Frank²

@hwxfrank

Left curve of @D2_Finance

Multi-strategy Fund: Tokenized Derivatives Strategies | 100% on-chain

ID: 1583415626

10-07-2013 15:47:12

2,2K Tweet

1,1K Takipçi

1,1K Takip Edilen

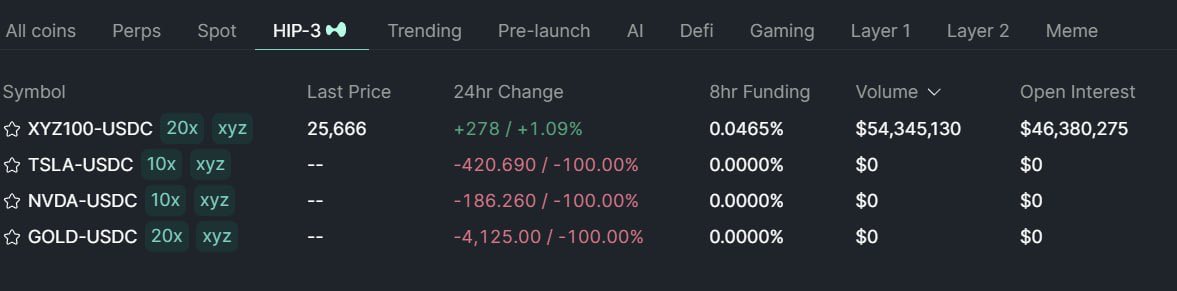

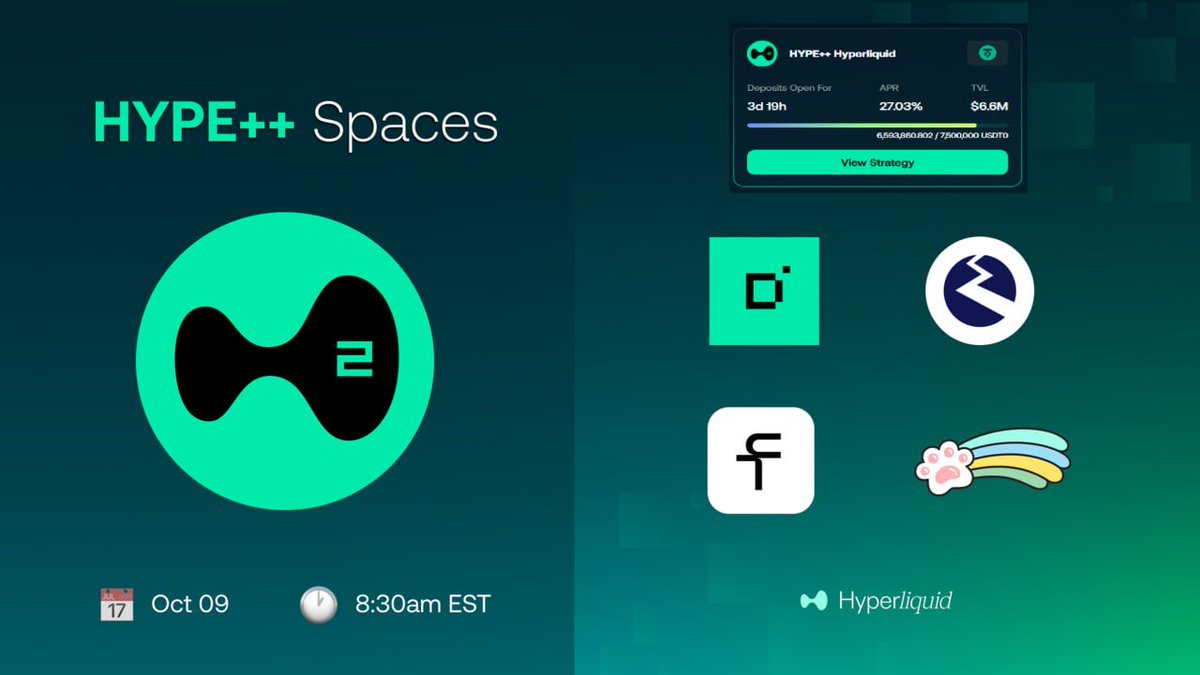

Safe to say a new strategy with $USDe deposits is on the way… 💚 With DeFi legos Backed by the full squad: Pendle Flowdesk Ethena Labs Hyperliquid Hyperliquid

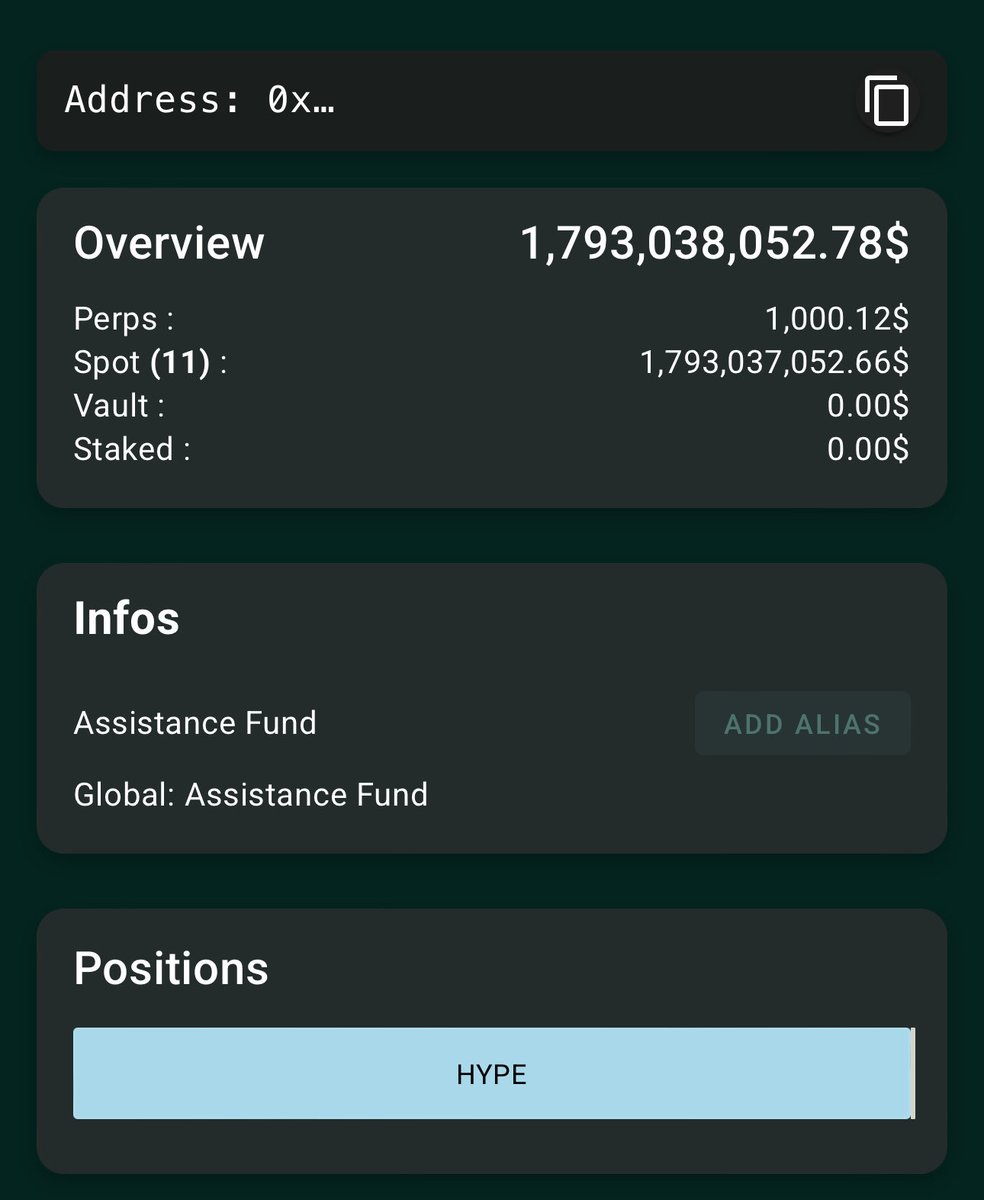

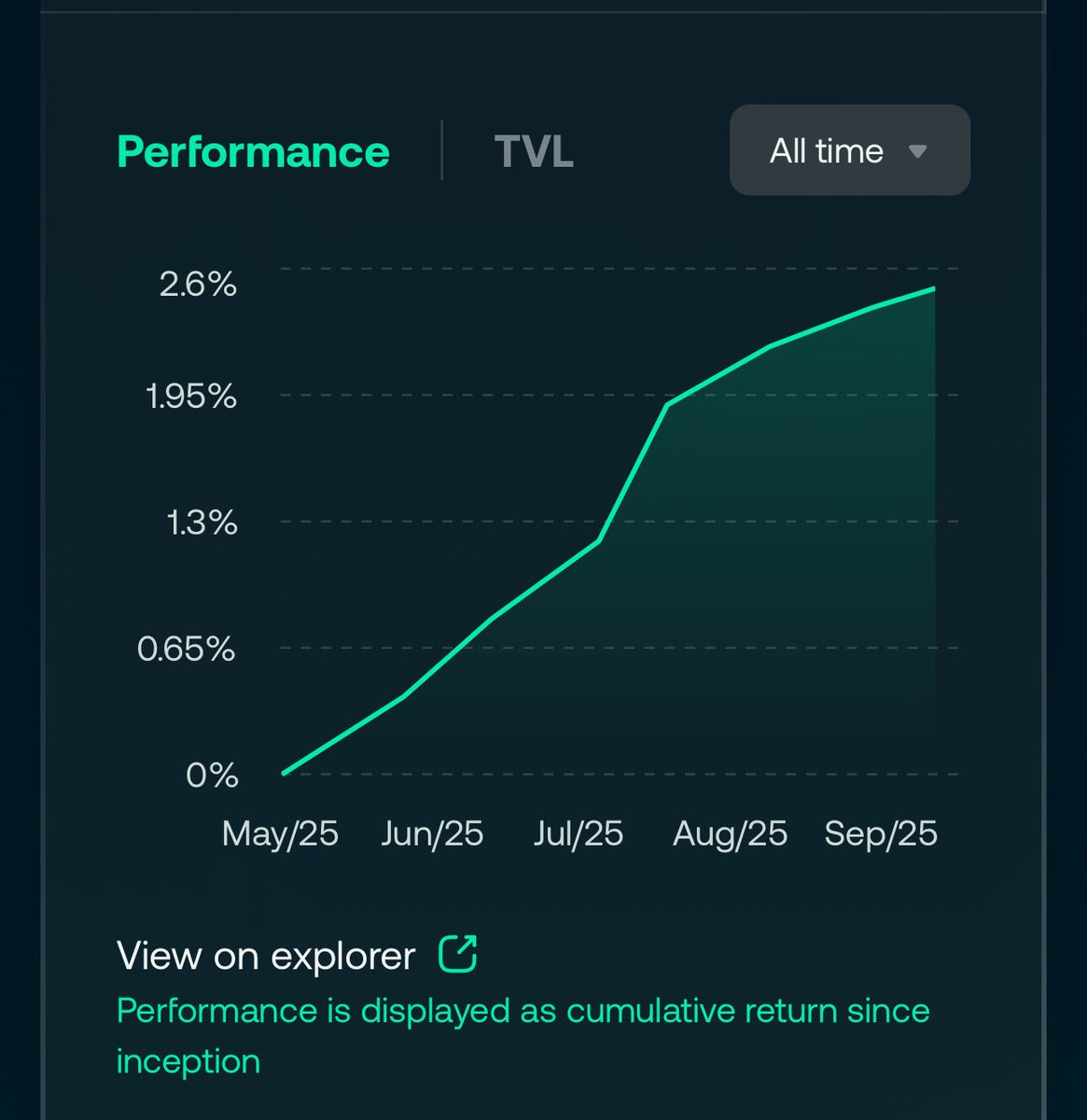

🟢 Good Net APR vs Evil Gross APY 🟥 Saw some chatter about “$100K in for 2 months → $400 out” while dashboards showed 2/4x higher funding PnL. 👉 Classic case of gross APY marketing vs net reality. Despite attempts at standardization (best so far:DefiLlama.com 0xngmi is hiring ), most

It was great meeting you xulian.hl and all other Hyperliquid builders Omnia.hl π androolloyd.hl anḍ̴͆͒ŷ̶͙̱̲ Felix HypurrCollective.hl 🐱 Riri.hl Sara.hl Tobias Reisner Wajahat Mughal and more. Job’s not finished. Hyperliquid

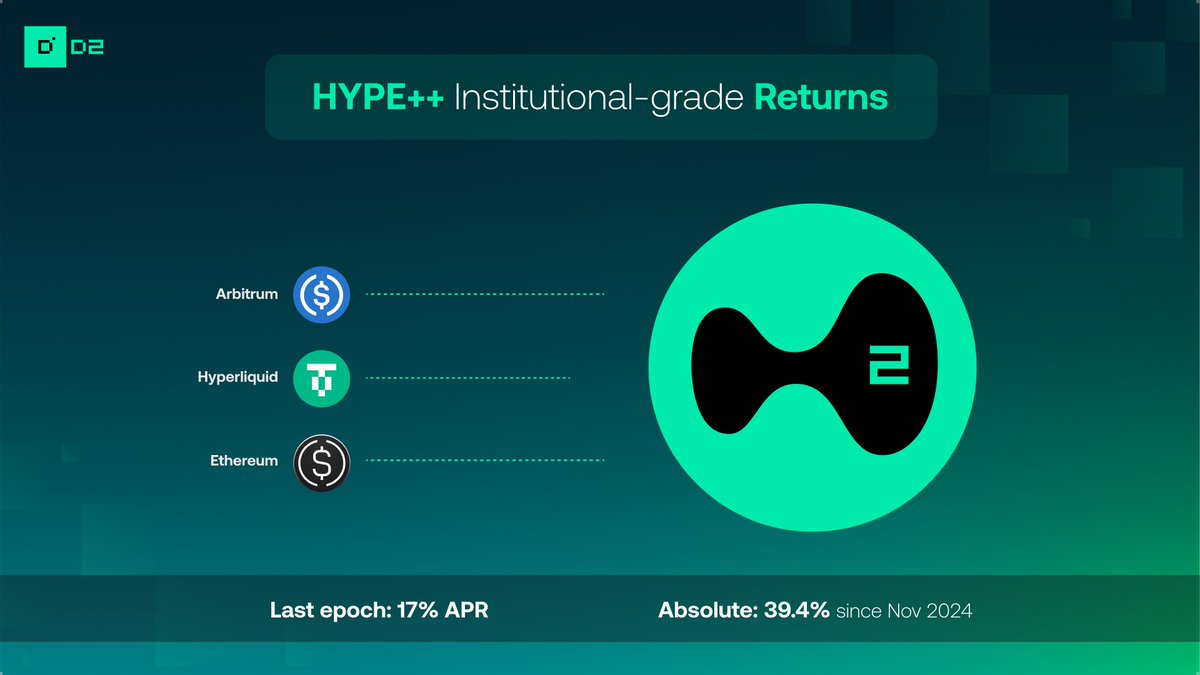

yuki was today years old when she found out about D2 Finance feel ashamed about it... what did yuki miss for all this time? 👇 D2 specialized in bringing institutional-grade derivative strats onchain - relative value volatility arbitrage trading - Where most onchain

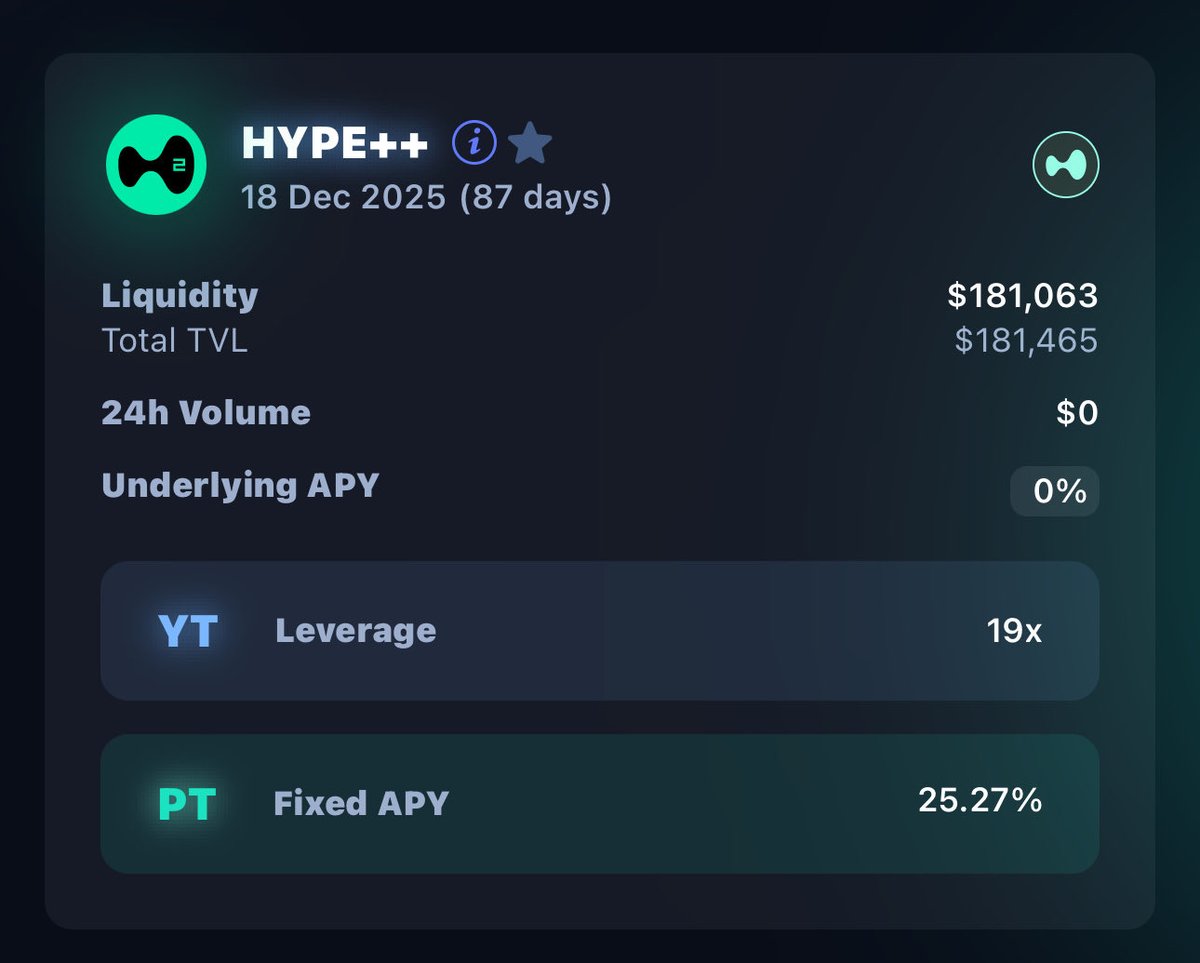

🚀 HYPE++ New Epoch: USDH Alpha Special (🏦 77% historical APR for the flagship) Fresh inflows are pouring in: 💧 1.5M → 6.6M USDT0 on Hyperliquid 💧 +3.5M already live on Arbitrum 💧 + new Ethena Labs sleeve dropping this weekend on Ethereum 👀 Cross chains yield

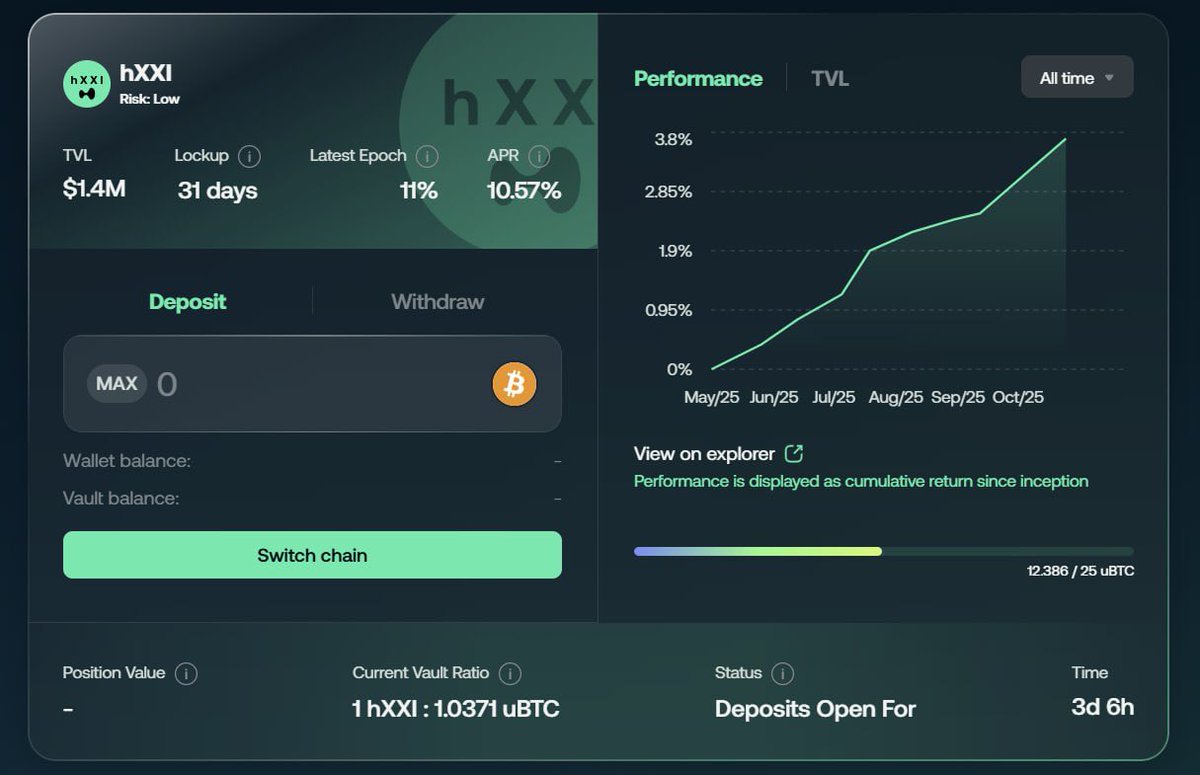

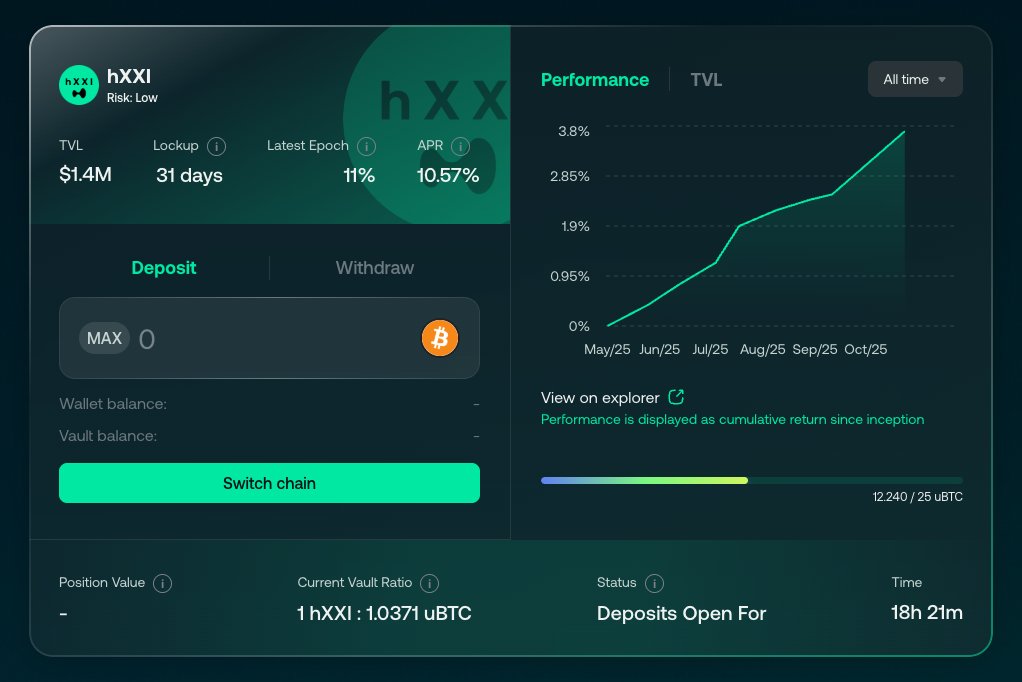

Best $BTC real yield in all of DeFi — and farming Unit and Hyperliquid S3 at the same time? 🤝 Any thoughts, Stephen | DeFi Dojo? 👀 hXXI just wrapped an exceptional epoch: ✅ +11% APR last epoch ✅ 10.6% APR since inception (+3.7% cumulative) ✅ No exposure / risk for most