David

@therightrisk

Raised in the dirt of Northern New England

-may the odds forever be in your favor-

ID: 2276415613

http://usdebtclock.org 04-01-2014 17:28:19

22,22K Tweet

1,1K Followers

5,5K Following

Consumer buying conditions for vehicles (blue), homes (orange), and large household goods (white) have rebounded but are still weak relative to history per University of Michigan

Larry McMillan Market Update - Thank you Lawrence G. McMillan ! youtu.be/kUte-mPnFC4?si…

The The Conference Board leading economic index (LEI) made a new cycle low in June … max drawdown extended to -17.8%

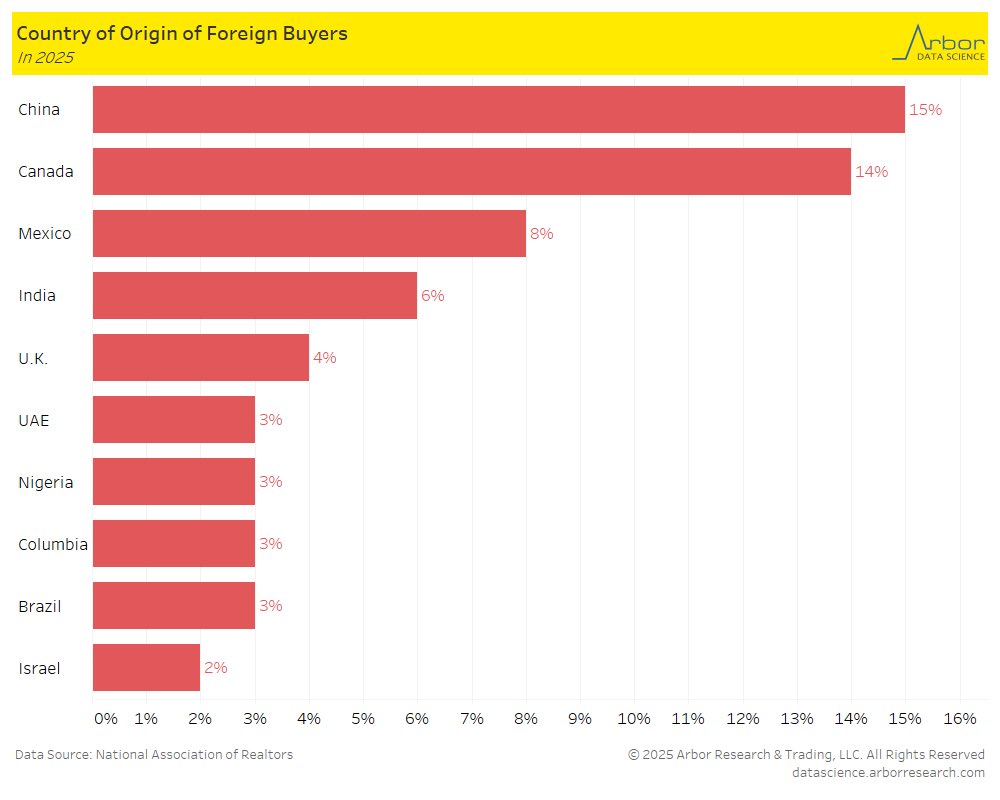

So far in 2025, buyers from China were largest group of foreign purchasers of U.S. homes (at 15%) ... Canada followed at 14% and then Mexico at 8% per National Association of REALTORS® Arbor Data Science