Baze Incognito

@traderbaze

You are a little soul carrying about a corpse...Marcus Aurelius

ID: 25649530

21-03-2009 06:36:25

3,3K Tweet

714 Takipçi

2,2K Takip Edilen

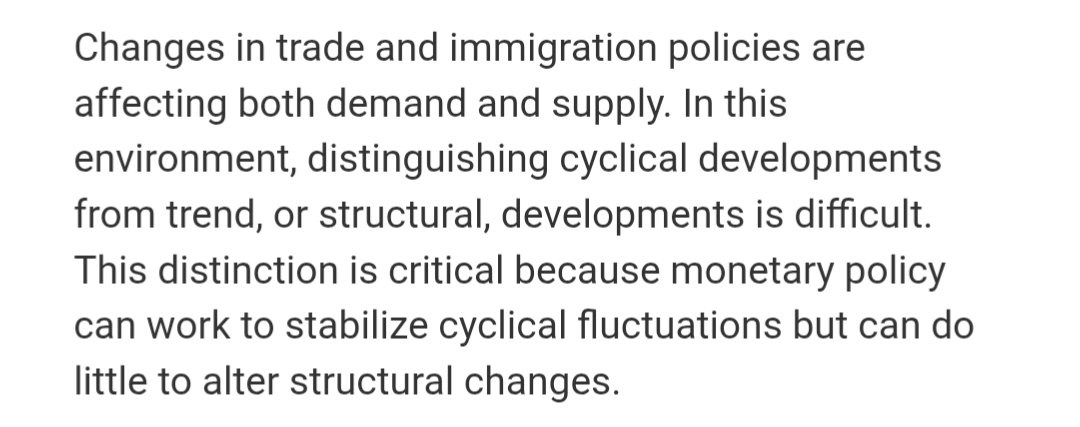

Must watch video posted on Mark's Mark Minervini YouTube Channel. Keep watching this video till you understand it. And then watch it again on repeat. This is gold - This is the Holy Grail in Trading youtu.be/JcFbWRs1myU?si…

If you haven't watched this excellent liquidity update from Michael Howell of CrossBorder Capital yet, I suggest you make it a near-term priority If he is right and we are heading towards a cycle turn, many of today's investors risk being caught by surprise youtu.be/8G1i0vstvTo