YAM 🌱

@yieldsandmore

A community of DeFi power users with a focus on yield farming.

Hosted by @SaulCapital and friends. Invite only.

discord.gg/yieldsandmore

ID: 1591284555637436417

12-11-2022 04:19:42

394 Tweet

2,2K Takipçi

108 Takip Edilen

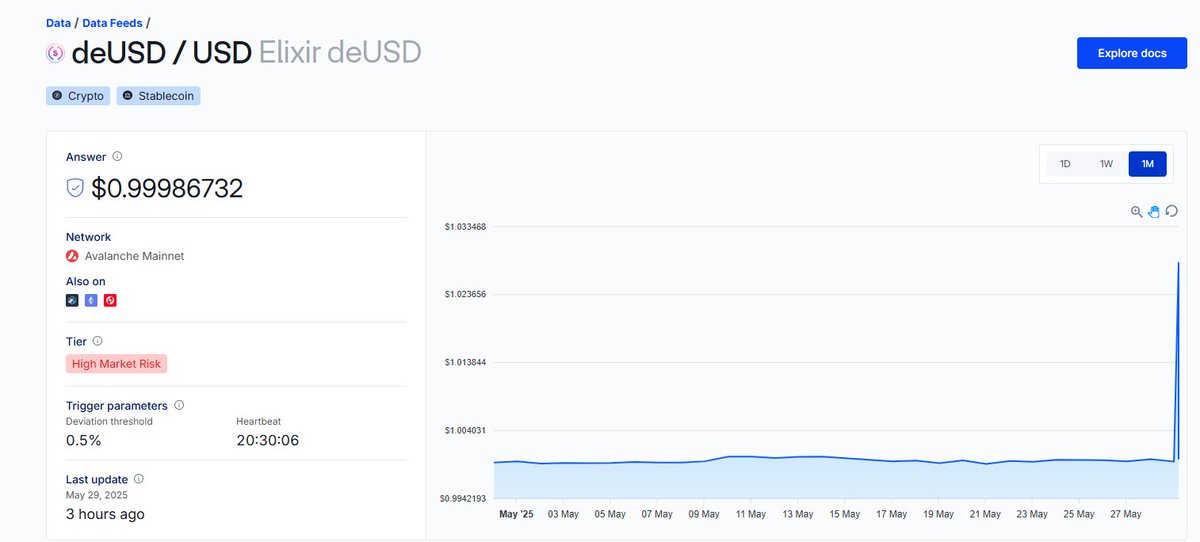

Earlier today, the Chainlink deUSD oracle on Avalanche🔺 falsely reported a price of 1.02832626 USD per deUSD, leading to over 500k in liquidations on the Euler Labs market for those with deUSD debt. We can't tell what prompted multiple oracles to report this high price, as none

Continuing our saga of highlighting cool stuff in DeFi, there's a new meta-aggregator on the block: Matcha Meta. Matcha Meta has two great features that made us use it: 1. Simulated quotes: Every aggregators' quote is simulated to see if the quoted output amount matches if

Be careful providing liquidity on Kittenswap (🐱,🐱). Their newly deployed gauges to farm $KITTEN emissions are proxied. The proxy owner is a wallet, not a multisig. There is no timelock. This applies to most of the contracts (Voter, RebaseReward, Minter, CL Gauge Beacon, etc.

Gigantic red flag from the Kittenswap (🐱,🐱) founder. We're not going to speculate on what's going on, but please, withdraw.

Get out of Falcon Finance. Falcon is associated with DWF Labs, everyone knows their reputation. While their Reserve Reports done by ht.digital take daily snapshots of the collateral, the exact positions/tokens USDf are backed by are unclear. Their latest report mentions them