The Energy-Efficient Commercial Buildings 179D Tax Deduction, is a tax incentive first introduced in 2005 as part of the Energy Policy Act.

Read more: taxpointadvisors.com/blog/view/impr…

#energyefficiency #taxdeductions #cpa #taxsavings

Optimize payroll management with accurate calculations and compliance guidance. Efficient salary disbursement and tax deductions. #Payroll #Consulting #Services #Salary #Compliance #TaxDeductions

EOFY is upon us! Check out our recording (or read the summary) of our recent webinar on Business Tax Planning and download our EOFY business tax checklist hubs.li/Q01V0vCf0

#businesstax #taxplanning #taxdeductions

Ways You Can Write Off Business Vehicle Expenses

auxag.com/insights.php?i…

#tax es #tax #tax deductions #accounting #bookkeeping

Traveling For Business This Summer? Here’s What You Can Deduct: hubs.ly/Q01VXgsj0 #tax #businesstravel #businessadvice #smallbusiness #tax deductions

Turn your summer gathering into a smart business move! 💼🔍 Learn the strategies to make your BBQ legally deductible. #TaxDeductions #BusinessExpenses #SummerBBQ #TaxPlanning

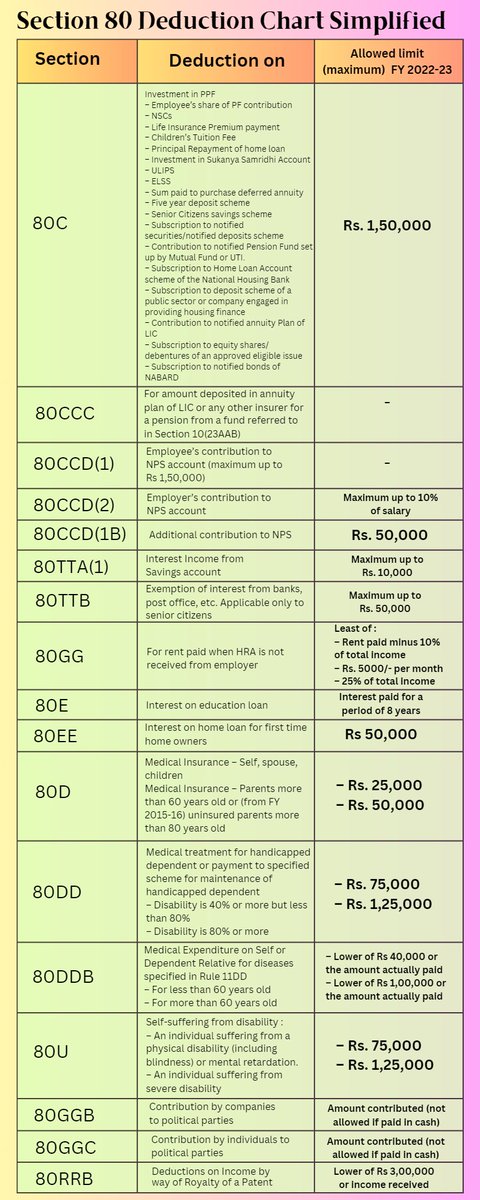

Why File ITR With SriBalajiTaxServices?

#incometax #taxseason #taxes #taxreturns #taxprep #taxplanning #taxprofessional #taxhelp #taxadvisor #taxrefund #taxcode #taxlaw #taxation #taxseason 2022 #taxfiling #taxstrategy #taxsavings #taxdeductions #taxcredit

Really Simple Investing Podcast, We are talking with Marissa Greeco-Reale, author and financial planner about tax planning and a whole bunch more in the interview. Maximize retirement accounts for tax deductions. Catch the interview: buzzsprout.com/2162120/126054… #TaxPlanning #TaxDeductions

Remember, it's important to speak with financial professionals such as Collins Hume BEFORE taking any action on #taxdeductions for topping up super contributions.

Let's talk collinshume.com/meet

collinshume.com/post/tax-deduc…

Looking for tax-savvy ways to donate to charitable organizations? We have you covered.

pescatorecooper.cpa/tax-savvy-ways…

#PescatoreCooper #smallbusiness #accounting #taxdeductions

TCJA does not allow itemized expenses for unreimbursed expenses like fees for internet connection.

Read more 👉 damienslaw.com/how-tax-deduct…

#SingleMemberLlc #SoleProprietor #BusinessRelatedCosts #BusinessOwner #TaxDeductions #TaxPlanning #BusinessTax #ProfessionalWorkHelping

To Book your Services, please visit taxhelpdesk.in/income-tax/

#taxdeductions #refunds #medicalbills #burden #studentloan #movingexpense #earenedincometaxcredit #service #consultant #incometaxcase #taxappeal #taxcase #fintech #investing #investments #finance #taxhelpdesk

Reduce your tax burden by taking advantage of tax deductions and credits. Work with a tax professional to ensure you're maximizing your savings! #taxdeductions #taxcredits #taxstrategy

🧑🎓 Student Loan Interest Deductions: Many countries allow you to deduct student loan interest payments from your taxable income. Understand the rules and limitations to maximize your tax savings and ease your student loan burden. #StudentLoans #TaxDeductions

🌴 Going on a summer business trip with your spouse? 🤝 Let's get into how to make this trip tax savvy ➡️ mtrsnow.com/insights/f/spo…

#summer #taxdeductions #itsawriteoff #taxes #taxcredit #erc #randd #salestax #mtrs