Nick Garcia

@thecurious_gark

@_Fortunafi | @spacewhalecap

ID: 396079147

http://www.fortunafi.com 22-10-2011 18:20:22

2,2K Tweet

1,1K Followers

3,3K Following

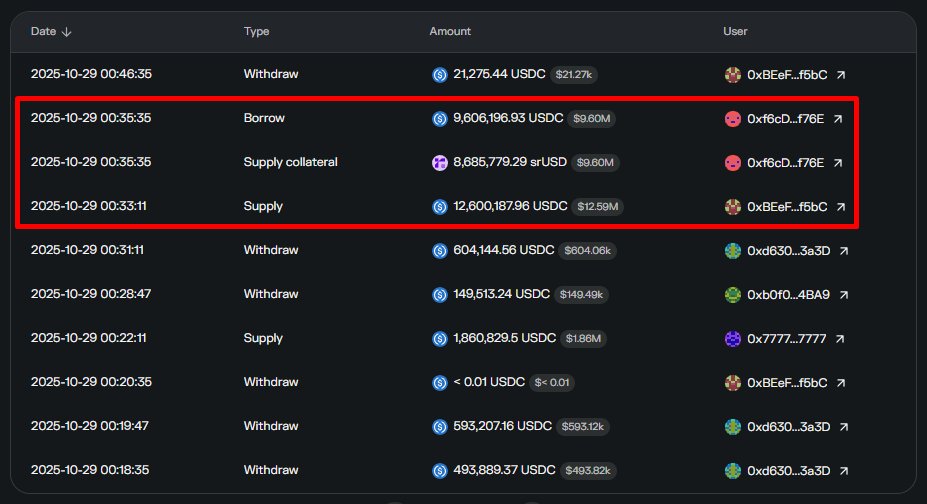

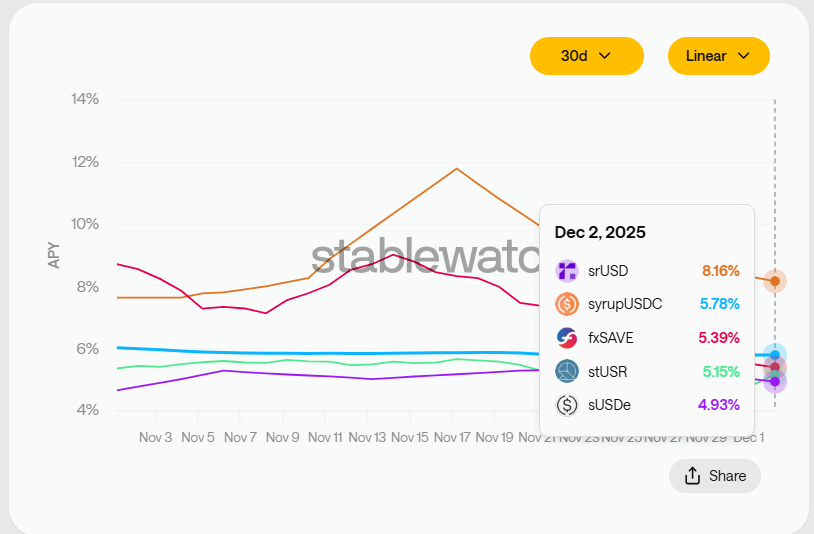

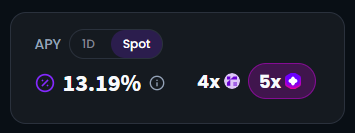

We are so back. Reservoir loops on Fusion (by IPOR) are back into double digits and stabilized. Reservoir loops are great again. app.ipor.io/fusion/ethereu…

We are excited to bring Reservoir yield to Monad (mainnet arc) Soon, users on townsquare ❏ (mainnet arc) can access wsrUSD one of the most transparent, highest yielding stablecoins in DeFi. MonadVoir loading...

Reservoir says gMonad wsrUSD and rUSD now live on Monad (mainnet arc) Choose Reservoir for the highest cross chain yields