Ted Chen

@tedchencpc

Founder of @CarnegieParkCap, Sponsor of @TLGYAcq, and Co-Founder of @Stablecoin_X

ID: 1954331832406728705

10-08-2025 00:00:34

0 Tweet

2 Followers

15 Following

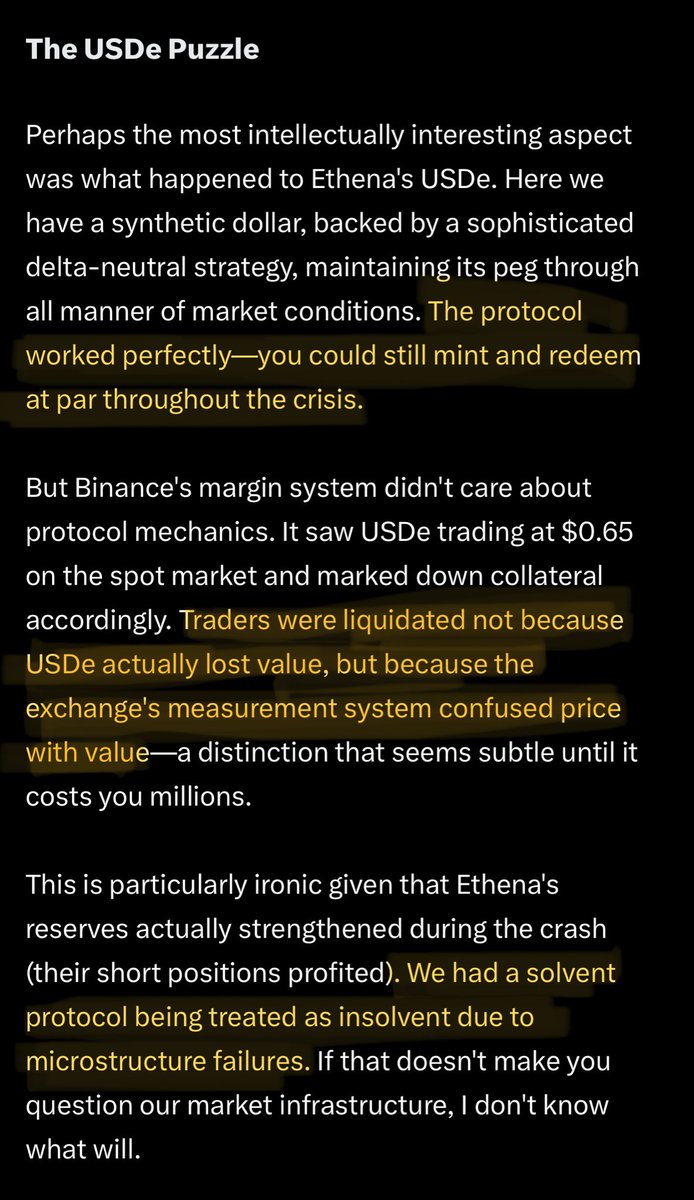

Ethena did NOT depeg, agreed with Haseeb >|< but there's a shorter, clearer description imo: The peg is not defined as the price on a single venue. If I create a centralized place where I buy/sell USDC for $.90 for a few hours does that mean “USDC is depegged?” Of course not. The