Slurms MacKenzie

@crypto_slurm

Highly addictive crypto slurm (may cause conviction) | 3x bear market thriver | Web3 advisor, angel investor | Follow before it’s consensus

ID: 66188538

16-08-2009 20:40:59

1,1K Tweet

29,29K Takipçi

863 Takip Edilen

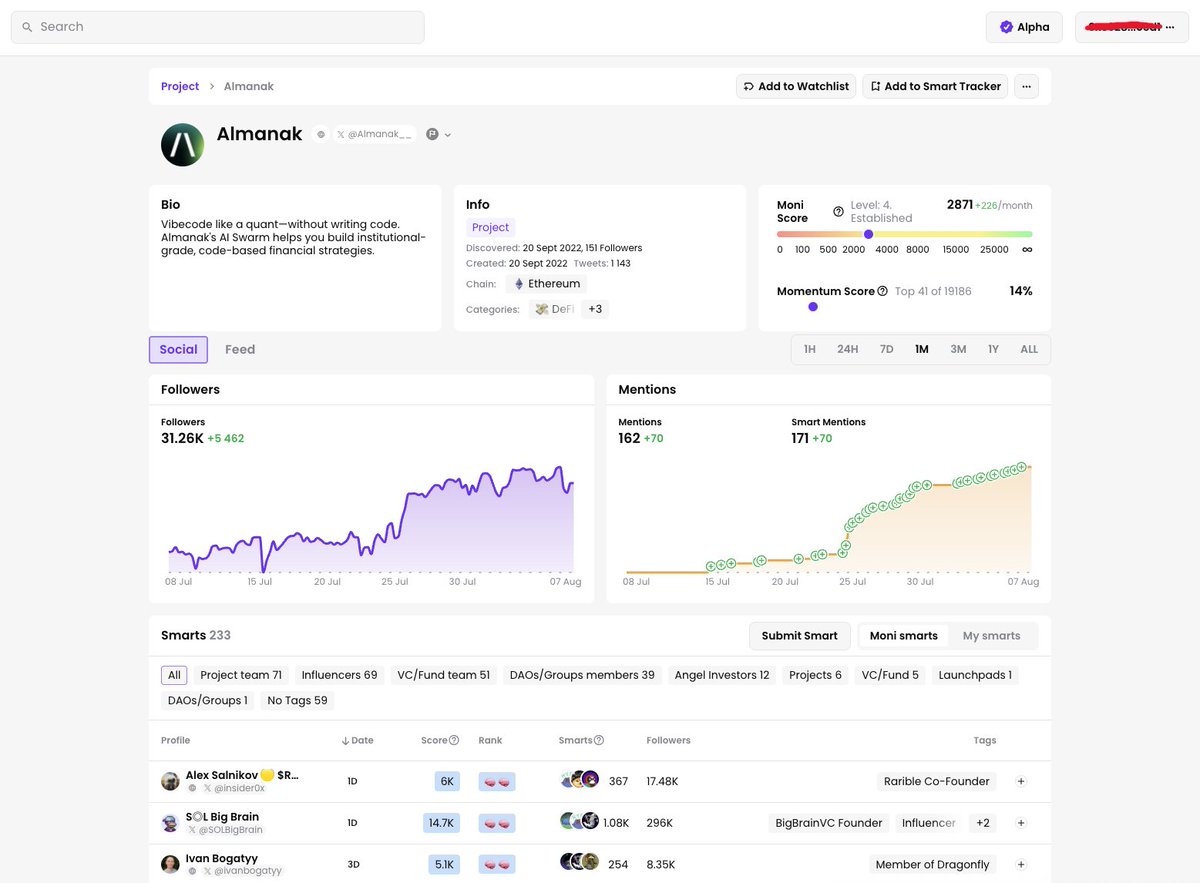

Almanak is right in the mix of the next great liquidity war. Bitcoin Sage said it best: the game is shifting to agent-routed capital. Protocols can now bribe AI agents to steer flow toward their pools, a new primitive for bootstrapping liquidity. The synergy with platforms like

0/ Exploring how tokenization on Ethereum can reach its full potential. A guest thread by Carlos Domingo of Securitize. 2025 will likely be remembered as the year of tokenization. Today, we’re looking at why that is and how we can accelerate that future.

“If AI can discover cures for every cancer, those people should get rich. But the whole world should also get a cheap cure.” — Sam Altman What if it’s not a traditional company that does this, but a DeSci community? Democratizing compute, funding, and discovery so breakthroughs in