ASYMMETRY®

@asymmetryetfs

ASYMMETRY® ETF managed portfolios for asymmetric risk-reward. #RiskManagement #asymmetric

ID: 2984607711

18-01-2015 20:55:13

229 Tweet

182 Takipçi

99 Takip Edilen

Wow! time flies when you're having fun! Just noticed my StockCharts.com subscription crossed the 15-year mark... and it speaks for itself. #Quant #TechnicalAnalysis #DataScience #DataAnalytics #Charts #TrendFollowing #trading

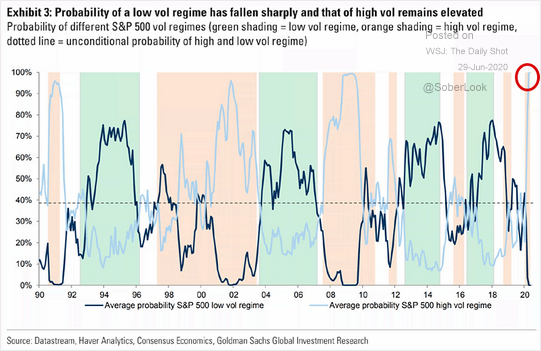

GS Forecasts Market Volatility Regime To Persist - it is the highest level in 12 years, more probability of a market move to the downside as volatility persists. Lance Roberts Michael Lebowitz, CFA Danielle DiMartino Booth Nomi Prins #Traders #spx Nick Colas & Jessica Rabe (DataTrek) Harris Samaras Mike Shell