Rashad Ahmed

@varshad_

Market risk economist @USOCC | mostly global macro | views are my own

ID: 1312718157019181056

https://sites.google.com/view/rashad-ahmed 04-10-2020 11:36:24

1,1K Tweet

3,3K Followers

1,1K Following

Looking forward to reading this new paper via Peter Ireland Reminded me of the BIS note (Borio, Hofmann, Zakrajsek) that made a splash some time ago (bis.org/publ/bisbull67…) V cool to see deep work on the topic

Did a guest spot in Tracy Alloway and Joe Weisenthal’s Odd Lots newsletter today: “When Should We Care About Unrealized Bank Losses?” bloomberg.com/news/newslette…

“Excuseflation” as coined by Tracy Alloway and Joe Weisenthal

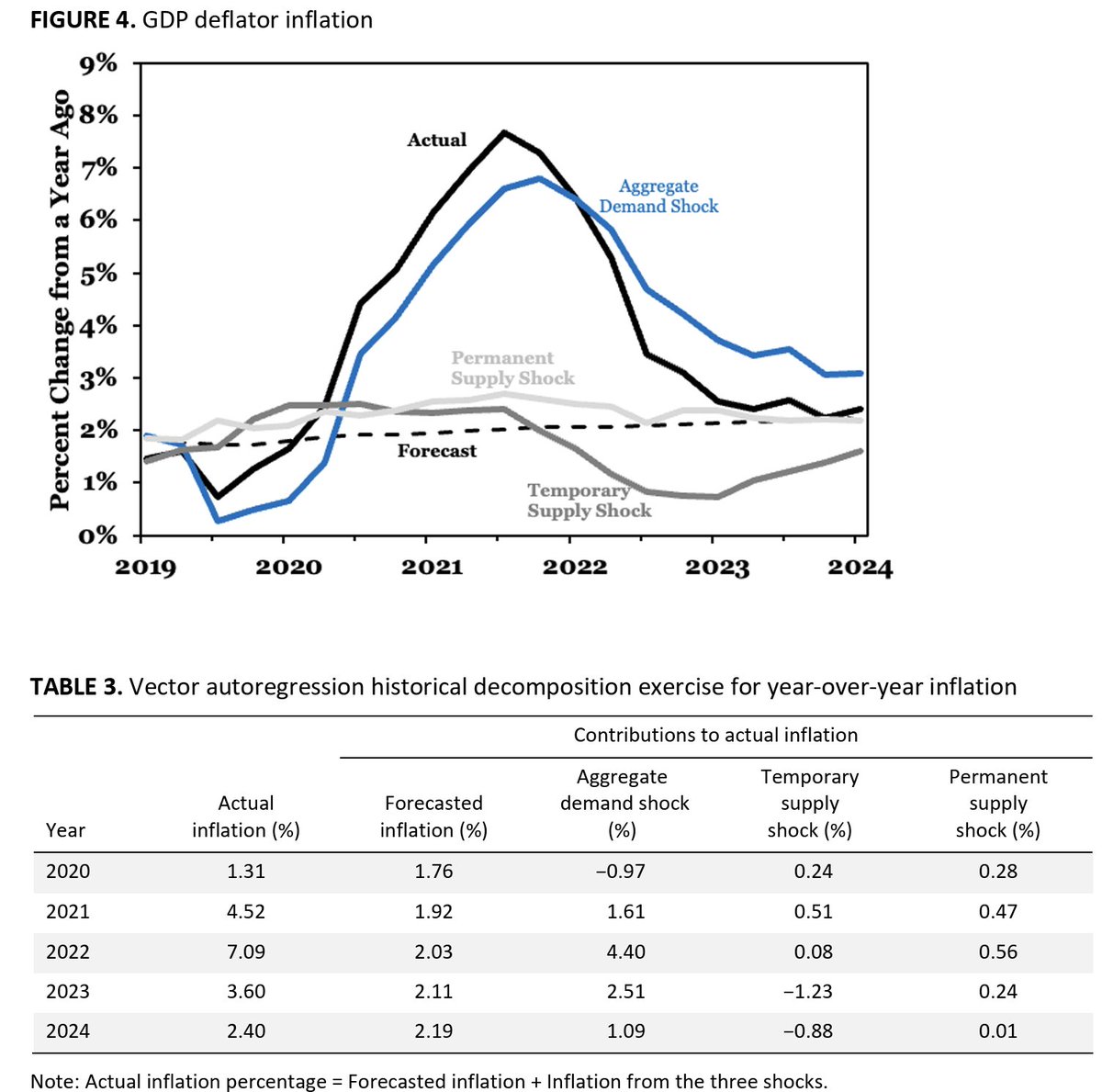

New working paper with Patrick Horan ☘️ where we provide a new decomposition of the inflation surge. Using a New Keynesian model, we show most of the inflation was caused by aggregate demand shocks. We also do a Jason Furman decomposition with similar results (1/3) John Cochrane

Thanks David Beckworth for having me on Macro Musings. What a privilege Interested in the global macroeconomics of stablecoins and crypto adoption? Check out our discussion Link: open.spotify.com/episode/5p9595…

My latest newsletter based on this week's podcast. nic carter Nick Anthony George Selgin Caitlin Long 🔑⚡️🟠 shorturl.at/oTbgh