💙So thankful to LoLex EdTechs 🔜 #ISTELive for curating these epic #EdTech #onepagers ! the epic combo of Lois Alston and 𝑨𝒍𝒆𝒙 𝑰𝒔𝒂𝒂𝒄𝒔, 𝑴.𝑬𝒅. 🧔🏻♂️ is 🔥🔥🔥 Check out their amazing resource below! 👇👇👇

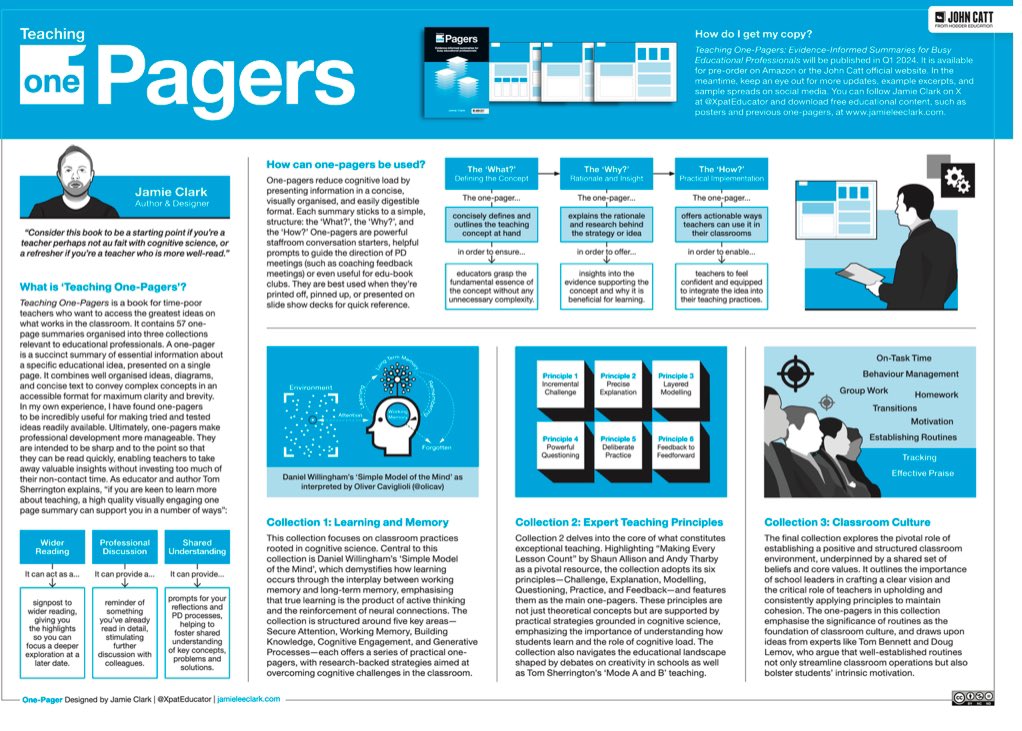

A busy first day back on campus for #StrathBusEd, marking workshop with Diane SQA, then exploring and unpicking our #questioning using some of the prompts from 5⭐️ Schools’s latest book, finishing off with Jamie Clark’s #OnePagers to link theory to practice.

My special Xmas gift has finally arrived. An excellent source of evidence-based education summaries. Amazing job. Thanks Jamie Clark 🙌🏻💯 #education #OnePagers

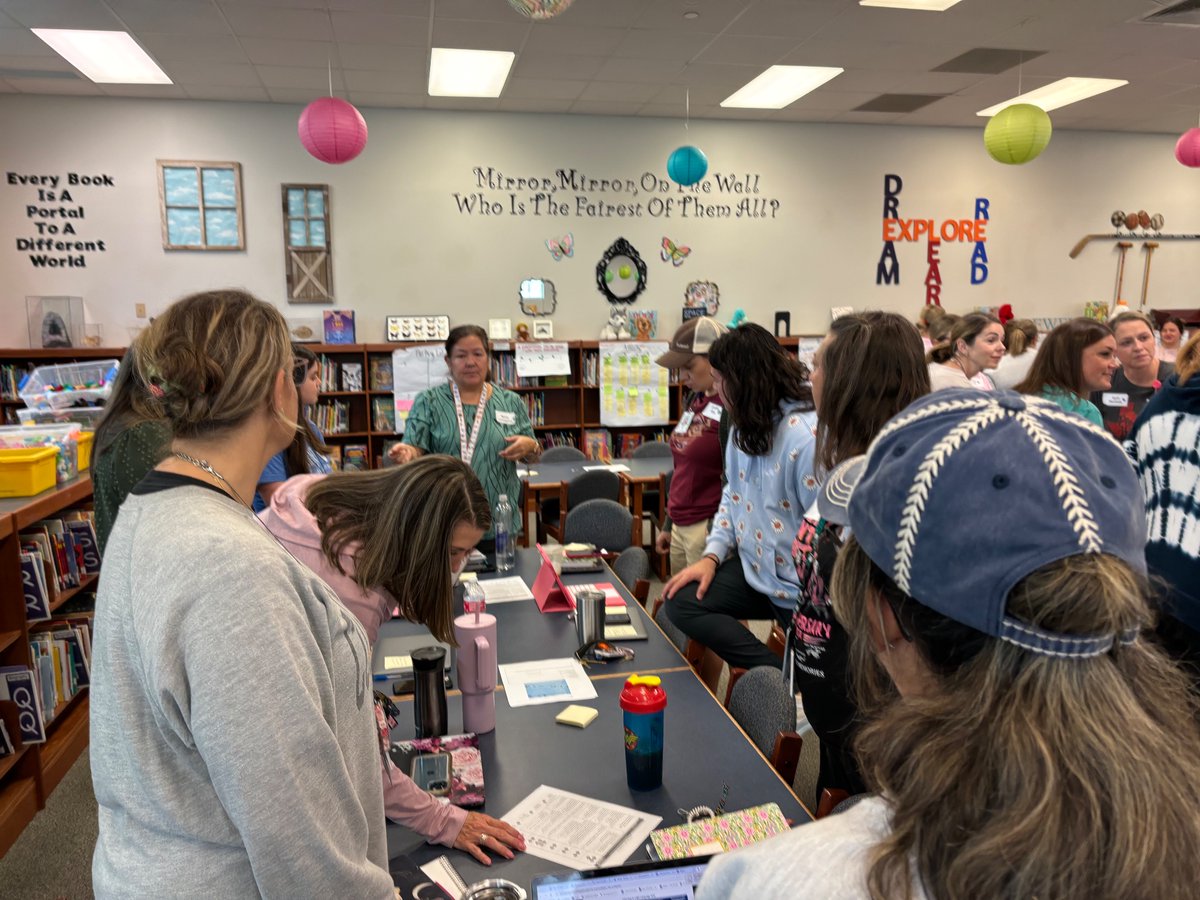

Our Pleasant Hill Elem teachers used relational practices to make connections with our #1LISD curriculum & high leverage strategies to increase student engagement! #onepagers #talkingpiece Heather Robbins

WOW!! #OnePagers by Jamie Clark (Jamie Clark) is just off the SCALE ! It's like an operators manual for being a teacher. @JohnCattEd is once again #AllKillerNoFiller ! 🔥 🔥 🔥 Rachael Goodliff #edutwitter #teachertwitter

Our one pagers projects for th solar system #solarsystem #scienceisfun #onepagers @Horn_Dream_Big Horn Library AliefLearns Alief ISD

Concluding our Civil Rights Unit! #Avid #OnePagers and our Civil Rights Journals to review for our test tomorrow! Lida Hooe Hawks #ReadingTeacher #MathTeacher #Amplify #2ndGrade

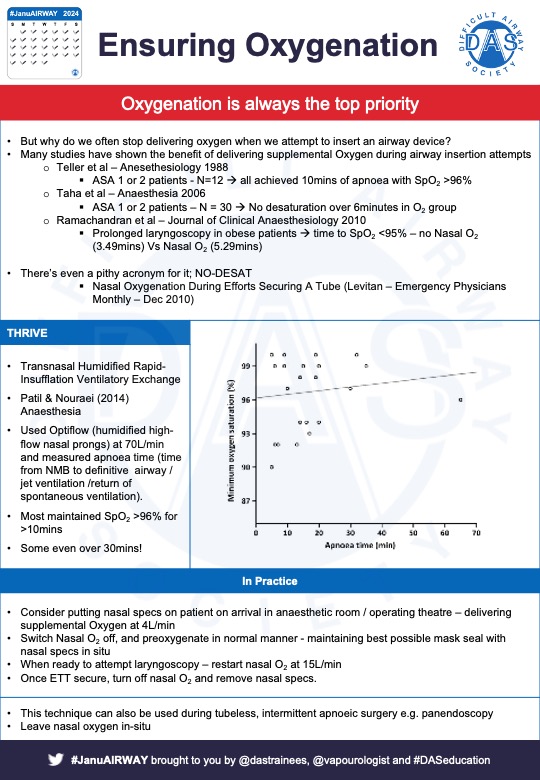

Pre/apnoeic oxygenation are key weapons, but must be done well. Patience, vital capacity breaths +/- high flow nasal oxygen are key. Here are #OnePagers on pre-oxygenation and NO-DESAT by @airwaycam & THRIVE by Anil Patel and Prof Reza Nouraei. #JanuAIRWAY 5/7