Accountant for Amazon Sellers

@info_afas

Mail us at - [email protected]

ID: 1397268960312127490

25-05-2021 19:11:00

20 Tweet

54 Takipçi

6 Takip Edilen

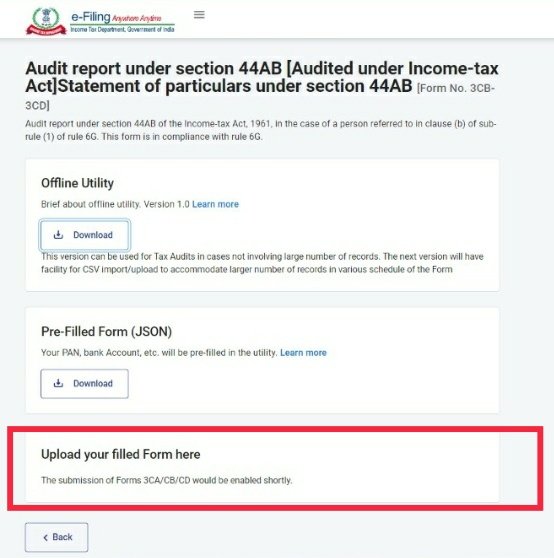

TAR UPDATE! Facility to upload TAR has not been made operational till date on #newincometaxportal 👇 Its almost a month,since the DEADLINE date of 15th Sep Is it the NEW NORMAL ❓😐 Income Tax India Ministry of Finance Institute of Chartered Accountants of India - ICAI Nirmala Sitharaman Office

Hey Income Tax India Last year Clause 16(d) Figures have been added in Income and demand raised This year 1. Agriculture income is added as Normal income and demand raised 2. Counting 234ABC interest wrongly calculated & demand raised What is more hidden for this year?

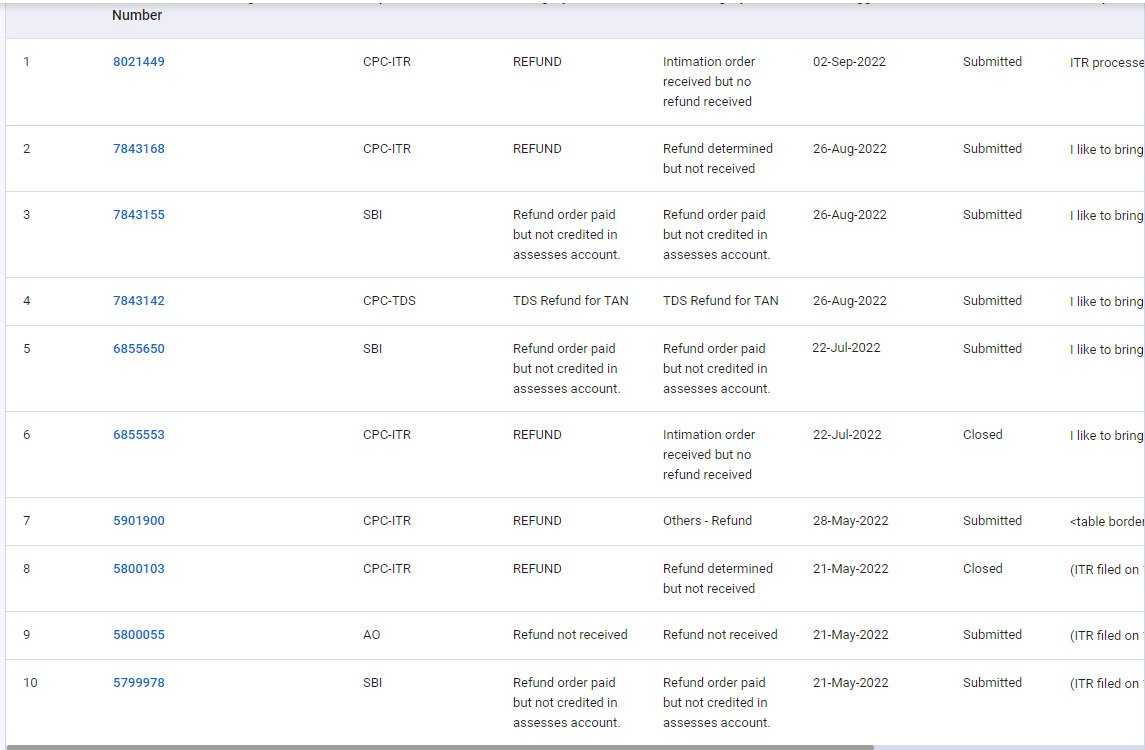

Dear Income Tax India in case of an NR, ITR is already processed on 3 Nov 21 and even after 10 months refund is not issued. Bank is also validated. Raised 10+ Grievances, most of not handled. CPGRAMS also didn't work. Do the needful. Your claims of quick refund are just jokes!