The Chartist

@thechartist

Proven, systematic share market strategies.

Membership | DIY Turnkey Code | Managed Accounts

Tweets by Nick Radge

thechartist.com.au/risk-stat

ID: 23002939

http://thechartist.au 06-03-2009 00:17:12

28,28K Tweet

46,46K Followers

384 Following

"...the risk isn’t owning too much of the future, but owning too little of it." Via Rudi Filapek-Vandyck Long and strong 💪

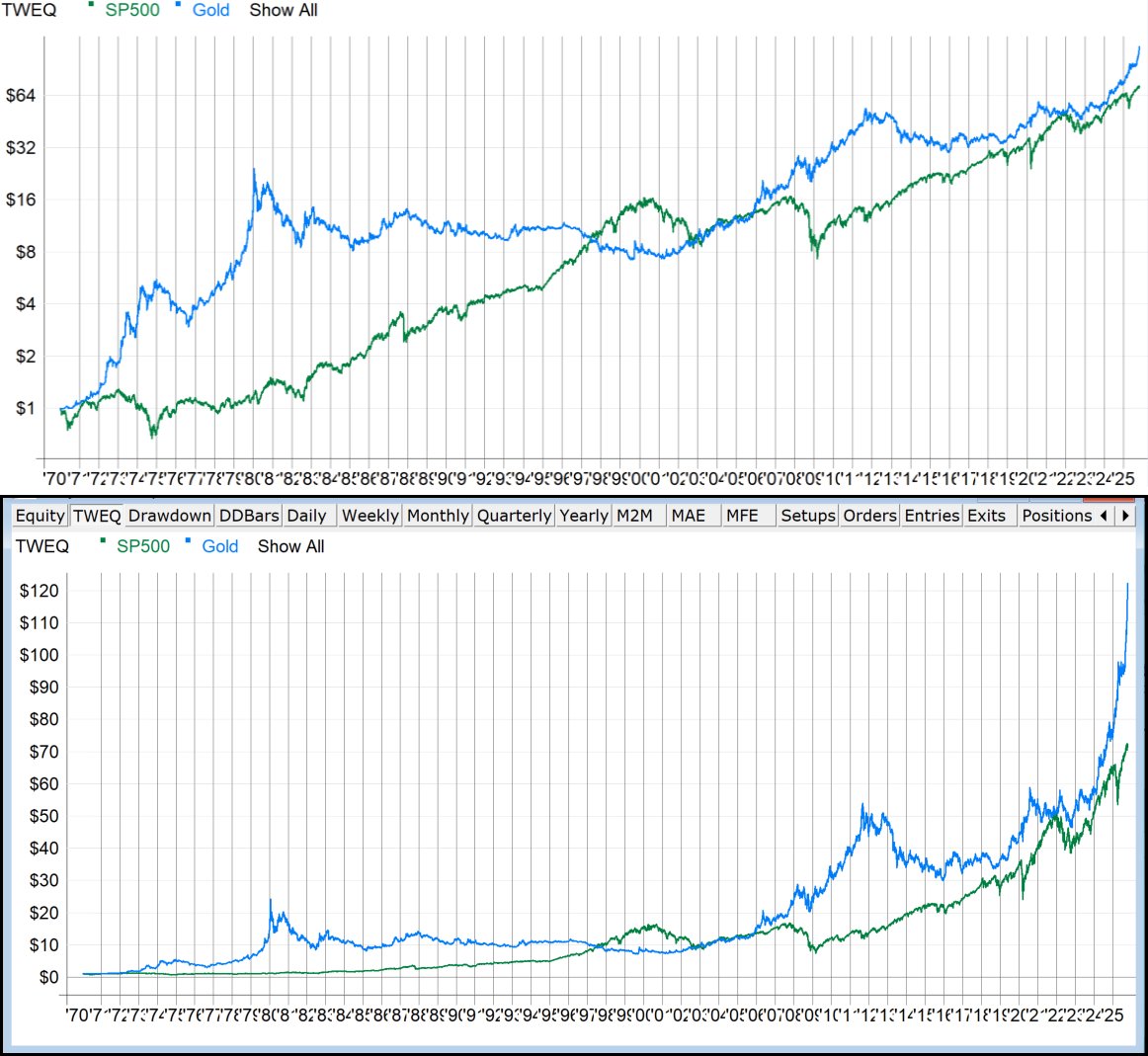

Wonderful presentation from Nick Radge The Chartist. On why you should test out any strategy for a sufficent enough time to let probabilities play out. Thank you! youtu.be/ew1L6SLpHgM?si…

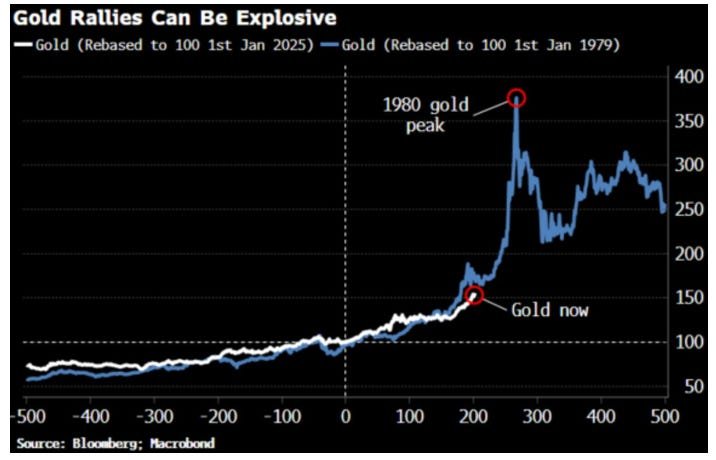

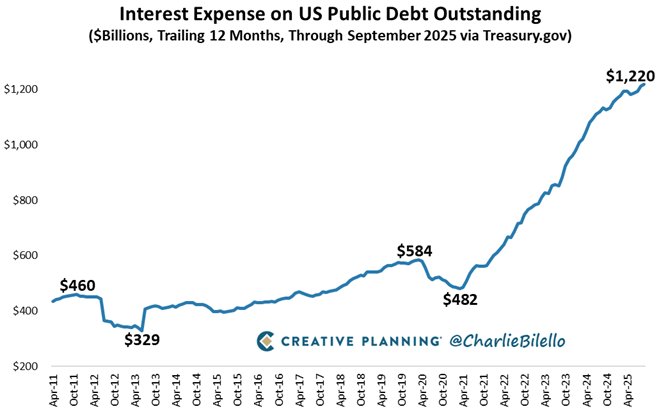

Amazing chart from Charlie Bilello and the reason $GLD is steaming higher... "The Interest Expense on US National Debt rose to a record $1.22 trillion in the last 12 months, more than doubling over the past 4 years. The US Government now spends more money on interest than it

Via Steve Burns Everyone is a trader. Some people trade time for a paycheck. Some people trade risk for profits. Some trade happiness for security. Some trade principles for politics. Some trade ethics for cash.

"A bad trade often sends a trader down a path of negative self defeating thinking and behaviour. Many enter a spiral they never escape from. Remembering your good trades and staying positive is hard but beneficial for success." - Peter Robbins

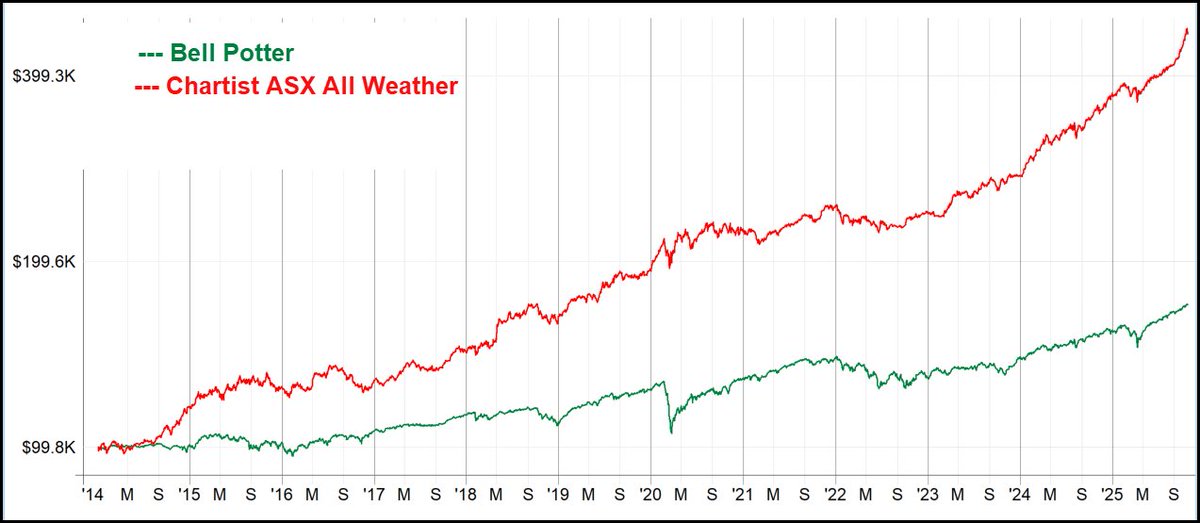

Interesting article by Livewire Markets on a Bell Potter diversified ETF portfolio. Here's the article link: livewiremarkets.com/wires/a-stockb… Obviously, with my current interest in All-Weather, I had to code this one up for comparison. A few caveats/notes: 1. Where an ETF is not yet