John Hunter

@jhagiliscapitis

Investment Manager that uses both fundamental and technical analysis for stock selection. My tweets are my own opinion. Always ensure that you DYOR.

ID: 1415611017522913282

http://agiliscapitis.com/ 15-07-2021 09:56:32

91 Tweet

243 Takipçi

1,1K Takip Edilen

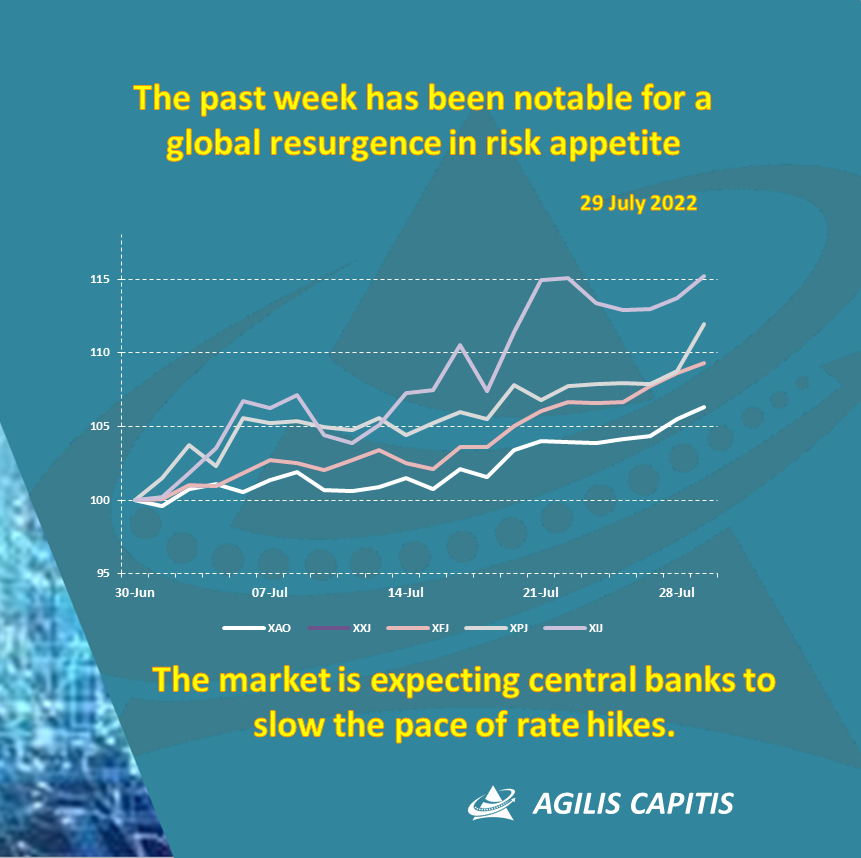

This week was a case of sell the rumour, buy the fact for the ASX following reports of Beijing lockdowns. Then buying the dip as COVID numbers eased and the further comments of economic support. ASX Close: Strong end to losing month as rate rise looms themarketherald.com.au/asx-close-stro…

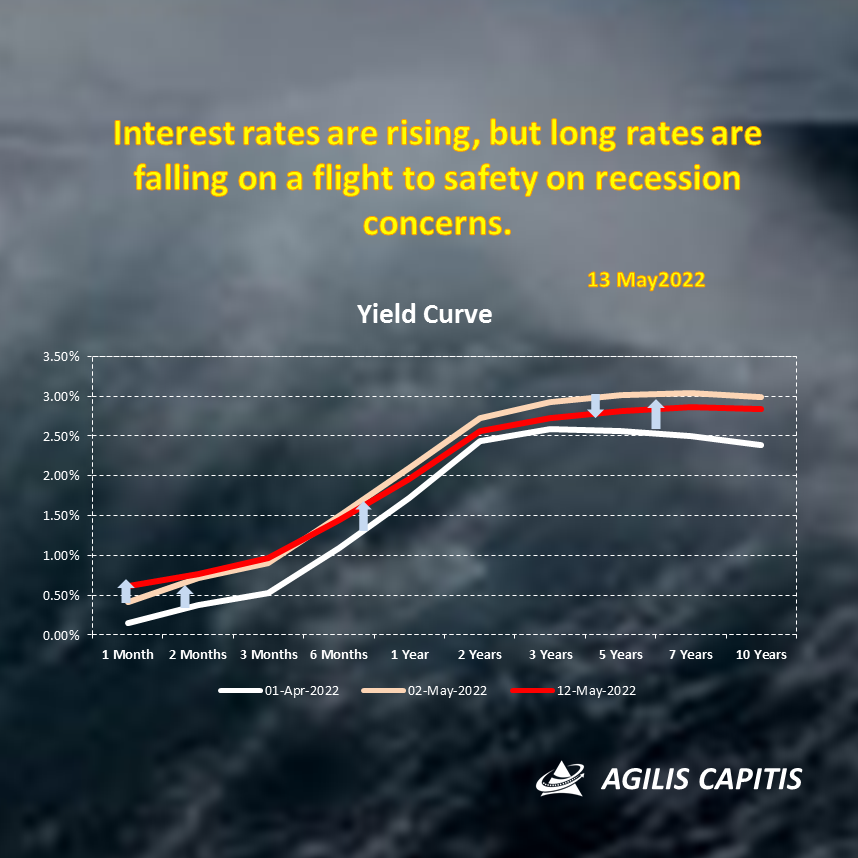

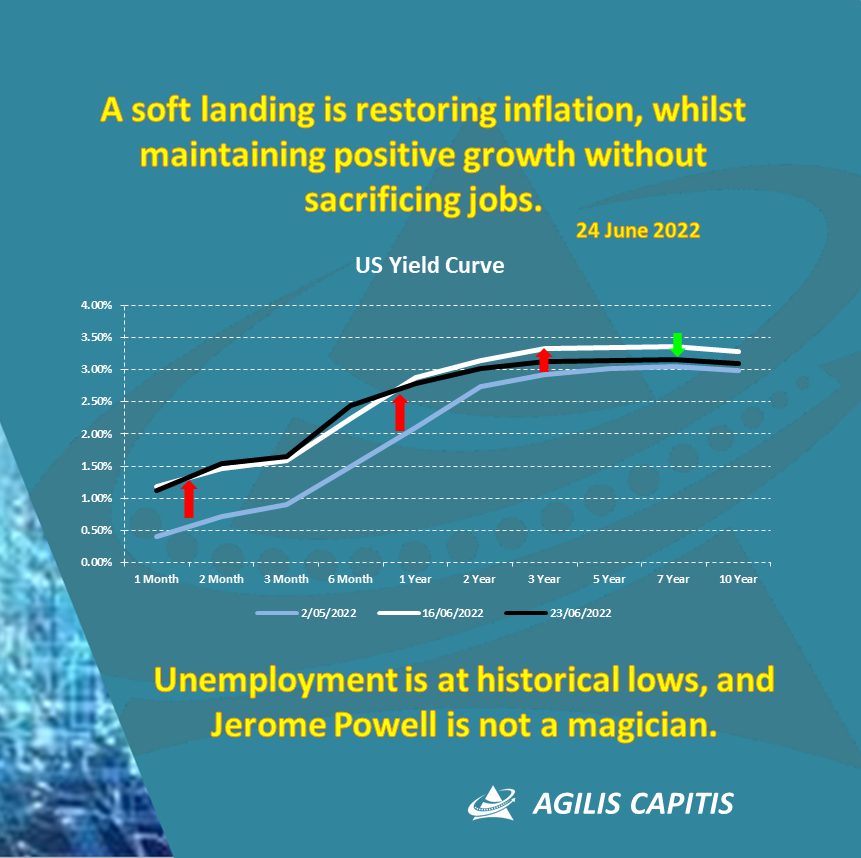

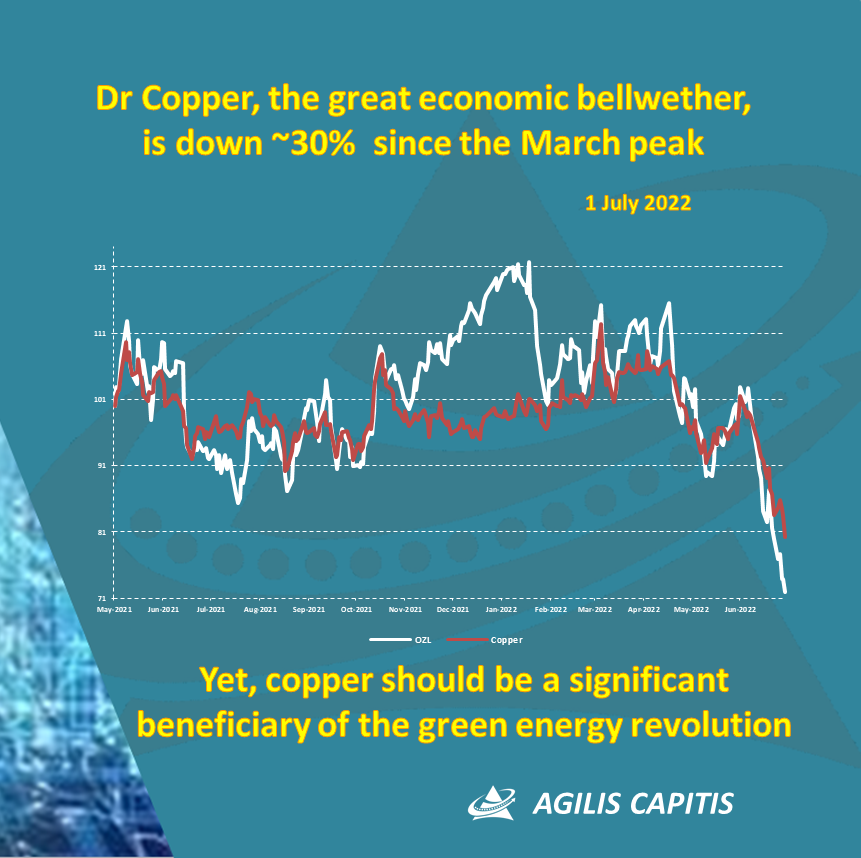

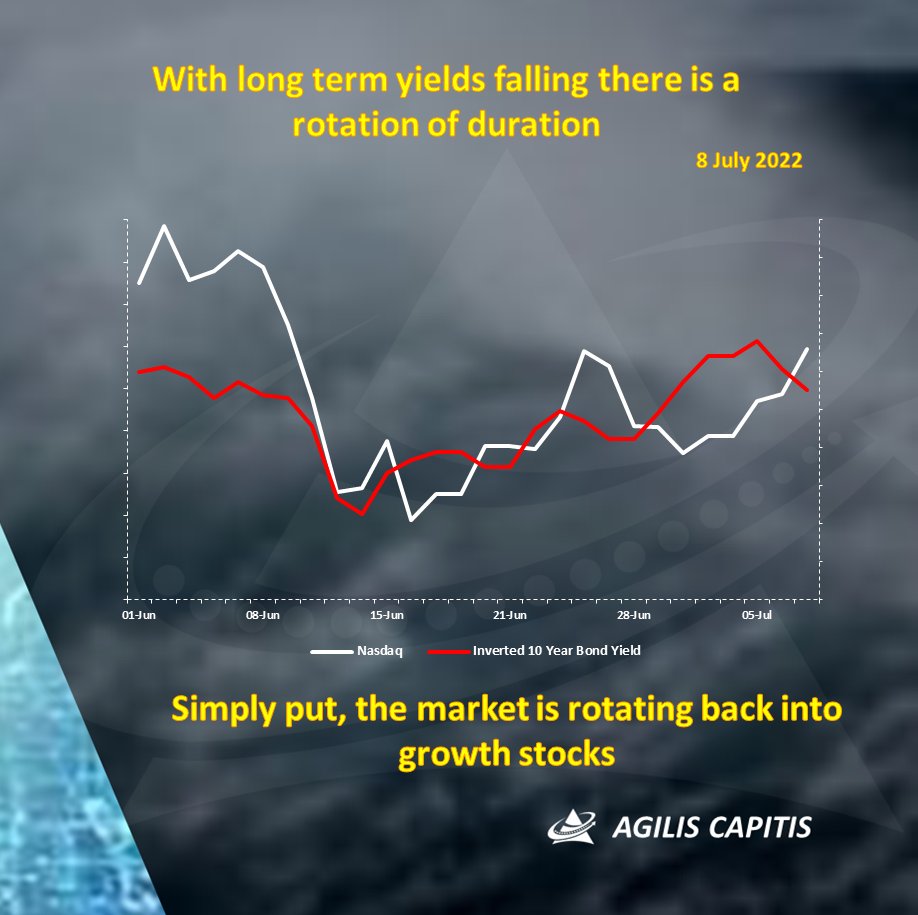

The US had a mid-week pump and dump, the BoE reignites stagflation concerns and the Chinese govt had an epiphany, their economic support rhetoric and COVID-zero policy are inconsistent. ASX Close: Rates panic fuels heavy weekly loss themarketherald.com.au/asx-close-rate… via @themarketherald

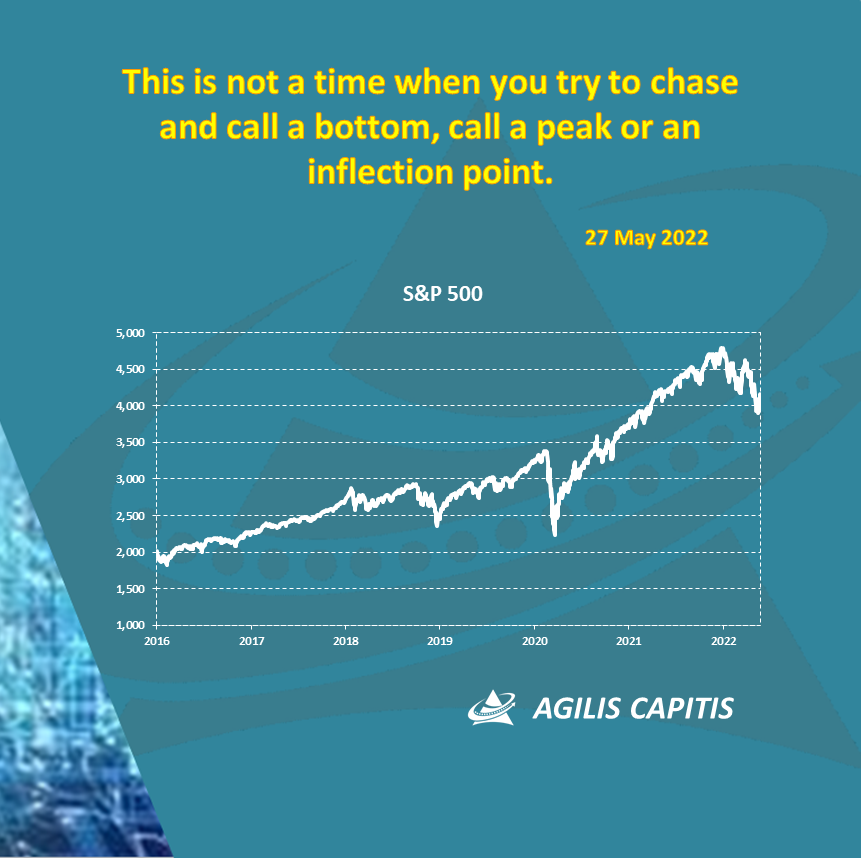

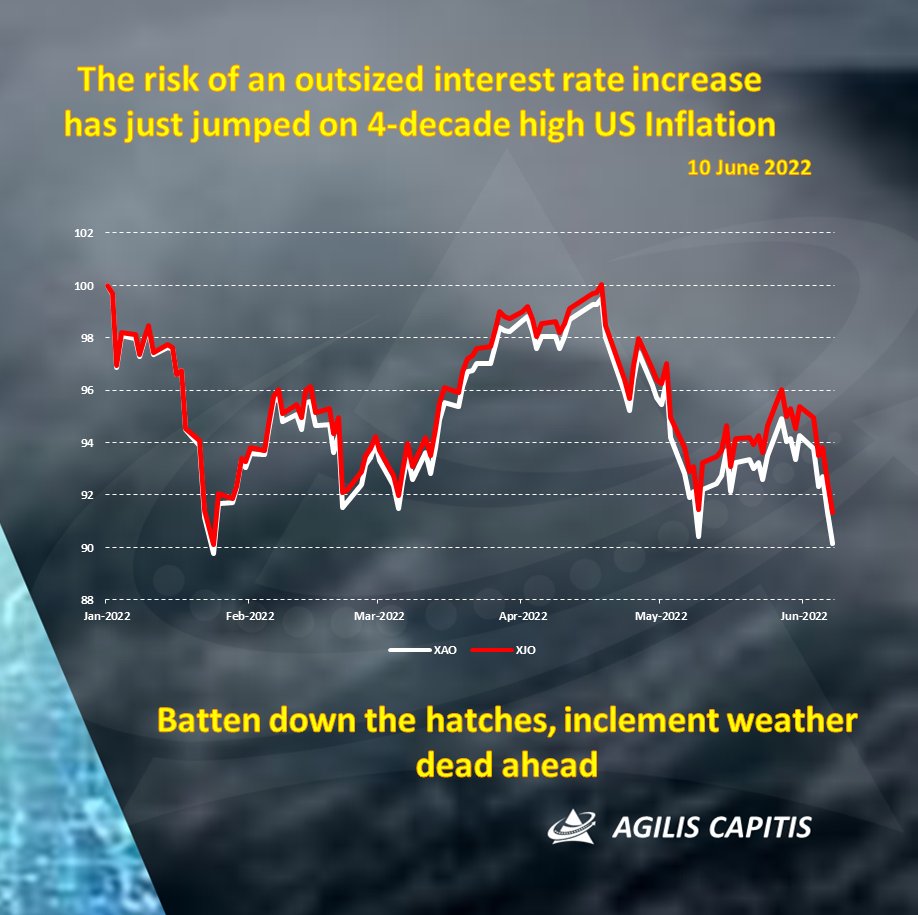

US CPI triggers a chaotic week but dip buyers step up | Can central banks engineer a soft landing or is recession likely | Xi and zero-COVID, thing are improving but still a disaster. What a Terra! ASX Close: Sharp rebound trims a fourth week of losses themarketherald.com.au/asx-close-shar…