Dorian Gray

@analystlearner

FinancialRealPolitik, Repo, Monetary Plumbing & Joga Bonito 🤙. Crisis observator. PSG 🥰

ID: 1166314928959053825

http://analysebourses.com 27-08-2019 11:42:12

12,12K Tweet

2,2K Takipçi

489 Takip Edilen

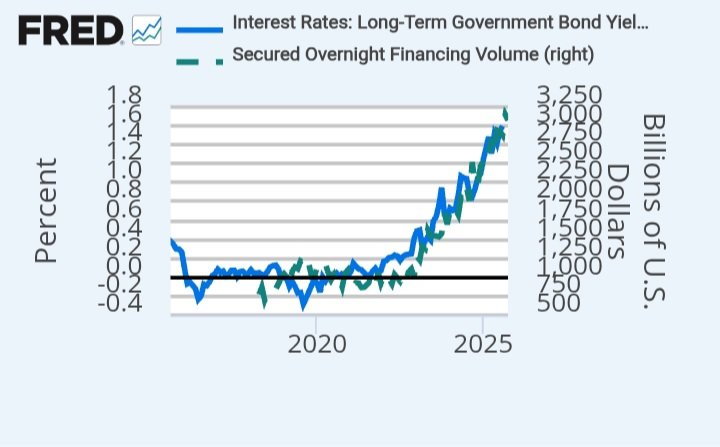

Forward & yield futures curves, spreads maturity 3-month #SOFR & #Euribor for the trading day of 09/30 have been published online US : analysebourses.com/us/SOFR3M.html analysebourses.com/us/Euribor3M.h… FR : analysebourses.com/SOFR3M.html analysebourses.com/Euribor3M.html #Forward #Curves #futures #rate