zygba

@zygbaeth

building magical internet coins communities | @puffer_finance

ID: 610300222

16-06-2012 21:41:58

758 Tweet

1,1K Followers

1,1K Following

. Puffer UniFi by Puffer Finance 🐡 🐡 scaling Ethereum, the Ethereum way: → Accelerating rollups → Backed by $13B+ in restaked ETH via EigenCloud → Architected for validator alignment and protocol-level trust Let’s break it down 👇

Please avoid accessing all the Puffer apps and social media; we are investigating the issue. Puffer Finance 🐡

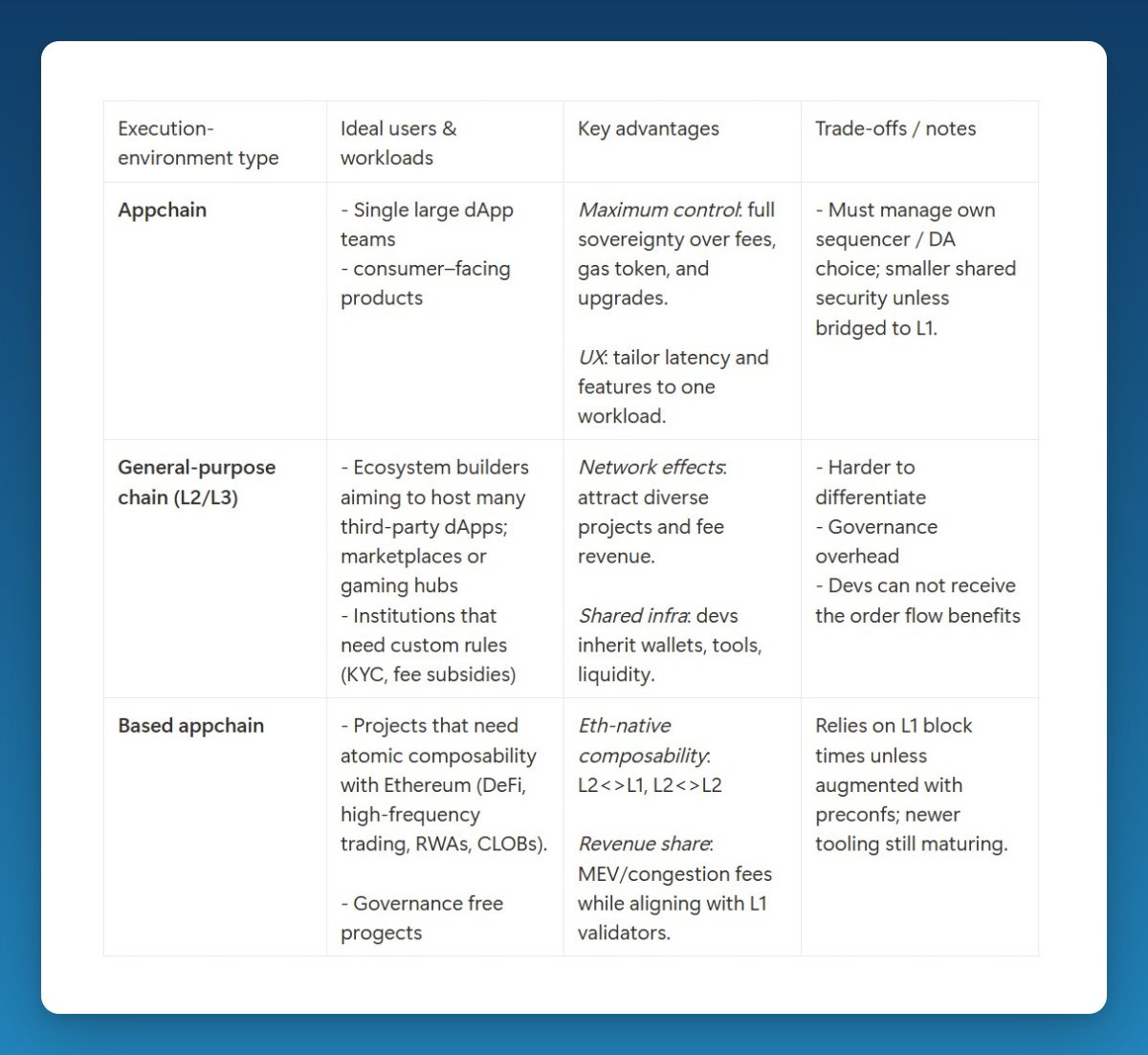

The rollup era created speed ⥊ Puffer UniFi 🐡⛓️ creates sovereignty With UniFi, you're not deploying smart contracts → You’re launching your own Based Appchain with full control over execution, fees, and order flow What that actually means ↓ + 10ms transaction finality powered

📊 Hyperliquid built its own L1 to serve high-frequency traders with on-chain order books, low latency, and deep liquidity. Why? Because Ethereum L1 is too slow, and L2s fragment liquidity behind slow bridges. The tradeoff: capital is siloed. To tap Ethereum liquidity,