Taxation Updates (CA Mayur J Sondagar)

@taxationupdates

CA | Tweets are personal | Retweet ≠ endorsement 🇮🇳🇮🇳🇮🇳

ID: 1151530035192328192

https://whatsapp.com/channel/0029Va52NFa1SWt3oyF1Hk1g 17-07-2019 16:32:09

7,7K Tweet

91,91K Takipçi

243 Takip Edilen

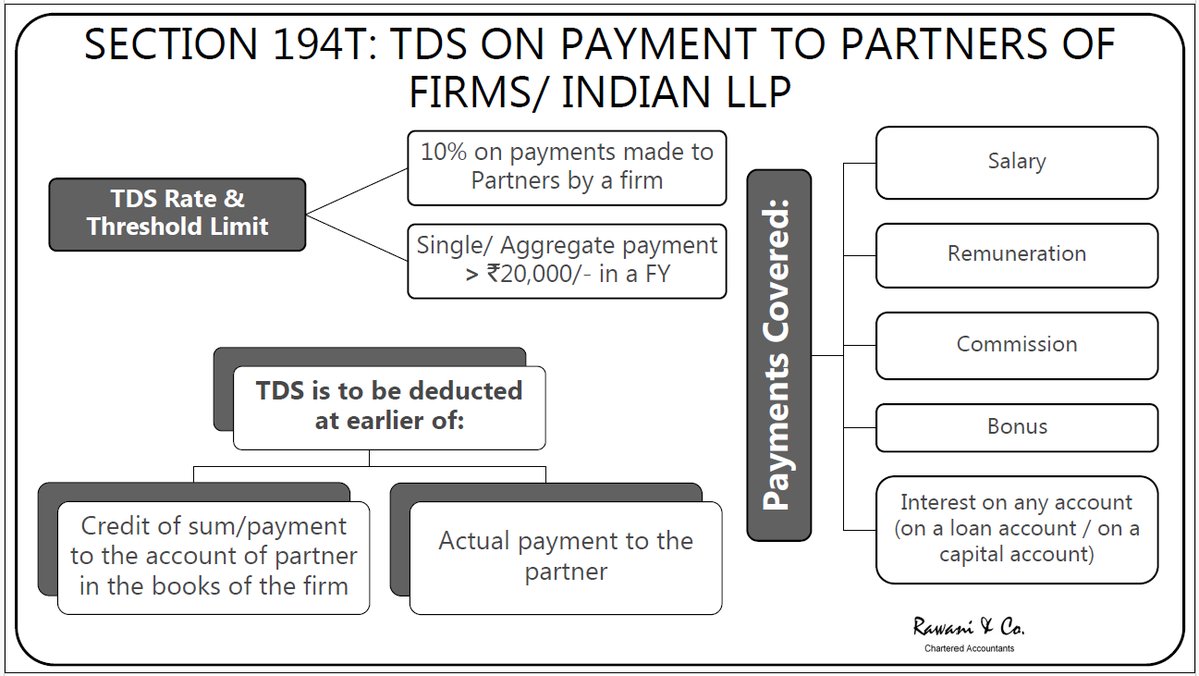

PRESENTATION ON "INCOME TAX PROVISIONS FOR ASSESSMENT YEAR 2025-26 & CHANGES IN ITR" Content Credit to Avinash Rawani PDF Link : drive.google.com/file/d/1HmtuVZ…

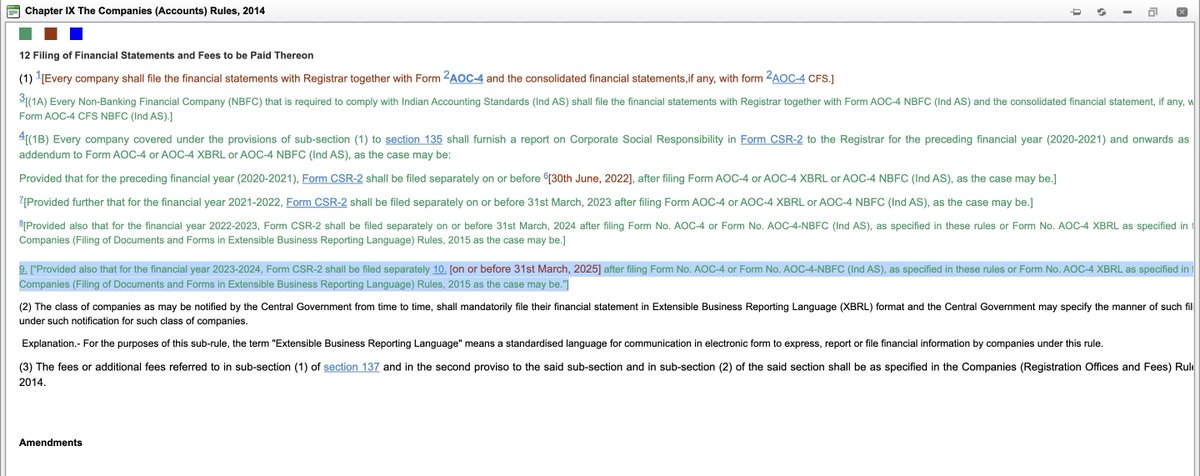

Due date for filing of Form CSR 2 for FY 23-24 is further extended till June 30, 2025. #CSTwitter Thank you Taxation Updates (CA Mayur J Sondagar) for always sharing timely updates. Link of egazette: egazette.gov.in/WriteReadData/…

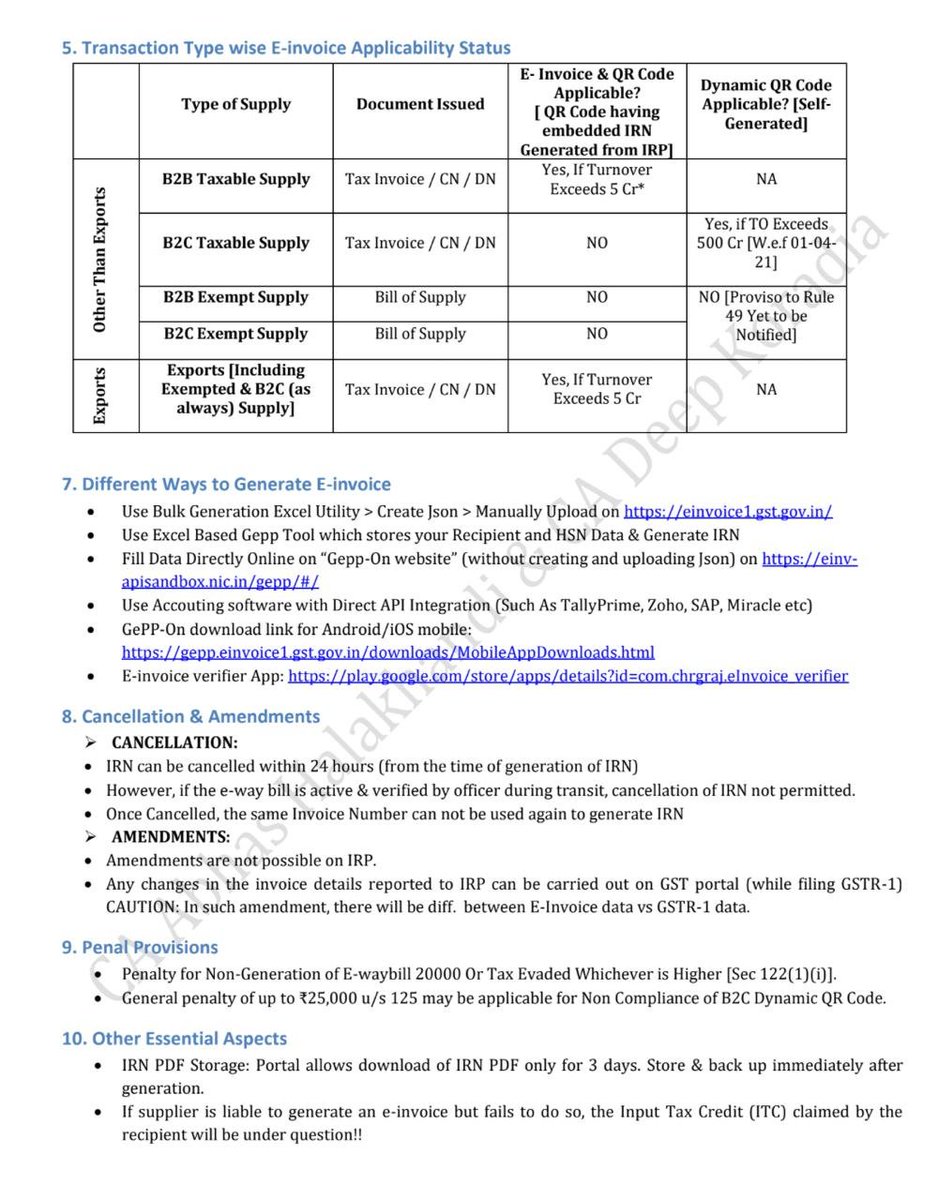

🚨 E-Invoice & Dynamic QR Code — Master Summary All rules, thresholds, exemptions, penalties, latest advisory and more, packed in ONE place! 📄✅ Prepared with GST Wizard CA. Deep Koradia 👍 Link to PDF bit.ly/E-Invoice-Summ…

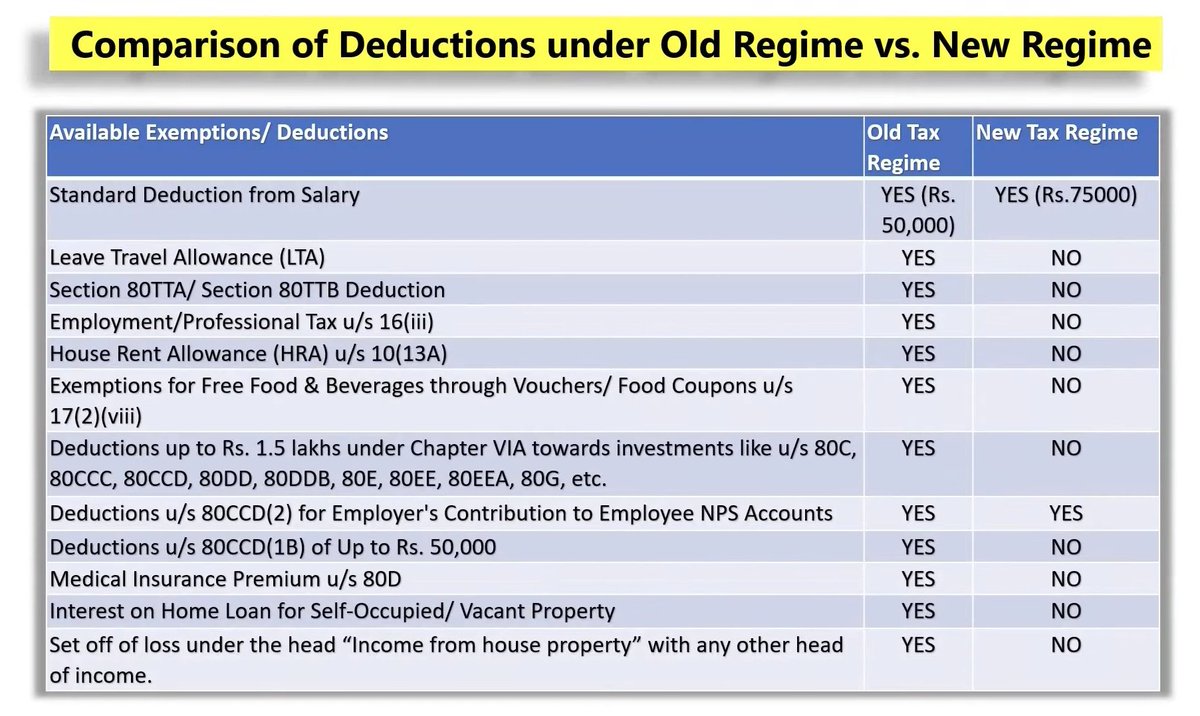

Income Tax Rates under New Tax Regime and Old Tax Regime Comparison of Deductions under Old Regime vs New Regime Content Source Income Tax India

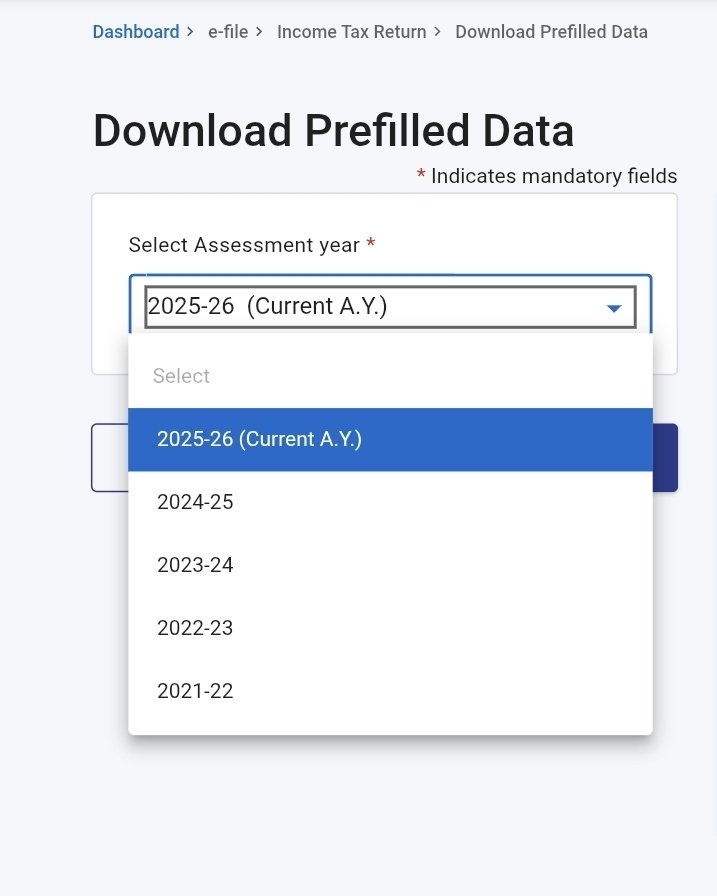

ITR Filing Started for AY 2025-26 For ITR 1 and ITR 4 Excel Based Utility and Schema Released for ITR 1 and ITR 4 Prefilled Data Download option enabled for AY 2025-26 ITR Filing due date 15/09/2025 Income Tax India