Melinda Nelson CPA

@melindancpa

Tax Partner Baker Tilly US, Explainer of Tax

AZ is home, musical geek, fan of soccer & Iowa State

All views and opinions expressed are my own.

ID: 810597269011513344

http://www.bakertilly.com 18-12-2016 21:27:03

11,11K Tweet

5,5K Takipçi

833 Takip Edilen

Remember, 1099s & W2s due Jan 31!! Kelly Phillips Erb Tracy Accounting Today Kay Bell Sylvia F. Dion Parker Tax Pro Library Cari Weston, CPA Jina Etienne CPA CGMA CDE® (she/her) TaxBuzz.com Deborah Fox, CPA Brian Streig, CPA Melinda Nelson CPA Phyllis Jo Kubey Jan Roberg @yourfavecpa Tyler Mcbroom Ed Zollars, CPA

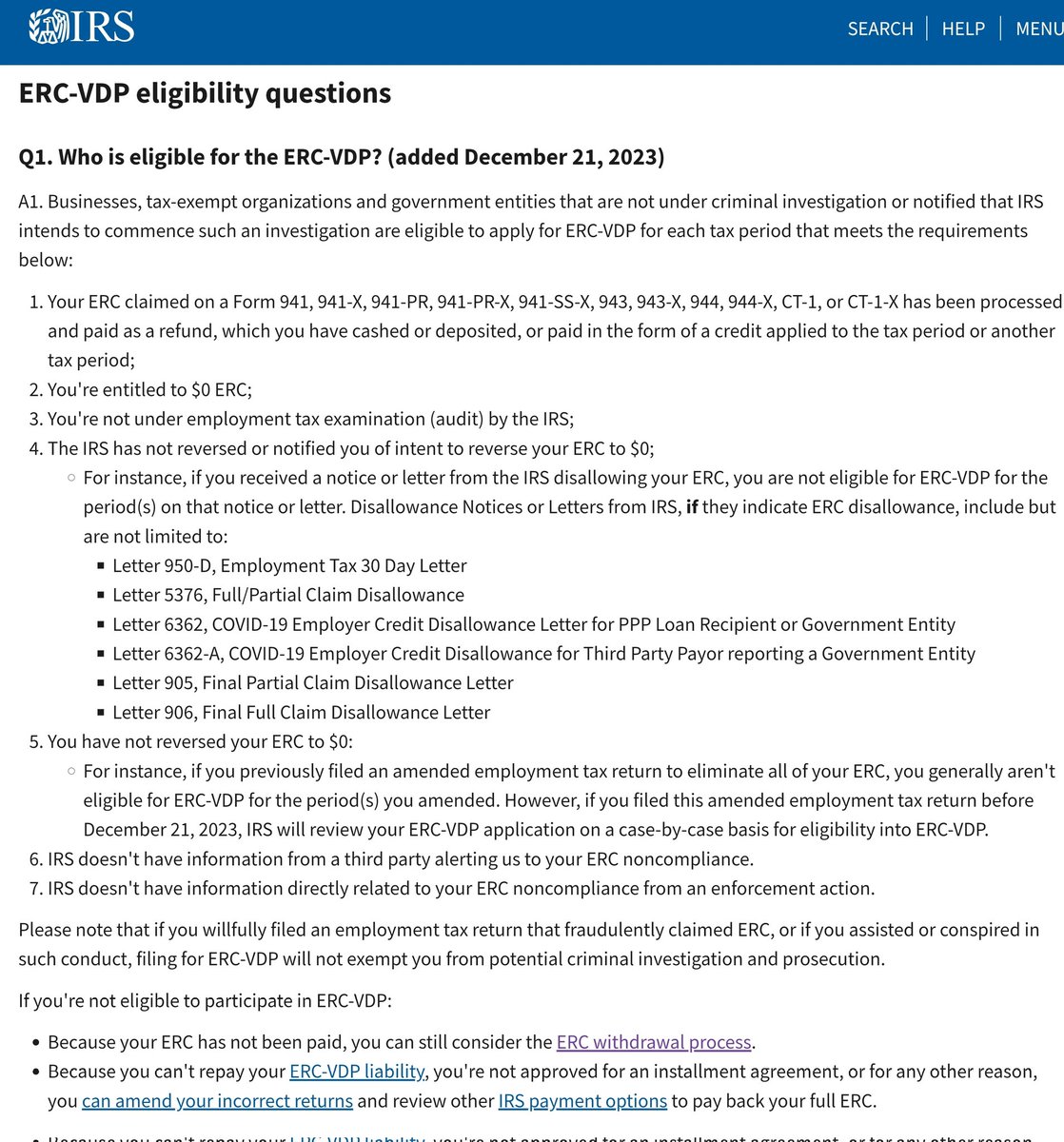

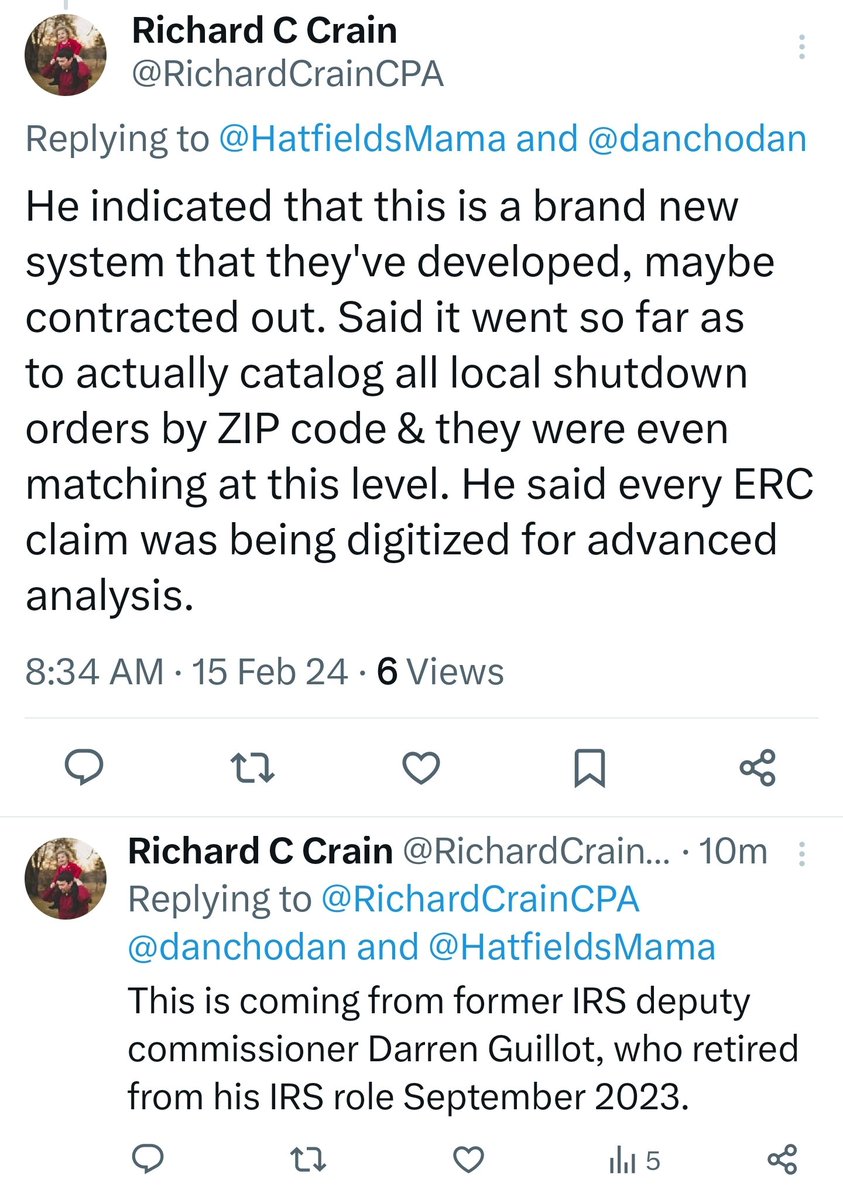

IRS has implemented advanced analytics and AI to identify fraudulent ERC & people are going to get nailed on this like crazy for the next five or so years. - Per Darren Guillot former IRS deputy commissioner - h/t Richard C Crain

What an amazing summer read... Thanks for sharing your story. Rex Chapman🏇🏼