Matt Caruso, CFA, CMT

@trader_mcaruso

Record-breaking investor - US Investing Championship Top Performer - Former Market Maker and Professor - Unparalleled Membership bit.ly/4giDsVS

ID: 431815660

https://linktr.ee/carusoinsights 08-12-2011 18:30:10

9,9K Tweet

59,59K Followers

1,1K Following

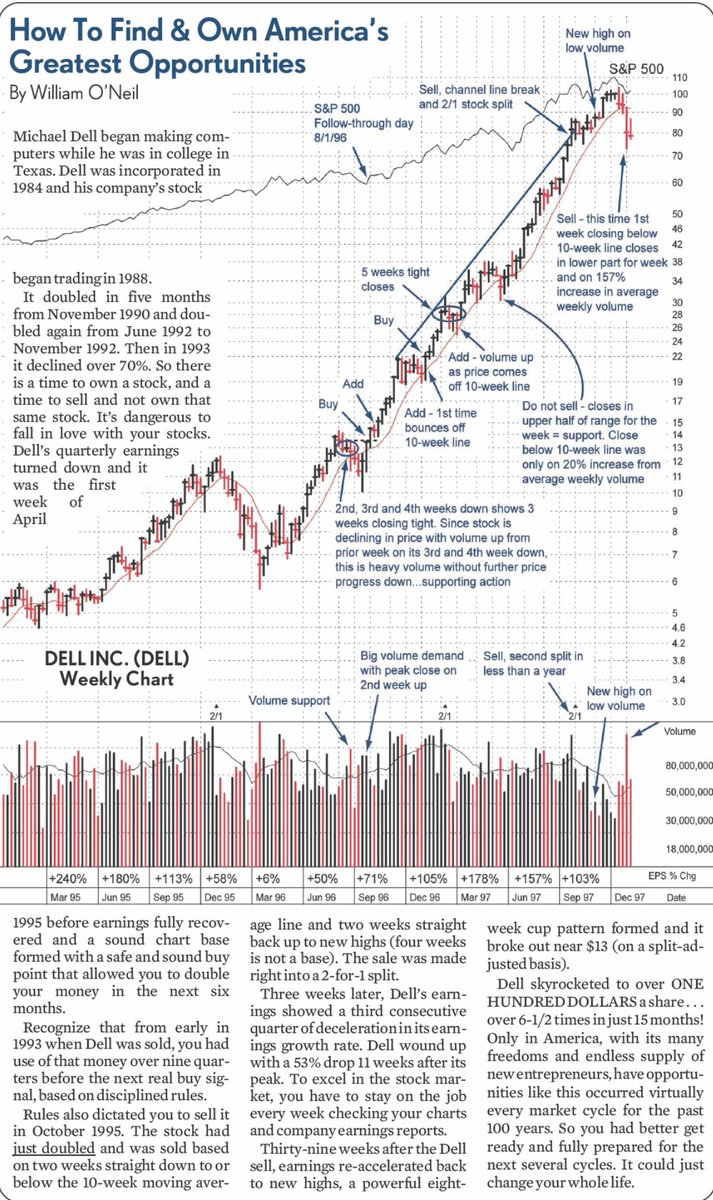

Great insights shared by Matt Matt Caruso, CFA, CMT. 1) All bear markets have a root cause 2) Bear markets ended with "Problem Solved" 3) Market usually bottomed ahead of "Problem Solved" due to one sided positioning 4) Historical charts of Bear Markets and how they ended 5) The