wash

@washparkcrypto

per aspera ad astra

ID: 1388564612128313344

01-05-2021 18:43:01

3,3K Tweet

1,1K Takipçi

5,5K Takip Edilen

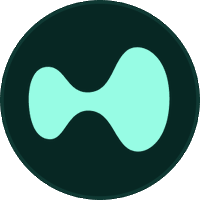

Anybody arguing that they should use a CEX because it hides your positions must have forgotten that every single exchange except for Coinbase 🛡️ has an internal desk. That internal desk theoretically has far more incentive to “hunt you” than market wide participants. Open,