Mary Biekert

@_marybiekert

Shareholder Communications @Fidelity; Former reporter for Bloomberg @Business; @ColumbiaJournMA Alum

ID: 826112291229802497

https://www.bloomberg.com/authors/AVRjvPX3Xew/mary-biekert 30-01-2017 16:58:13

825 Tweet

908 Takipçi

1,1K Takip Edilen

High-risk companies that tapped the $1.4 trillion U.S. leveraged loan market have been largely insulated from rising short-term rates. Now they’re about to feel the pain. w/ Mary Biekert Dan Wilchins bloomberg.com/news/articles/… #leveragedloans #leveragedfinance #libor #sofr

The leveraged loan market has found a way to compete with private credit -- offer broadly syndicated unitranche loans. W/ Jeannine Amodeo David Brooke bloomberg.com/news/articles/… #privatecredit #directlending #leveragedloans #leveragedfinance #levfin

Almost 40% of capital raised in #privatecredit markets last year went to the 10 biggest funds, according to a new report. One of my latest with David Brooke bloomberg.com/news/articles/… #directlending #leveragedfinance #levfin

A gauge of the dollar’s strength rallied to a record high Thursday as Treasury yields climbed, while the yen slumped past the key 140 level for the first time since 1998. My latest for Bloomberg Markets bloomberg.com/news/articles/…

That feeling when you wake up at silly o'clock to find the $JPY has cracked 140 because the dollar is still king... bloomberg.com/news/articles/… via Mary Biekert and I

Swiss franc no longer a sure bet as the ECB contemplates jumbo hike bloomberg.com/news/articles/… via Mumbi Gitau Grace Mary Biekert

Japan’s finance chief helps draw a line — for now — under the rapidly unraveling yen bloomberg.com/news/articles/… Today's latest for Bloomberg Markets

It's been a crazy week in FX markets. Ending it with the pound plunging to a fresh 37-year low against the US dollar, inching ever closer toward parity, is the *cherry* on top - with Libby Cherry bloomberg.com/news/articles/… via Bloomberg Markets

From stocks to bonds, credit to crypto, money managers looking for somewhere to hide from the Fed induced storm battering virtually every asset class are finding solace in a long reviled corner of the market: CASH. Latest with Liz Capo McCormick and Alex Harris bloomberg.com/news/articles/…

The British pound tumbled to a record low Monday, but speculators are betting it will slide further to a level that was virtually unthinkable in recent decades: $1 or less. My latest for Bloomberg Markets bloomberg.com/news/articles/…

The US dollar’s galloping strength is likely to reduce the profits of a third of the companies in the S&P 500 this quarter bloomberg.com/news/articles/… via Bloomberg Daniela Sirtori Mary Biekert

The collapse of the pound and UK government bonds in the wake of Liz Truss’s historic tax-cutting plan has exposed vulnerabilities in a usually sleepy corner of finance bloomberg.com/news/articles/… via Bloomberg Markets

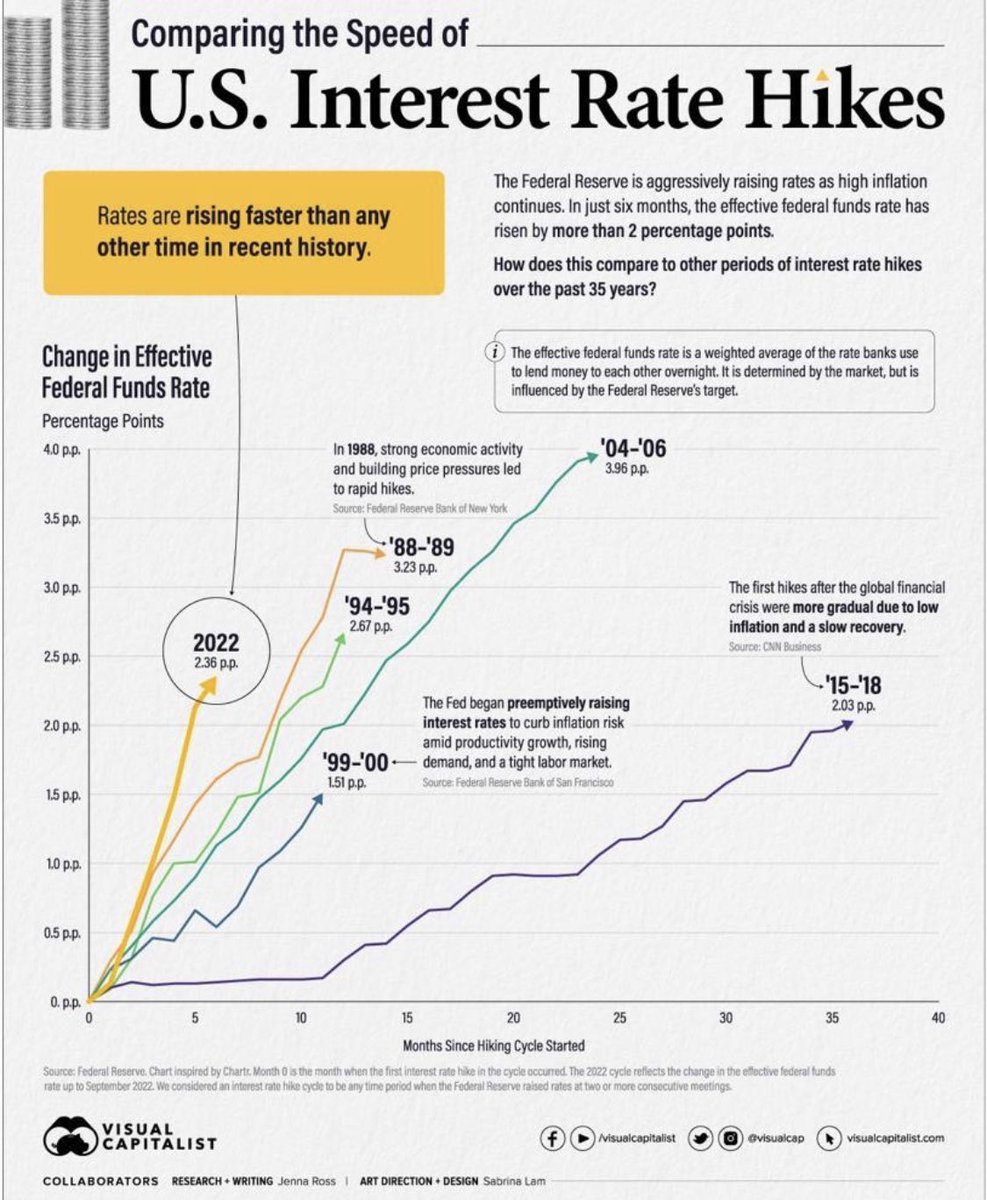

From Visual Capitalist and consistent with the now widely held view that the #Fed was very late in understanding and responding to #inflation. The resulting “HFL” approach to rates — higher, faster and for longer — is translating into the most front loaded rate cycles in recent history.

![Elena Popina (@lena_popina) on Twitter photo With four sessions to go, the S&P 500 has posted seven 1% down days so far in September, which ties for the most since [checks notes]

March 2020. With four sessions to go, the S&P 500 has posted seven 1% down days so far in September, which ties for the most since [checks notes]

March 2020.](https://pbs.twimg.com/media/Fdm5D1fXoAETO81.png)