Prometheus Research

@prometheusmacro

Research service with the goal of democratizing finance. Making institutional-quality insights and research available to the public.

ID: 1348305278131953664

https://www.prometheus-macro.com 10-01-2021 16:26:57

14,14K Tweet

41,41K Takipçi

514 Takip Edilen

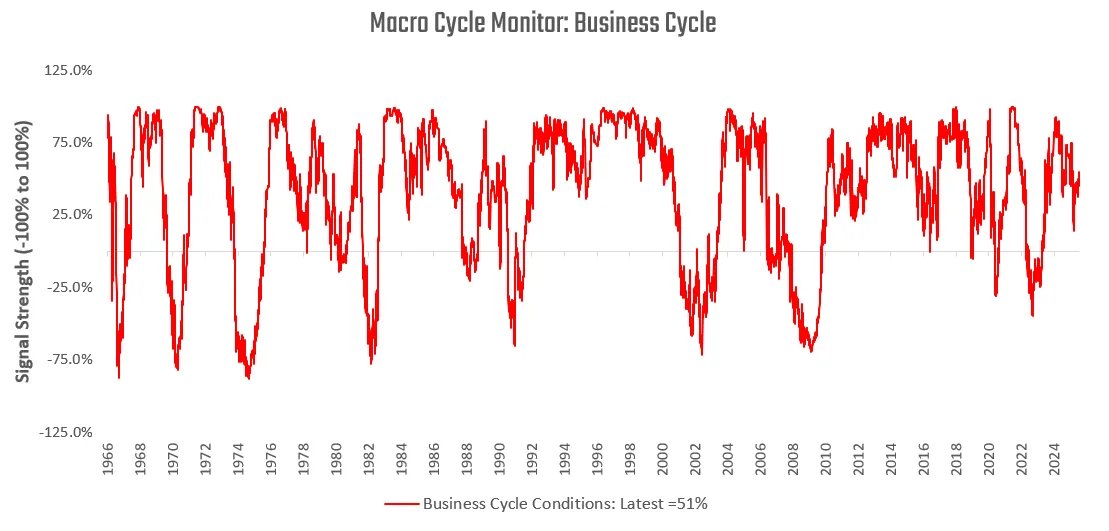

How Would You Allocate Assets in Today's Macro Backdrop? Scanning through asset prices and macro fundamentals to figure out the best reward/risk for asset allocation. 1/16 Lots of Prometheus Research data...