Twigmaester

@twigmaester

Developer, trash tier philosopher | work @SkyEcosystem & @BlockAnalitica

ID: 2946247048

28-12-2014 18:23:35

288 Tweet

165 Takipçi

440 Takip Edilen

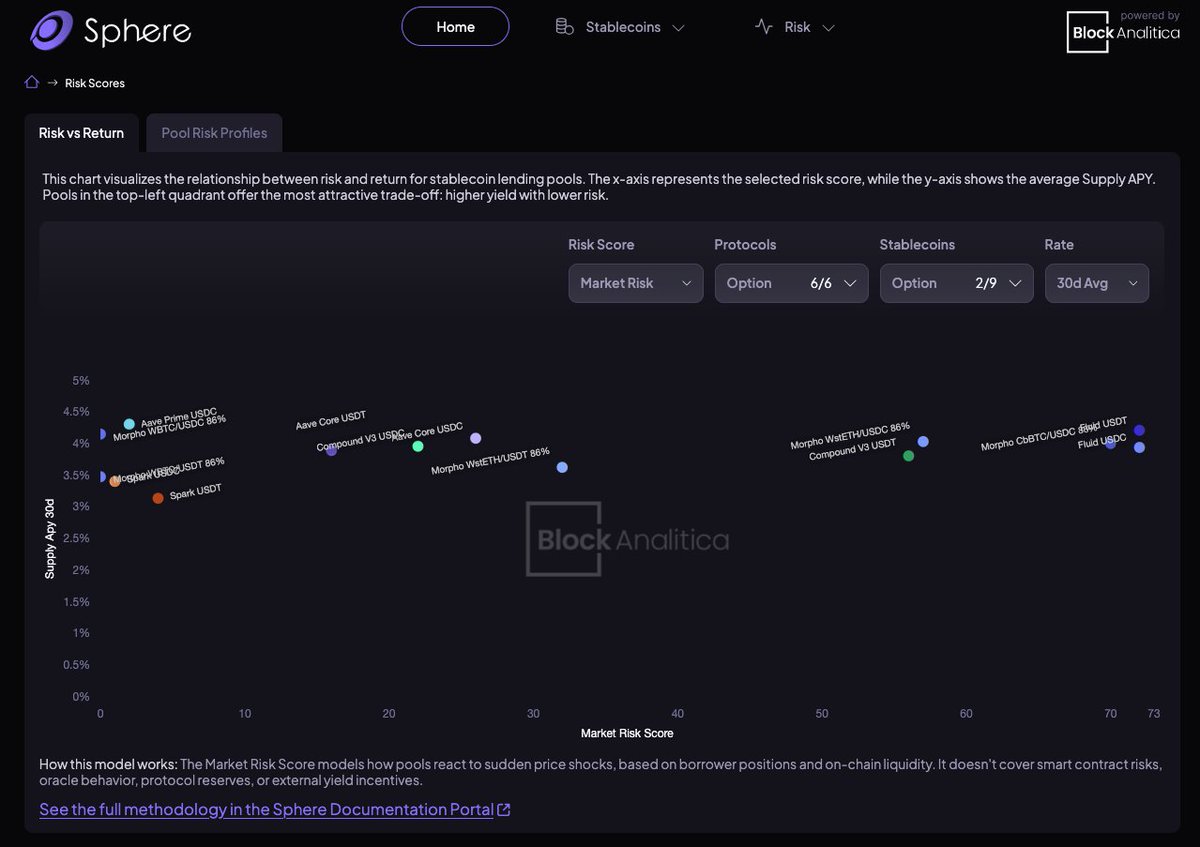

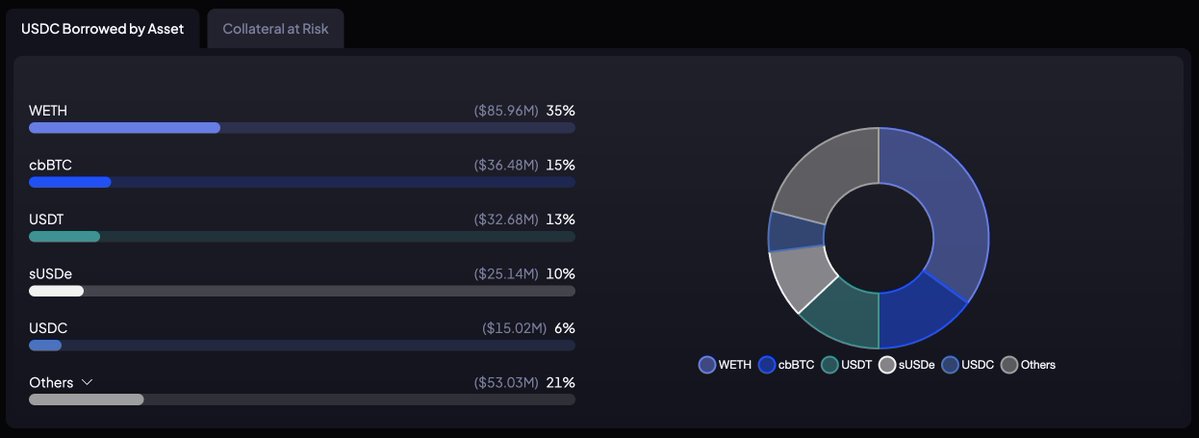

Quick alpha: You can check the backing of each stablecoin pool on Block Analitica's Sphere dashboard.

Compound V3 USDS market heating up 👀 Compound Labs • Supply APY: 1D avg 16.41% (7D avg 8.83%) • Borrow APY: 1D avg 19.12% (7D avg 10.4%) • Total Borrow: $8.45M • Current Utilization: 90.74% • Collateral breakdown: deUSD (69%), cbBTC (16%), wstETH (7%), WETH (4%), tBTC