JT

@tcmllc

Growth stock investor focused on finding the next SUPER WINNERS. 26 yrs experience, life long student, and founder of TickerMonkey.com traders community

ID: 32362720

http://www.tickermonkey.com 17-04-2009 10:29:59

23,23K Tweet

27,27K Takipçi

707 Takip Edilen

Trading in the Zone came up yesterday morning, so it made for a great moment to review some notes on it. Zach Lucido made a great 11 page summary back in 2014 and these are just a few of the quotes contained therein. "When you learn the trading skill of risk acceptance, the market

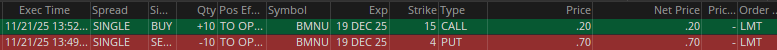

Another great opportunity for folks interested in TradingView Let TML Trader know what your TML candidate is!