Tarun

@tarunmallappa

- deep-dives on India 🇮🇳; education, business and economic progress;

- always looking for the next big opportunity in India.

- finance professional;

ID: 91738093

22-11-2009 06:26:27

3,3K Tweet

9,9K Followers

386 Following

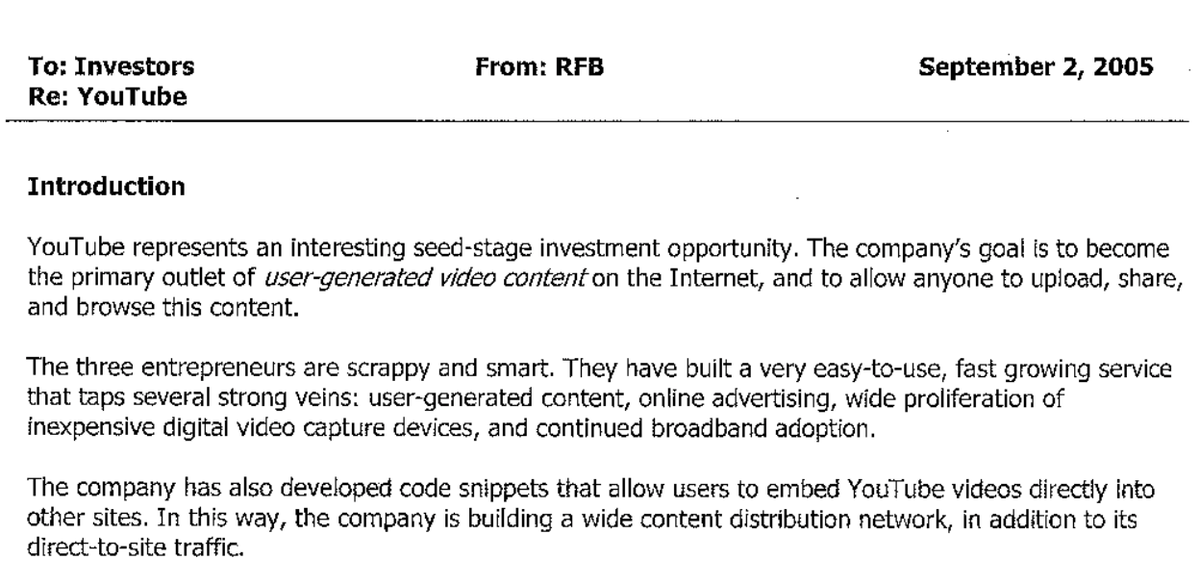

AS one of the most prolific opportunity spotters signs off from Sequoia Capital, this stands out as a testament to his amazing investment skills; Dear Roelof Botha - Thank you for inspiring a generation on how to write investment memos and for that matter any memos needing decision

Deep Kalra (Deep Kalra) wishes tough times to every founder in his/her early days. Such nuances can only come from people who have executed from the trenches; If you are a founder, in whatever domain you are operating, brace yourself for a phase which will ask you

Investment announcement in lenskart by then IDG Ventures 14 years ago in 2011. It took courage to actually back a founder with $4 Mn funding in 2011 when venture as an asset class was in its infancy in India. Kudos to the team at Chiratae Ventures for spotting this opportunity way