TheValueist

@thevalueist

L/S in themes in tech and energy. Results never lie. Not financial advice.

ID: 1838186195508969472

http://buymeacoffee.com/thevalueist 23-09-2024 11:59:17

2,2K Tweet

560 Takipçi

322 Takip Edilen

TheValueist This is actually a very impressive list, well done. Most folks that attempt to map the physical AI landscape focus on the same large companies that sell robotic arms or chips. In reality most of the content of a robot are the boring mechanical parts like motors, bearings,

Today, we’re announcing ZT Systems’ US-based manufacturing team has found a new home with Sanmina Corp. Through this divestiture, AMD and the world-class ZT Systems design team will partner closely with Sanmina to build advanced rack and cluster-level AI systems. Building on

The best reason to follow The Wall Street Journal is to quickly read the front page as laid out.

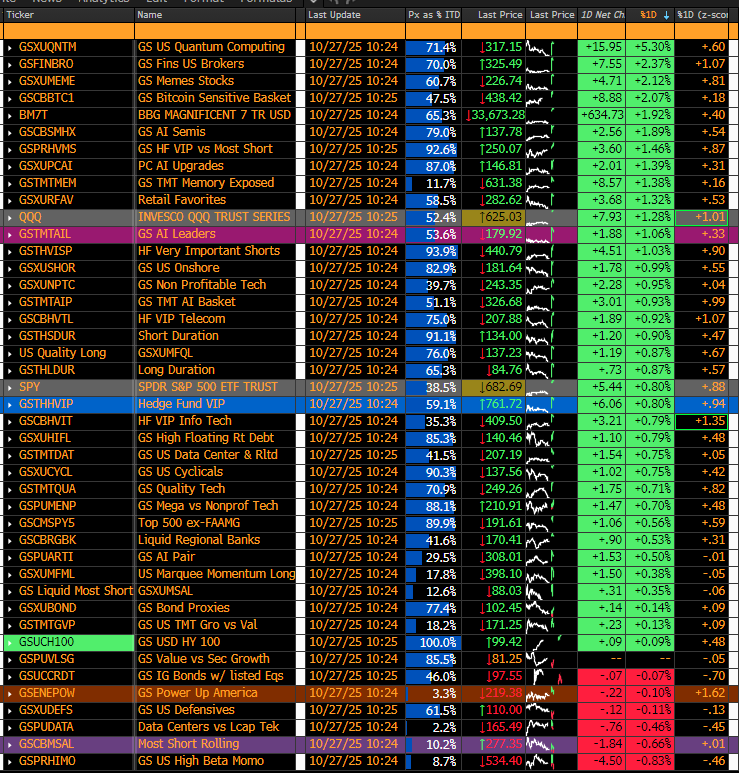

The TheValueist Factor Basket Report as of 10:24 am on 10/27/25. Executive Summary: The opening tone is risk‑on but with a notable rotation back toward megacap growth leadership and away from the broad squeeze dynamic that dominated 10/23–10/24. “Quality over speculation”