VesselsValue

@vesselsvalue

Vessel valuation and market perspective for the maritime industry | A Veson Nautical Company

ID: 181896508

http://www.vesselsvalue.com 23-08-2010 09:26:05

4,4K Tweet

10,10K Followers

861 Following

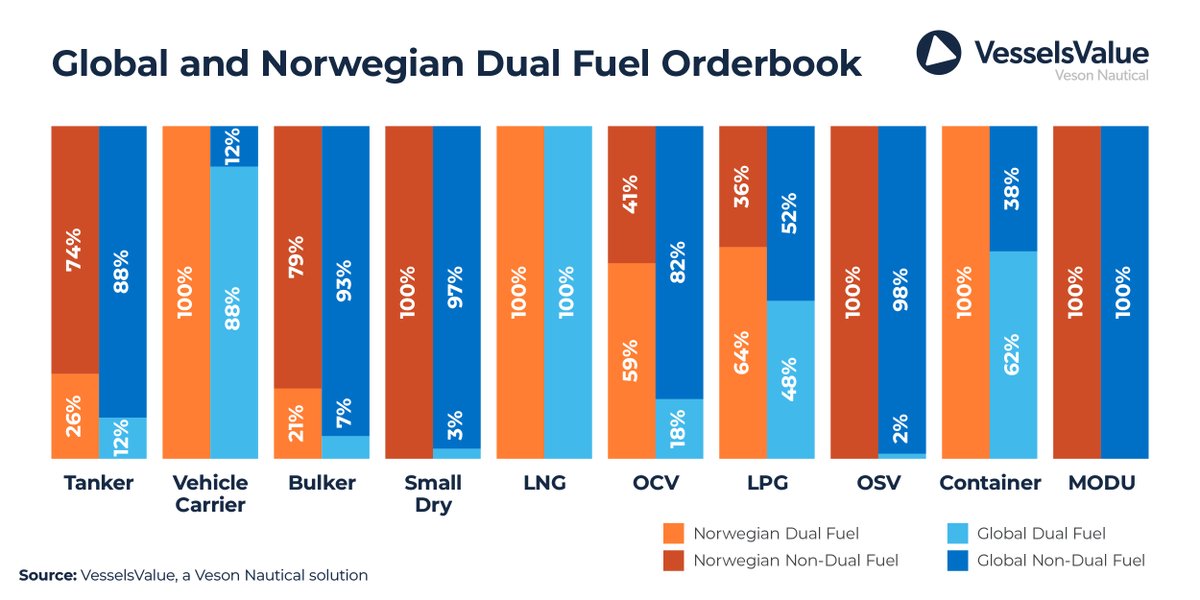

Ahead of Pudgy Party 2025, we examine the Norwegian fleet: 46% of newbuilds by Norwegian companies are #DualFuel vs. 27% globally. Dive into vessel types, top owners and S&P trends here: hubs.ly/Q03nScCR0