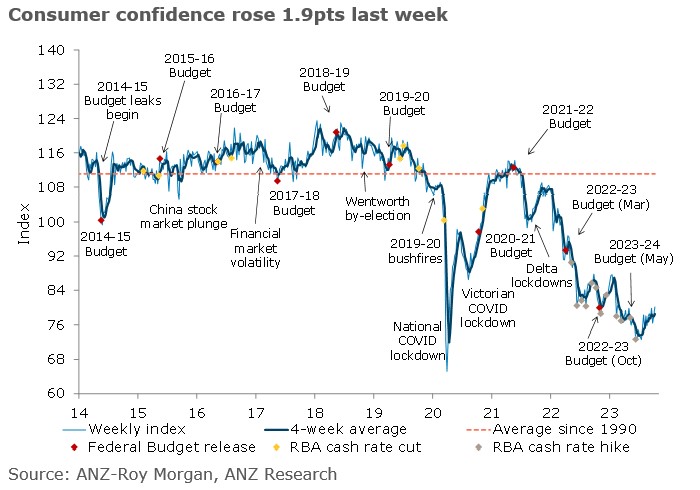

The ANZ-Roy Morgan Australian Consumer Confidence reached its highest since end of Feb, but is still weak. Confidence about personal finances has been key to the uptrend. #ausecon Adelaide Timbrell Arindam Chakraborty Roy Morgan

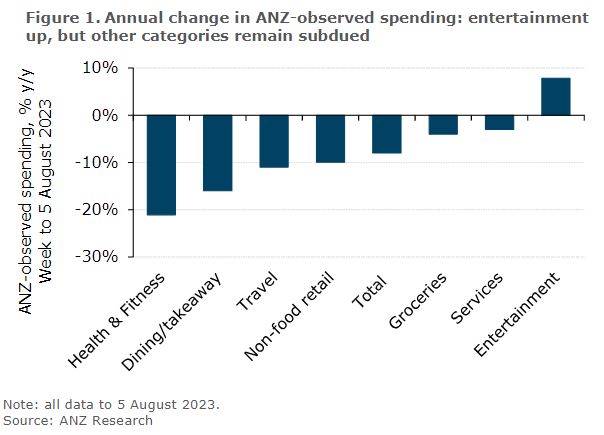

ANZ-observed Australian spending was down 10.4% y/y in the first 20 days of August. The pullback is being felt in the CBDs, with in-store spending down 12% y/y in the nation’s city centres. #ausecon Madeline Dunk Adelaide Timbrell

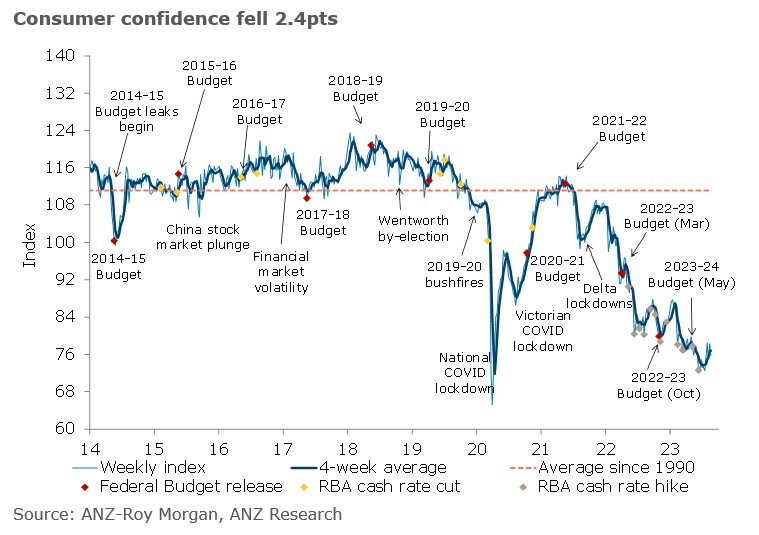

ANZ-Roy Morgan Aus Consumer Confidence fell 2.4pts, perhaps on AUD weakness. Household inflation expectations jumped to 5.5% from 5.2% the week before. #ausecon Adelaide Timbrell Arindam Chakraborty Roy Morgan

The #Barbenheimmer frenzy lifted entertainment spending in Aus, making it the only segment to see annual growth. However, overall spending is down as consumers appear to hold back on discretionary spending - my colleagues Madeline Dunk & Adelaide Timbrell's ANZ_Research report.

The Reserve Bank's decision to keep the cash rate on hold for a second month in a row has been welcomed by borrowers.

We're joined by Adelaide Timbrell, senior economist at ANZ Australia, for her reaction to the decision. #9News

Property industry concern on housing supply and affordability at record highs according to the June 2023 results of the ANZ/Property Council Survey.

afr.com/property/comme… Nick Lenaghan ANZ Australia

#anz #propertysurvey #HousingCrisis

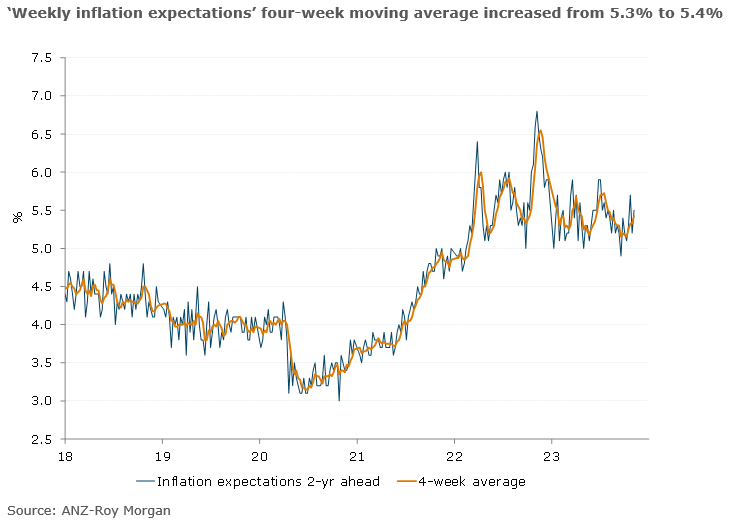

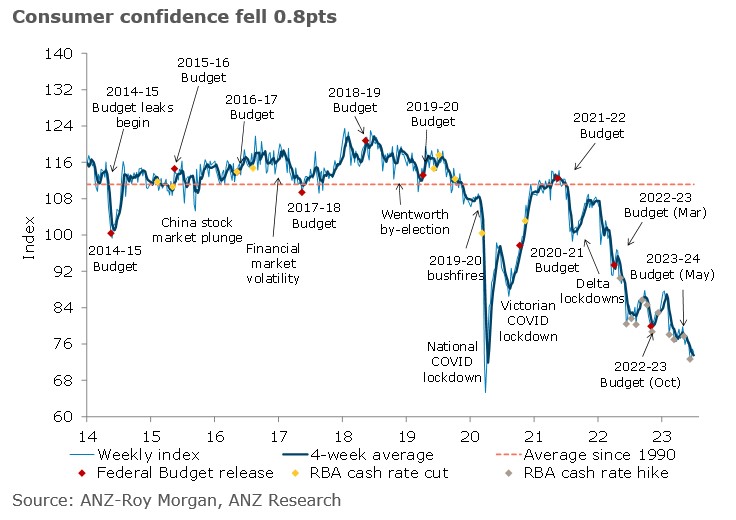

ANZ-Roy Morgan Aus Consumer Confidence fell ahead of the RBA meeting. The 4wk ave was the 2nd worst result in 30yrs. ‘Current’ and ‘future financial conditions’ remain weak as inflation expectations hit their highest 4wk ave for 2023. #ausecon Adelaide Timbrell Arindam Chakraborty

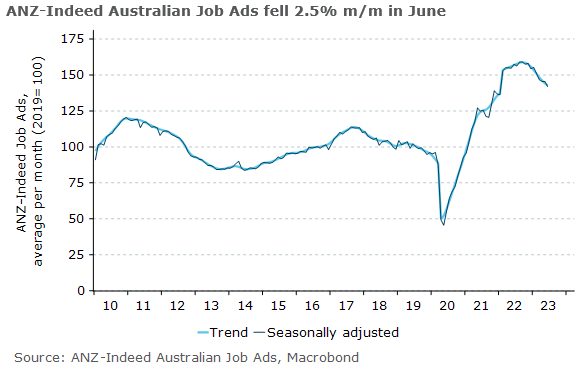

ANZ-Indeed Australian Job Ads fell 2.5% m/m in June, but is 47.5% higher than pre-pandemic levels. It will take time for the tightness in the labour market to ease. @MadelineDunk Callam Pickering @adelaidetimbrel Arindam Chakraborty

Cash rate up to 4.1%. We at ANZ_Research forecast another 25bp hike by August.

Next step for the RBA will be to assess the trends in prices and unit labour costs against how rates & the fixed-rate roll-off impact household spending & overall activity.

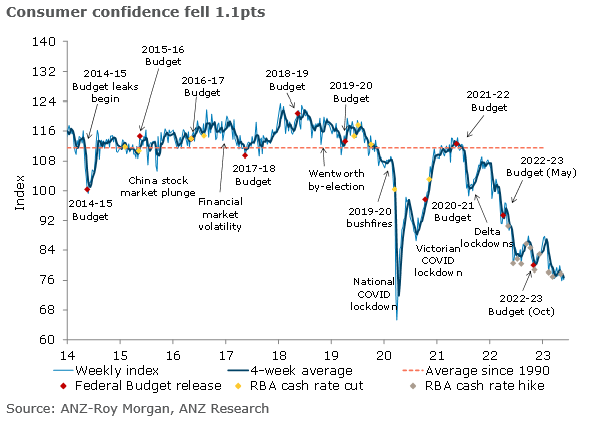

ANZ-Roy Morgan Aus Consumer Confidence fell 1.1pts. Average confidence for May 2023 (76.8) was the weakest calendar-month average since Dec 1990, as cost-of-living pressure continues to impact households. #ausecon Adelaide Timbrell Arindam Chakraborty Roy Morgan