Gordon Berry

@wealthagent

Business Adviser. Chartered Certified Accountant and Chartered Tax Adviser. NLP Master Practitioner.

ID:301075537

https://armadillo-support.co.uk/ 18-05-2011 20:50:58

40,8K Tweets

1,6K Followers

1,2K Following

Follow People

A year ago the LCAG spokesperson was promoting & trying to sell WTT to desperate #loancharge ‘victims’ even though he knows the main person at WTT does have previous involvement in failed tax ventures:

- Rebus Investment Solutions

- Future Capital Partners

- Elysian Fuels

Sarah Jane Just be wary. The #loancharge received Royal Assent 7 years ago but some would have you believe that they have a plan. Those who bought the plan now find their liability has doubled.

CC Sarah Jane WTF have, by their own admission, doubled the liability of those who did not settle before 30/9/2020

Some of those will be the same people who they charged for the mess in 2017 when they mistakenly wrote-off loans (don't tell HMRC) & they charged them again for magic beans!🤦♂️

CC Sarah Jane The law was clarified in 2017 by the Supreme Court, which said all previous court decisions were incorrect.

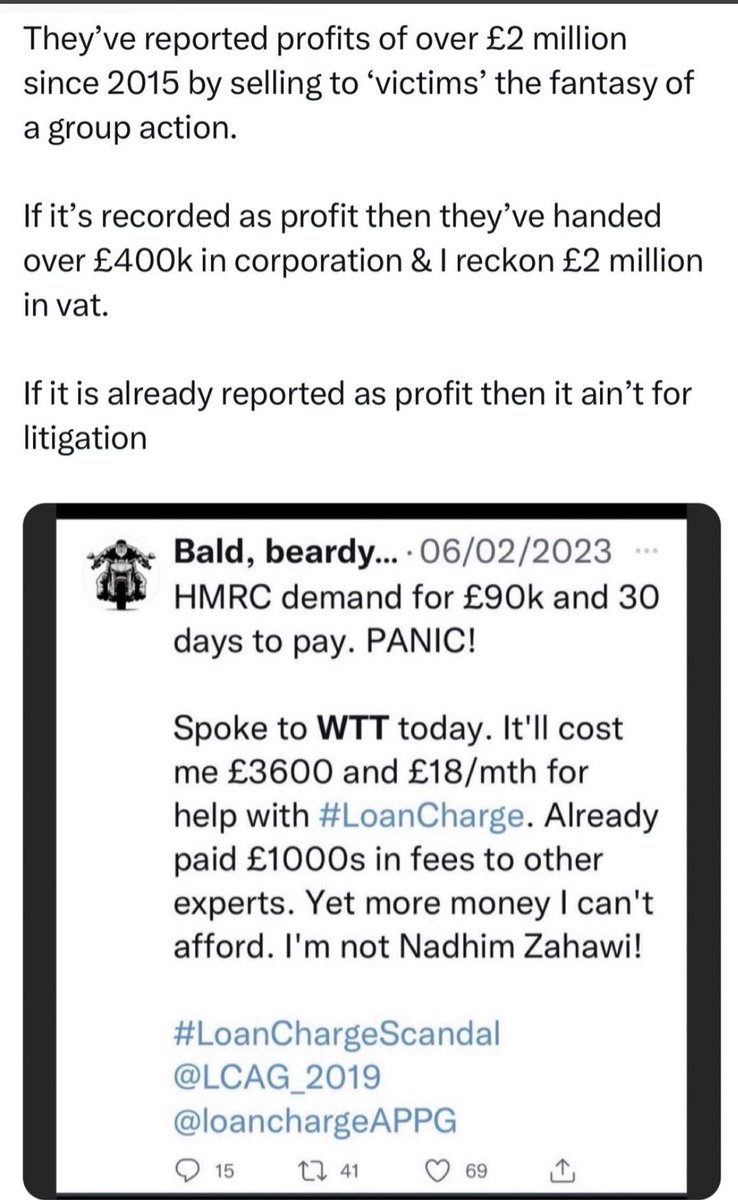

The law has been clear since 2017. The #loancharge was designed to override the PAYE credit. Yet that’s when WTF started selling litigation! They’ve since taken £millions!

CC Sarah Jane The Supreme Court did not say employer was liable.

The #Loancharge was first proposed in Sept 2015, before the Supreme Court decision in July 2017.

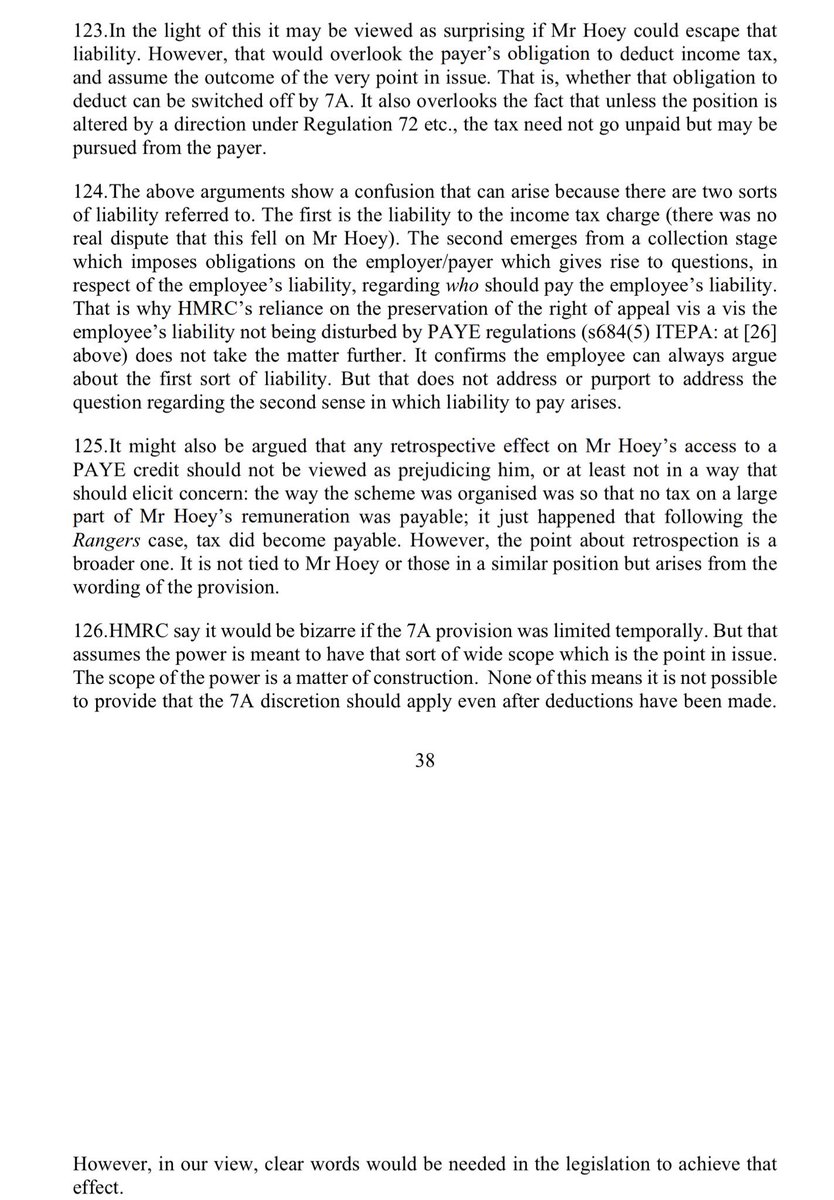

Hoey defended all way to CoA against HMRC use of s684 but Courts disagreed👇

WTF took litigation fees in 2019, yet no litigation!🤦♂️

CC Sarah Jane The Supreme Court said PAYE was due.

Court of Appeal said it was due from individuals.

The #loancharge says those with post-DR loans are taxed regardless of what previous stood.

Yet you argue with me for exposing those who charge £3.6k to join their false hope “resolution”

WTF

Sarah Jane Ross Loan Charge Action Group [LCAG] Greg Wright Loan Charge Impact The public don't realise HMRC are trying to charge two different taxes on the same 'income'.

The first is income tax because HMRC say these are not real loans.

The second is IHT because HMRC say these are real loans!

Still others treated differently👇

x.com/BylinesScotlan…

UKRetroTax Dr Loan Charge RomanTax Armadillo - Tax Support fedupwithretrotax Loan Charge & Taxpayer Fairness APPG Ask Keith/Osita/Ray here about:

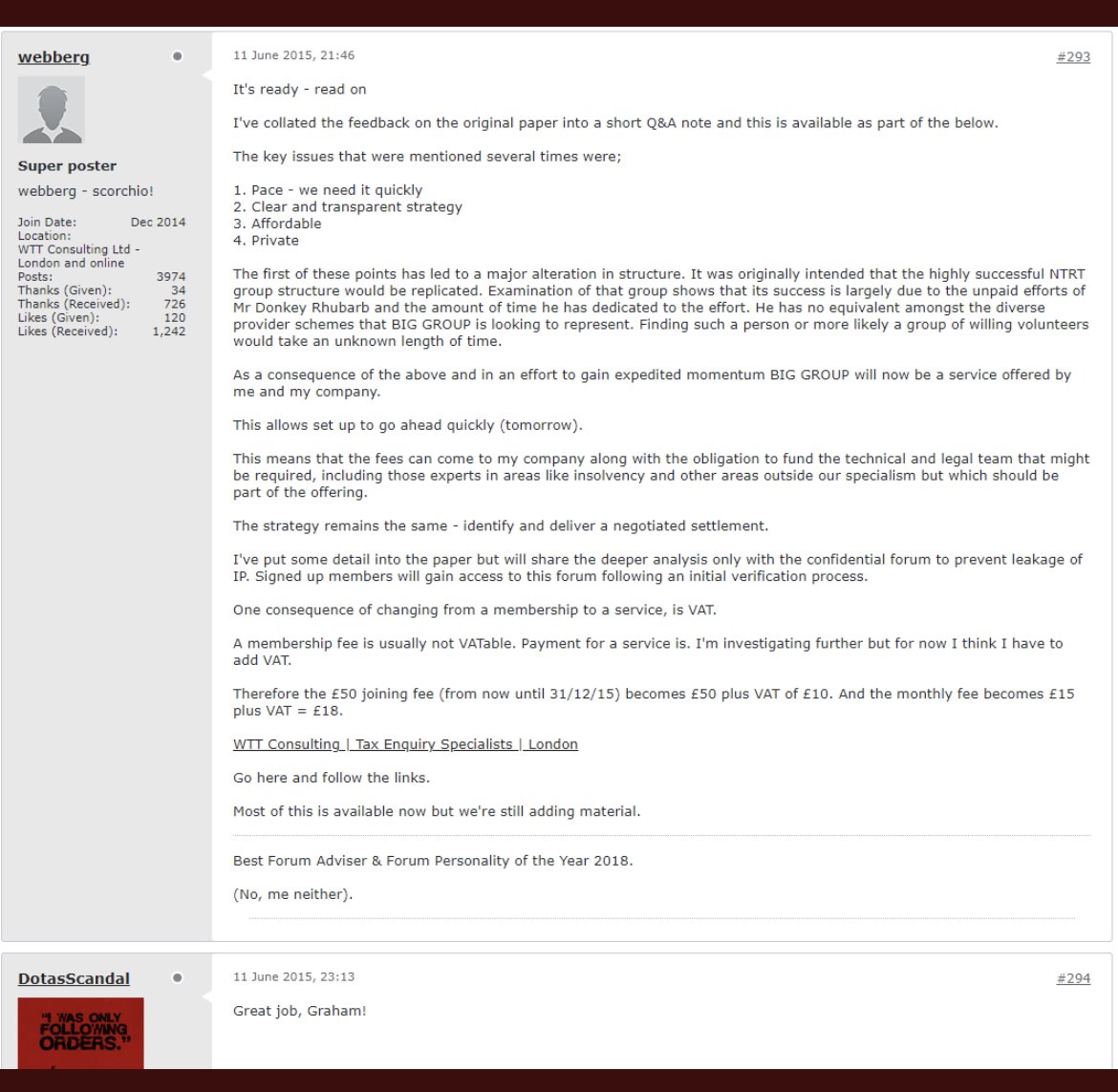

- a Big Group settlement with a £3k joining fee

- selling a 65% chance of success

- “litigation fund” with vat added

- writing off loans in 2017

- 7 years of fees but no litigation

- loans on white space in 2019 tax return

- individual JRs for all

This isn’t intellectual property, it’s what every tax adviser knew but dismissed because the #loancharge from 2017 overrides it.

Seven years after the #loancharge received Royal Assent, people are still buying these magic beans.

Mark Kerr WrathOfMyBombast 🇺🇦 Boudica 💎🇺🇦 Jim Brown #LCAG Ian Todd Steve Packham HMRC Victim #STOPtheLoanCharge @absmal1948 Sammi McKean 💙🇺🇦 Jack IR35-BN66-LoanCharge-LeadsToDeath Ed Martin Girl Power DotasScandalNotDead camp999 jon quinn Scarlett Jona I’ve been shafted ⚒️ 🇺🇦 untRuth Stanier Director HMRC #LCAG Loan Charge Action Group [LCAG] ContractorUK Sir B.Rupt Dave Chaplin - CEO, ContractorCalculator Endangeredkiwi monty smith Gary McGown GazzaH Garry Neal HBtweetie Jerry Giles I find it amazing that none of the Big Group subscribers seem the least bit interested in what has happened to the funds they have contributed over a number of years since 2015. Where is the 'litigation fund' they were asked to pay into in 2019? How much was collected?

Sarah Jane Taxed From The Future Smel Snide Jon Thomson was HMRC CEO who in 2018 wrote to MPs to try and divert their attention away from looking into the #LoanChargeScandal

They gave him a knighthood, moved him sideways within the civil service & he started calling himself Sir Jonathan Thomson.

Sir B.Rupt Jim Harra HM Revenue & Customs There are parallels in the behaviour of the institutions, be that the Post Office or HMRC.

HMRC hoodwinked MPs to introduce retrospective legislation that HMRC's own impact assessment said would bankrupt citizens, simply as part of a punishment strategy

x.com/wealthagent/st…

Colin Bartolomeu The state will outlast you & they’ll get far more as interest & IHT continues to rise.

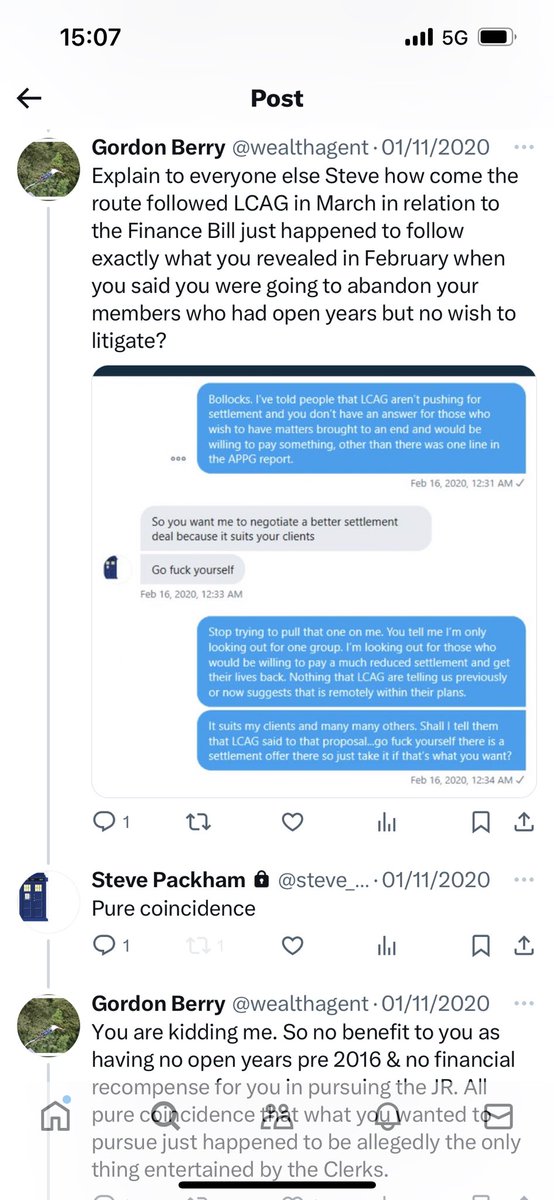

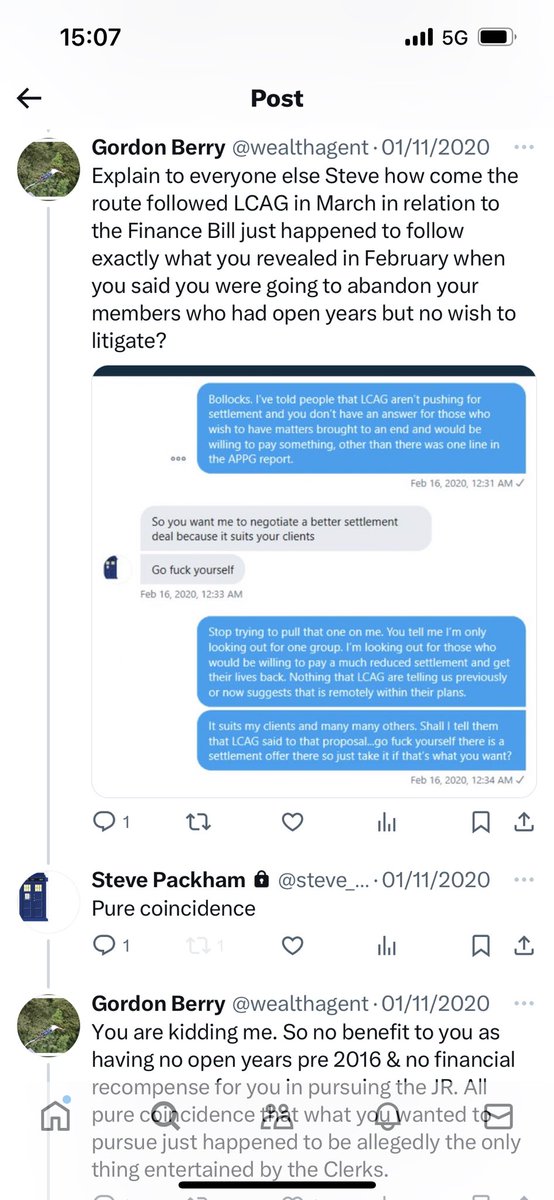

We submitted a proposal to half everyone’s liability & let them settle 4 years ago. But LCAG torpedoed it.

By encouraging non-disclosure in the 2019 return LCAG helped double the liability!

Ray McCann Armadillo - Tax Support HMRC always said 85% would be collected from “employers”

HMRC now say they’ve brought £3.9 billion “into charge”

So is it too simplistic then to say that HMRC could exceed the original £3.2 billion target by applying the Supreme Court ruling without need of #loancharge or s684?

Ray McCann £3.2bn. But that too was misleading Ray. It includes sums that wouldn’t be lost through future use; not the amount actually to be paid. Lies, damn lies & …….

First they came Sarah Gabbai Ray McCann HM Revenue & Customs I've pointed out the #loancharge doubles post-DR debt. All tax advisers have known this since 2017. The law is clear. So if you were sold on not settling by those who claimed they've a 'resolution', but they didn't warn you that your tax could double. Then just block me instead🙄

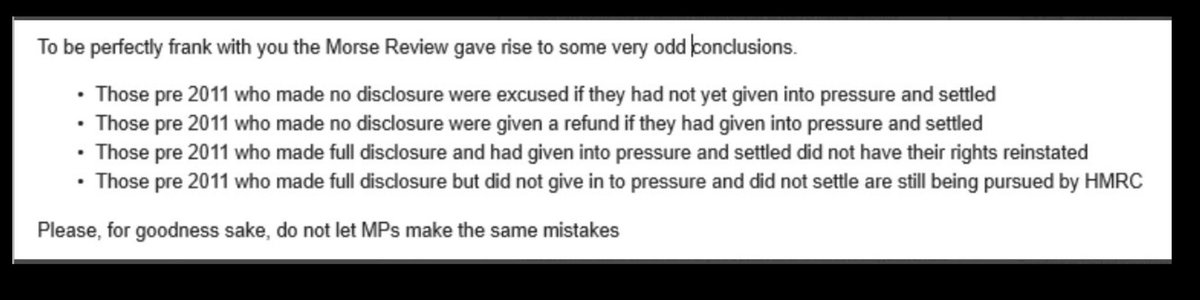

First they came Sarah Gabbai Ray McCann HM Revenue & Customs People who didn’t disclose pre-2011 were forgiven by Morse.

It’s the correct application of the taxes act, but gives an unfair result.

Particularly given HMRC are using a retrospective application of an obscure s684 to apply tax on pre-DR loans

#loancharge doubles post-DR debt