Minutes to Millionaire

@min2millionaire

Showing ordinary people how to spend few minutes a day to turn thousands into millions through a portfolio of cryptocurrency, stock options, gold and silver

ID: 1300757178052046851

01-09-2020 11:28:08

3,3K Tweet

133 Takipçi

1,1K Takip Edilen

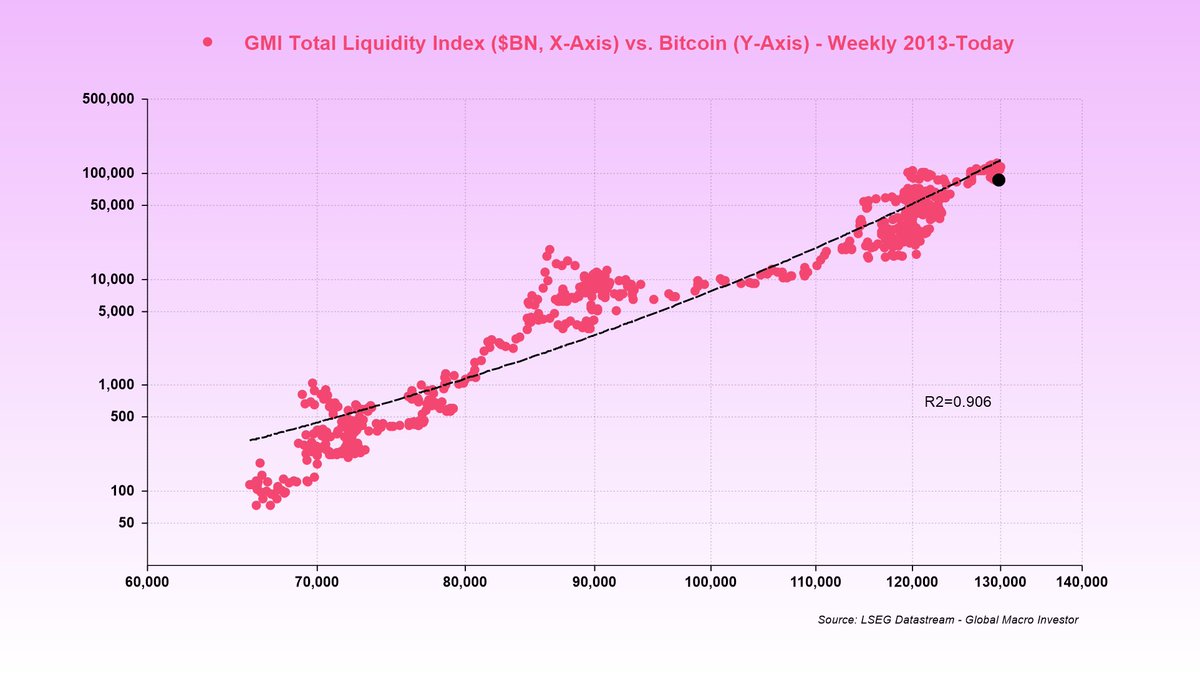

Yesterday, the #Fed cut rates and launched a $40 billion #bond #buying scheme to ease liquidity strains. The overall statement was the most #dovish since 2021. Michael Lebowitz, CFA

Raoul Pal Dan Tapiero Bull Theory Also agree, as this is something we’ve written extensively about in the past... What’s happening is that gold is front-running the liquidity injection coming next year, as there is still a substantial stock of interest payments that needs to be monetized through some