Christos Kotsogiannis

@kotsogiannisc

Prof. @UniofExeter Director of Tax Admin. Research Centre (@TARC2013), Fellow of CESifo, editor of CESifo Econ. Studies, Assoc. Editor JOTA and Finanzarchiv.

ID: 1072571014054170624

https://sites.google.com/site/kotsogiannischristos 11-12-2018 19:17:11

531 Tweet

306 Takipçi

159 Takip Edilen

🚨New paper alert🚨 We released a paper this week with Felix Hugger & Ana Cinta G. Cabral on MNE effective tax rates . We have new results on the stock and location of global low-taxed profits. We think the work has important implications for the global min tax. Thread: 1/

Recently published paper in the Journal of Public Economics : "Pareto-Improving Minimum Corporate Taxation" Vol 225 (Sept 2023) by Shafik Hebous & Michael Keen (Michael Keen ) sciencedirect.com/science/articl…

#HappeningNow RRA_CG Ruganintwali Pascal opened the 2nd RRA Research Day where he highlighted the importance of research in maintaining RRA’s status as a progressive, forward-thinking, people-centric organization and contribute to the policy revision such as the most recent tax law reform.

Thank you to Rwanda Revenue Authority and @ICDTTax for the opportunity to discuss digitisation in tax administration and learn more about the evidence-based research RRA is doing International Growth Centre TARC World Bank Research Giulia Mascagni Fabrizio Santoro Luca Salvadori

The advice that tax authorities should do more “desk audits” & less “comprehensive” requires qualification. See this paper ⬇️ for the why! Enjoyed working on this project and learned a lot from Luca Salvadori John K @Theo68933256 and colleagues at Rwanda Revenue Authority Dr. Innocente Tagadenis

Excited for TARC to be taking part in the 58th General Assembly of Secretaría Ejecutiva in Foz do Iguaçu, Brasil. The theme is of interest to all tax administrations, and to TARC too! Economic and Social Research Council University of Exeter News University of Exeter Business School

Principles for Pareto Efficient Border Carbon Adjustment | Michael Keen Christos Kotsogiannis #EconTwitter cesifo.org/en/publication…

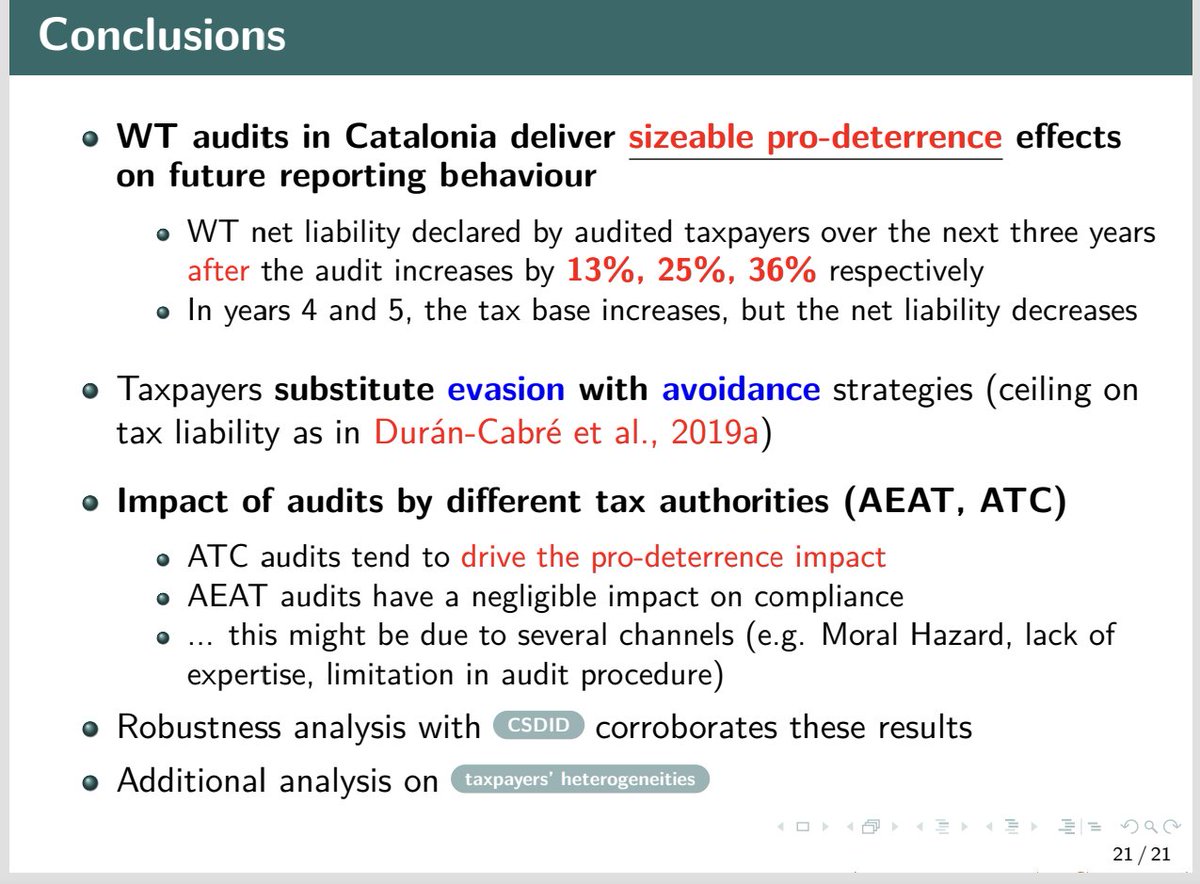

Many thanks to the organizers of the Encuentros Economía Pública for having me presenting our paper on #Wealth #TaxAudits (with #JMDuran Alejandro Esteller Moré Christos Kotsogiannis) to the discussant (#JValles) and all the participants for the fruitful & productive debate Barcelona School of Economics IEB TARC

Many thanks to the University of Gothenburg Göteborgs universitet / University of Gothenburg and the Quality of Government Institute QoG-Data for hosting me. Thoroughly enjoyed the discussions on long-term effects of #state #capacity on #tax #revenue, including property taxes, and tax compliance TARC

Many thanks to the organizers of the Barcelona School of Economics workshop in Public Economics for the opportunity to present our paper on #Wealth #TaxAudits (with #JMDuran Alejandro Esteller Moré Christos Kotsogiannis) and all the participants for the fruitful & productive discussion IEB TARC

The day has arrived for the 22nd C.R.E.T.E event on Milos 🇬🇷 If you are around join me in the 1st session of the day on 14.07 where I will be presenting recent work with Michael Keen on #BCAMS TARC Christos Cabolis Luca Salvadori Sofronis Clerides

📄 "Do tax audits have a dynamic impact? Evidence from corporate income tax administrative data", published in the Journal of Development Studies (JDS). #Paper by IEB's researcher Luca Salvadori, with Christos Kotsogiannis, John K & @Theo68933256 Open-access 🔗 i.mtr.cool/tnnynupgah #EconTwitter