Quantifiable Edges

@quantifiabledgs

Assessing Market Action with Indicators and History

ID: 15391371

https://quantifiableedges.com/ 11-07-2008 13:45:24

5,5K Tweet

20,20K Takipçi

111 Takip Edilen

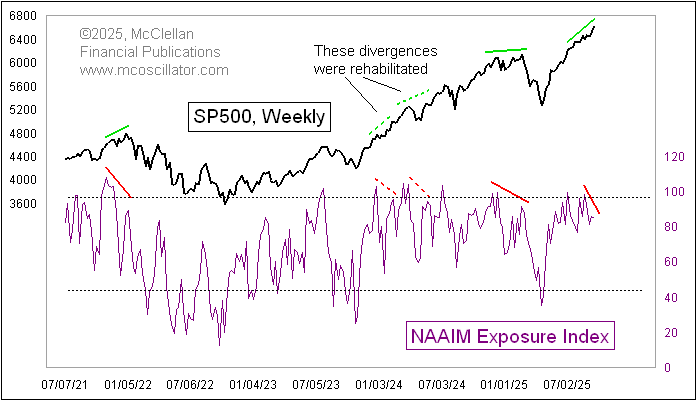

Interesting podcast conversation between Adam Taggart and Tom McClellan this weekend: youtu.be/8uysmVS66zg?si…

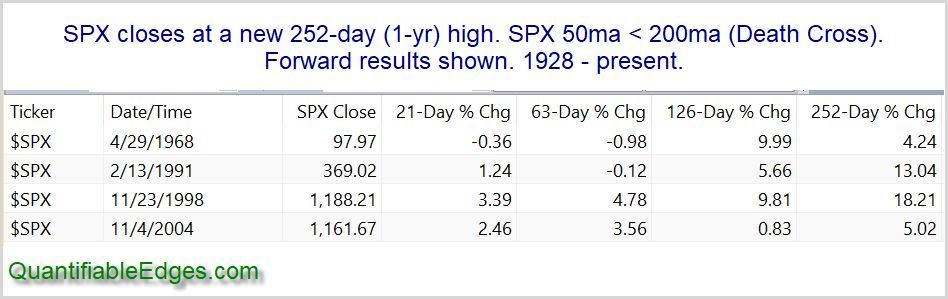

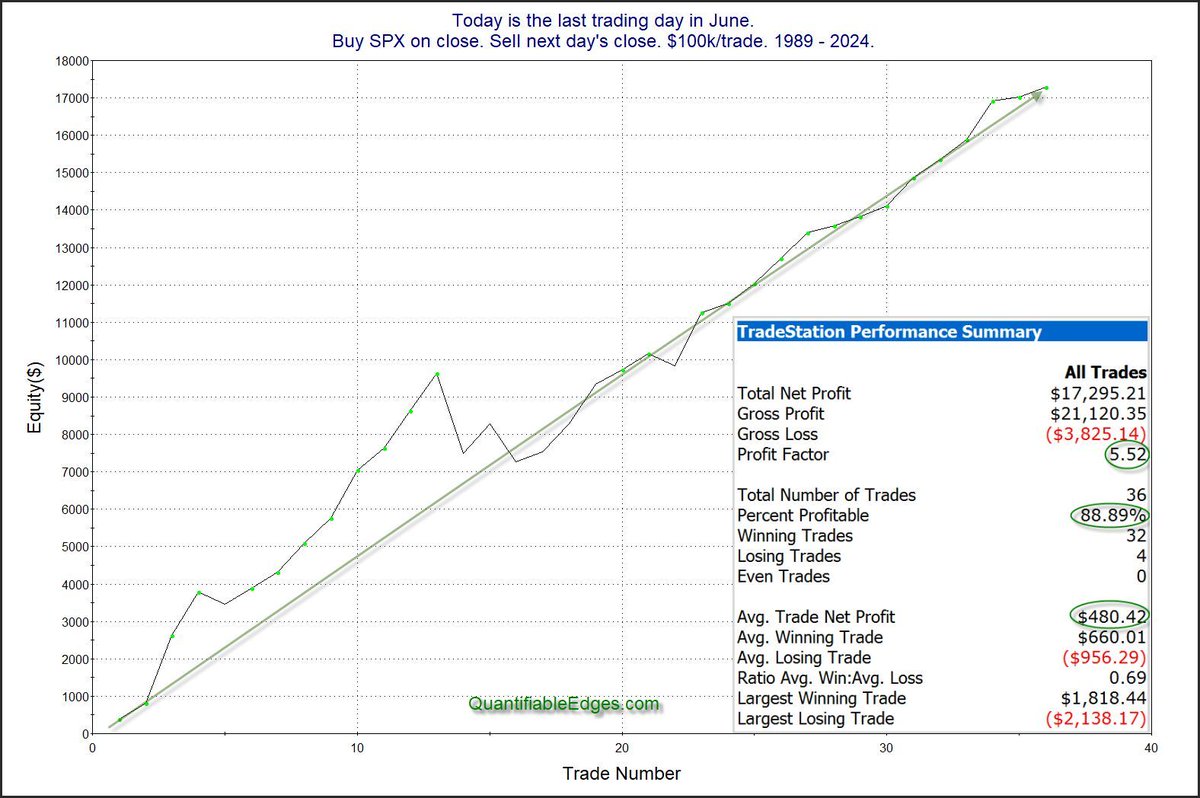

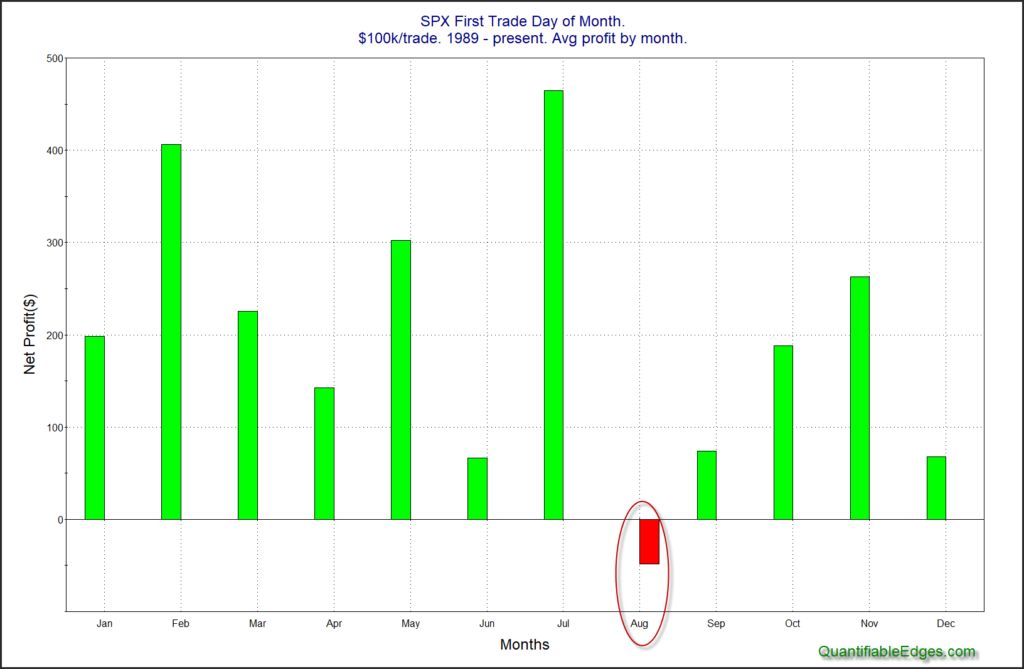

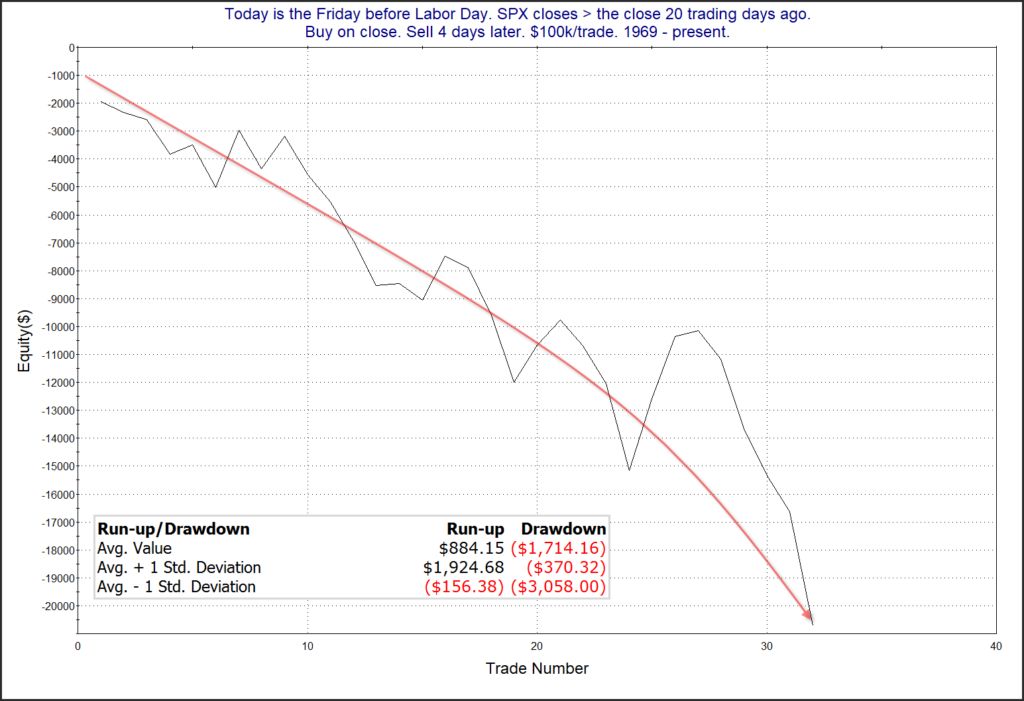

$FED Day coming Wednesday. A few notes about Wed odds for you to prep as we approach... edge has been stronger with selling ahead of announcement. 3 examples: quantifiableedges.com/action-mon-tue… and quantifiableedges.com/why-a-new-high… and quantifiableedges.com/strong-selling… Also notable is that the edge basically