Tim McQuillan

@tmcquillan1

Sales utility player. Interested in learning about investing, personal finance, channel partnership sales and fintec. Experienced in all. All comments my own.

ID: 53124023

https://www.t-m-sales.com 02-07-2009 17:16:02

119 Tweet

94 Takipçi

493 Takip Edilen

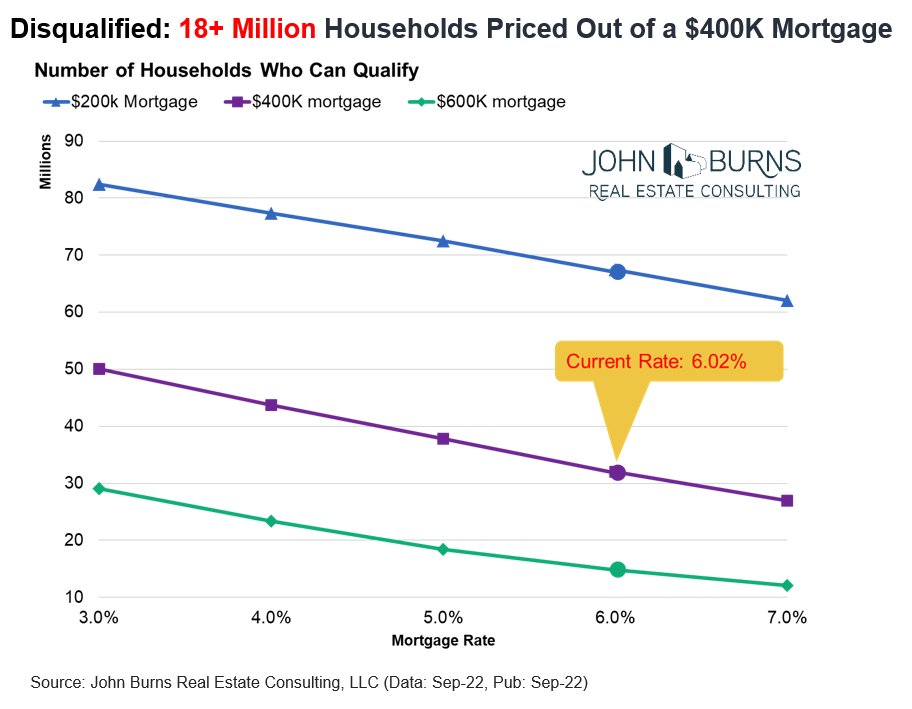

"I'll take types of mortgages and how to compare them for $500." Learn everything there is to know about #Conventional, #FHA, term lengths, fixed v variable rate loans in our latest blog by Zina Kumok - Personal finance writer/speaker 🇺🇦. Let's simplify the homebuying process. hubs.li/Q015PX-q0

Mark Sauer Kind of amazing for 2022 right? Globally speaking, more people have smart phones than a reliable place to park capital for 2 years without having to think about it. What does that say about the state of the global financial system?