Adam French

@thatadamfrench

Snr. Editor @NerdWalletUK. Sometimes on TV & radio talking money, consumer rights and scams • Ex @whichuk • Off Twitter, find me on LinkedIn instead

ID: 832186369594294272

https://linktr.ee/adamfrenchuk 16-02-2017 11:14:26

4,4K Tweet

1,1K Takipçi

2,2K Takip Edilen

We are pleased to announce the shortlist for the BEST PODCAST 🎙category: olive magazine Immediate Which? Dawn Connelly Carolyn Wickware Nigel Praities geoffreylondon Carolyn Wickware gal-dem @podpodofficial Campaign

As a Suffolk boy (although now crossed the border to Norfolk), it was a pleasure to pop up on BBC Suffolk to discuss price rises, cost-cutting and support available with Sarah Lilley Listen back here (from 2.10): bbc.co.uk/sounds/play/p0…

The recent 'cheap-money' era is ending, but high inflation means your cash isn’t buying as much as it once did either. So, what can you do about it? nerdwallet.com/uk/personal-fi… NerdWallet UK

I've started a new role as Head of News and Comms at Moneyfacts Group plc. Come talk to us about: 👉 Rates, rates, rates: the financial data Moneyfacts has is frankly staggering 👉 Making sense of the financial decisions we all face. 👉What financial trends mean for the economy.

Moneyfacts: Warning for higher rate taxpayers with more than £14,500 saved says Adam French Read more here: moneyfactsgroup.co.uk/media-centre/c… #moneyfacts #financenews #moneyfactscompare #tax #savings

Lovely to make a brief appearance early on BBC Breakfast this morning discussing some of the pitfalls of the current Lifetime ISA regime. Moneyfacts Press

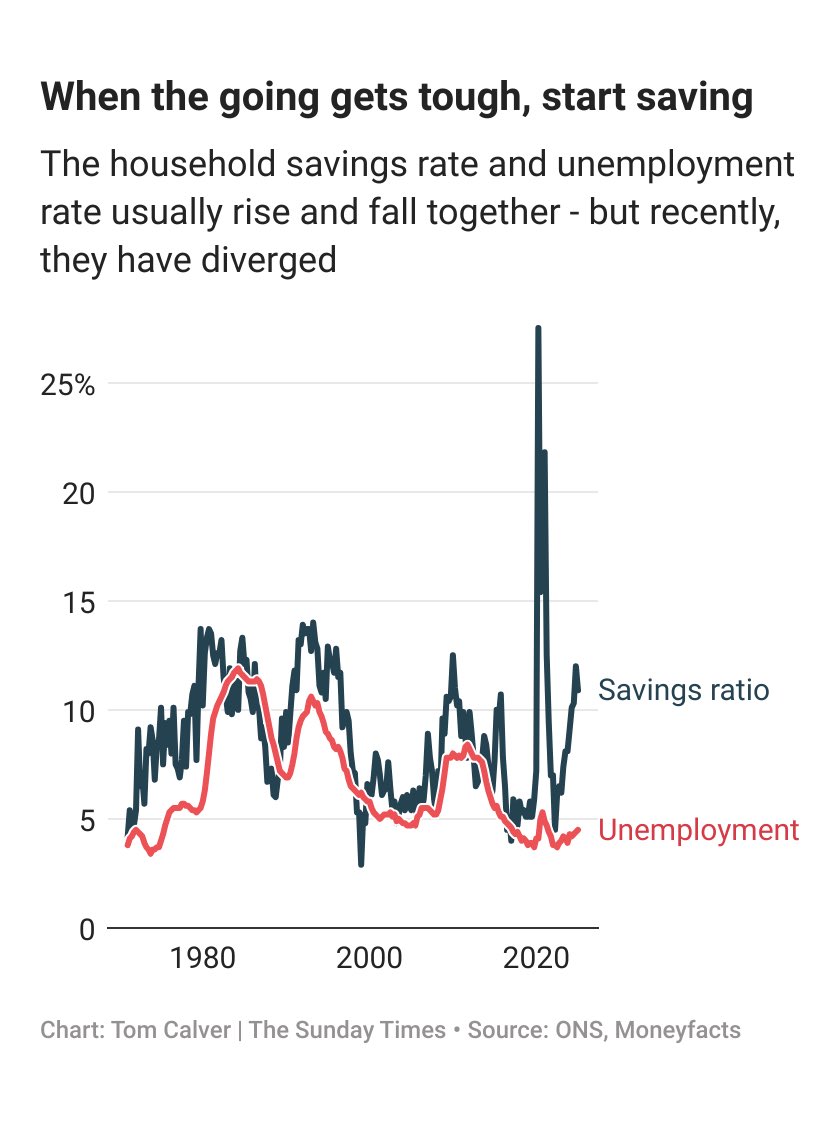

This week’s The Times and The Sunday Times column is about how we’re bad at investing Decades of data shows that rather than investing for profit, UK savers are motivated by pessimism This “when shit hits the fan, save all you can” approach is bad for our finances, and bad for the economy 1/4