Shayna Strom

@shaynalstrom

President & CEO @equitablegrowth. @ACLU & @OMB44 alum. She/her. Views are my own. Retweets ≠ endorsements.

ID: 1567226956793483265

06-09-2022 19:04:06

303 Tweet

1,1K Takipçi

310 Takip Edilen

The 2025 expiration of the Trump estate tax cuts, which were part of the 2017 tax bill, hasn’t received as much attention as other parts of the upcoming debate. It deserves more as I discuss in this research brief published by Equitable Growth today: equitablegrowth.org/research-paper…

Congratulations Daron Acemoglu! So well deserved.

Excellent walk-through of how we can raise revenues and living standards, while addressing priorities like unmet caregiving needs and the climate crisis next year. "The promise of equitable and pro-growth tax reform" by equitablegrowth.org/research-paper… via Equitable Growth

Check out this new Equitable Growth blueprint for real pro-growth tax reform! Regressive "trickle down" tax cuts don't work, but the academic evidence shows us what does: Progressive reform that... ✅Combats inequality ✅Raises revenue ✅Encourages competition & innovation

Taxing the rich is the fair thing to do, and it can also be the pro-growth thing to do! Shayna Strom, David S. Mitchell and I have a new paper out today explaining how progressive taxation can help boost strong, durable, inclusive economic growth. Thread! equitablegrowth.org/research-paper…

Tax reform can and should be pro-economic growth (and also equitable). Read how in our newest paper, with David S. Mitchell and Michael Linden.

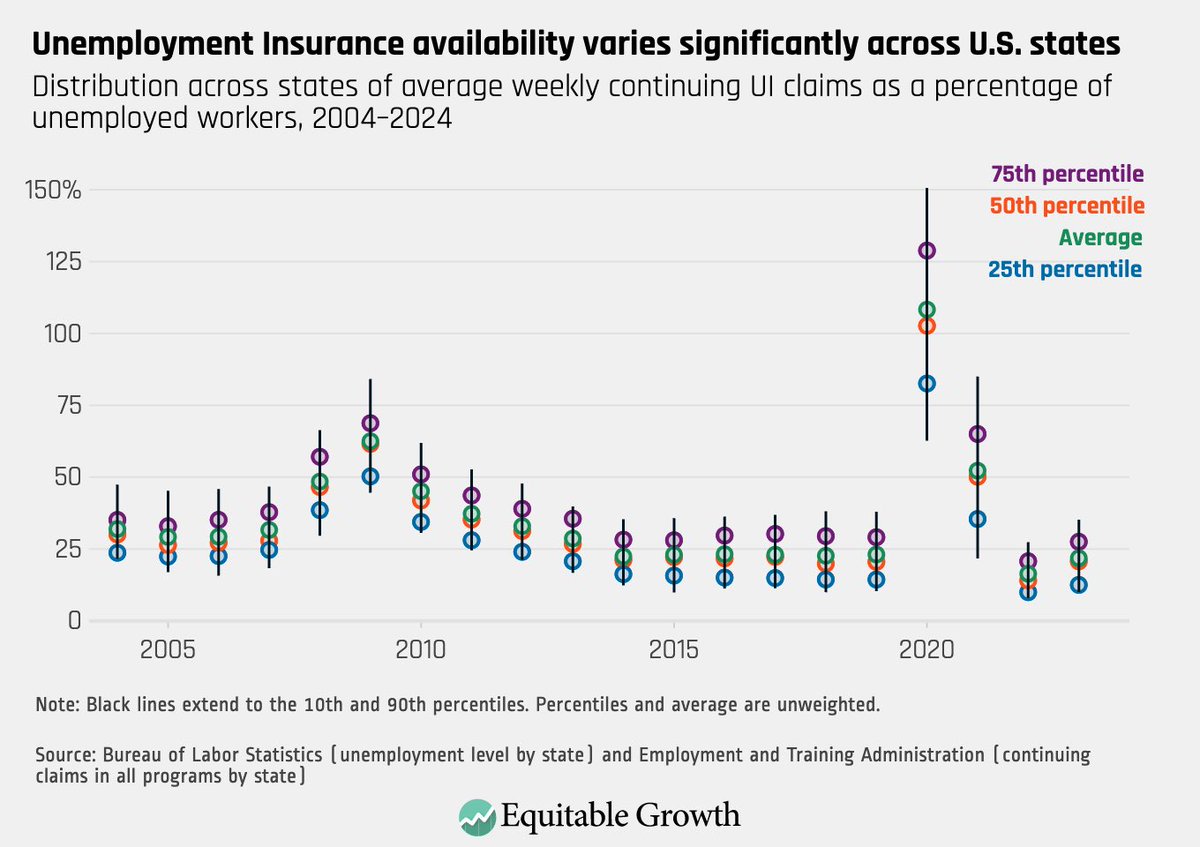

Have a post up at Equitable Growth today about UI earnings eligibility rules. They were functionally waved via PUA during the pandemic, and UI use expanded dramatically.

The tax code should work for everyone—not just the wealthy few. Tax reform can reduce inequality, fund critical public investments, and incentivize productive economic behavior. Read the report by ESB's Michael Linden and Shayna Strom, with David S. Mitchell: equitablegrowth.org/research-paper…

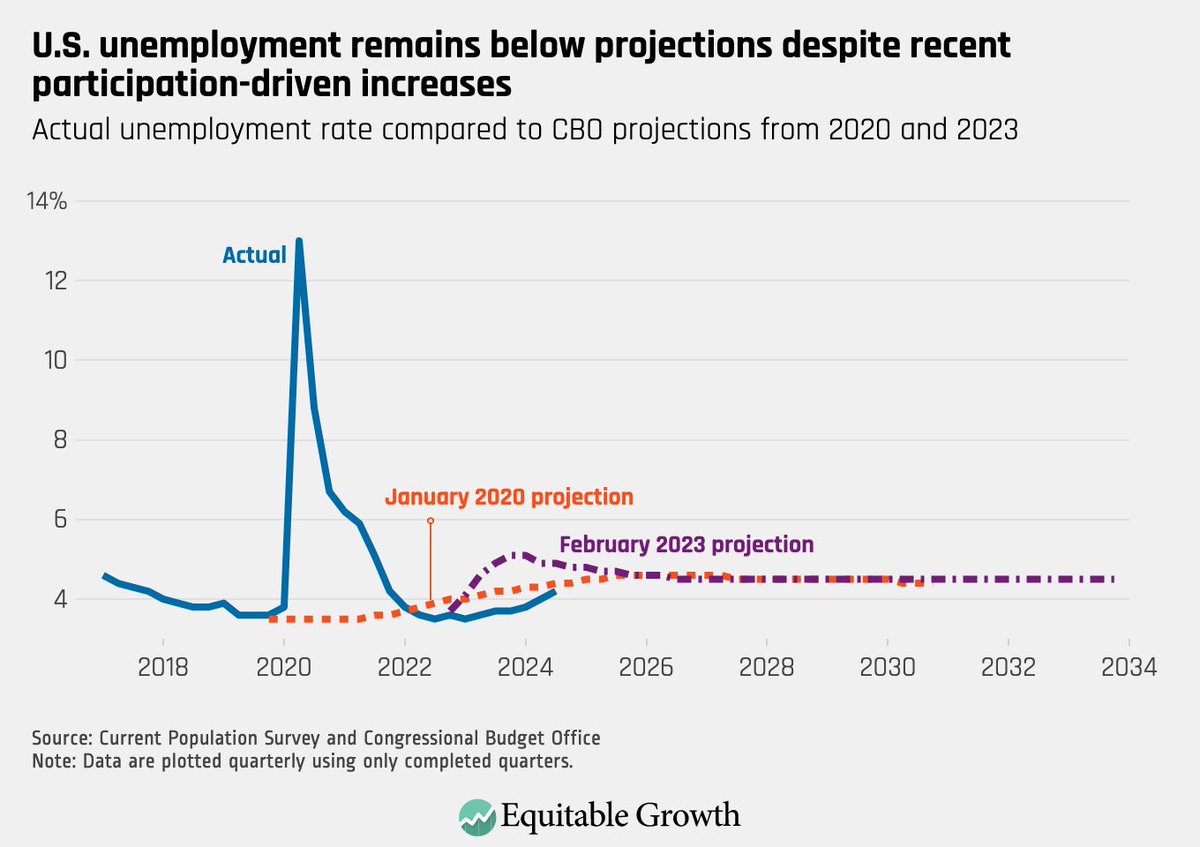

New Equitable Growth post from me today: the labor market is pretty good by recent historical standards, but that’s not all - it’s also better than we thought it would be 1) before the pandemic and 2) early last year

This is a fabulous pick--Elizabeth Wilkins is brilliant, strategic, and a wonderful human being to boot. Thrilled for Elizabeth, for Roosevelt Institute, and for the entire economic policy community.

From Shilpa Phadke & Shayna Strom, making the case why we need an economy where "care is a public good."

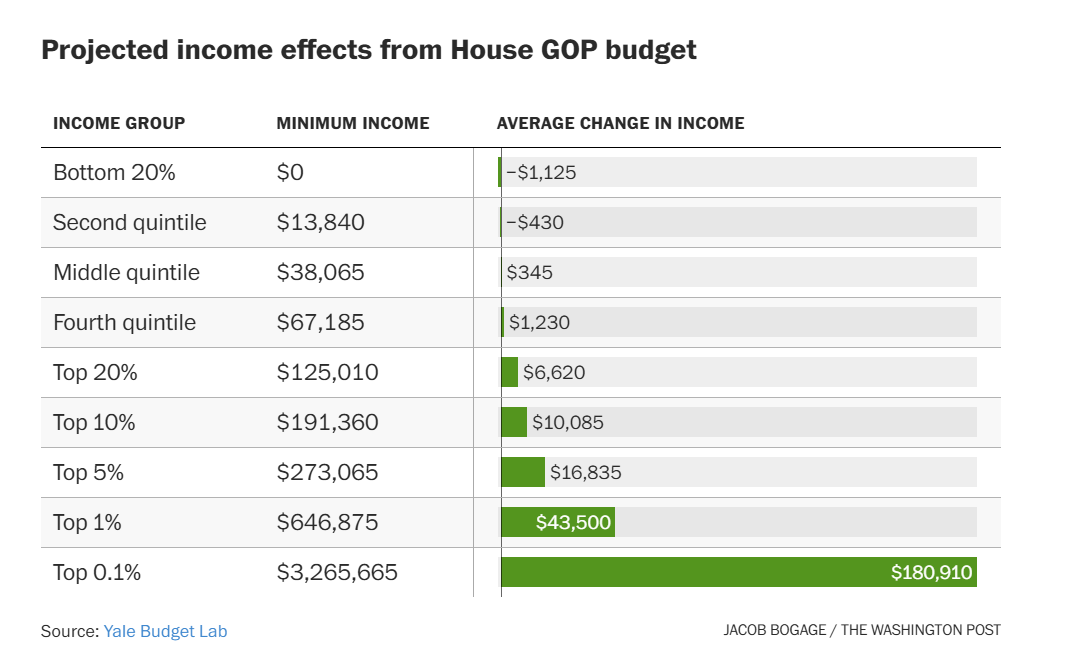

Grateful to (((Jacob Bogage))) for covering The Budget Lab's new report on the distributional effects of the House-passed Budget Resolution. Overall: huge tax cuts for higher-income families are partially paid for by cutting healthcare and SNAP, *raising costs* for the bottom 40%