OSFI announces new stress test for uninsured mortgages mpamag.com/ca/news/genera… samuelhorsman.ca | [email protected] | 902-638-8708 | Canadian Mortgage Professional Magazine #mortgagenews

Denise Brown RE/MAX Whistler BC Canada And starting Q1 next year, OSFI guarantees lower prices

Crazy to buy now

Ben Rabidoux Most of FINTRAC’s time is spent figuring out how to download lawyers, OSFI, Banks, RCMP, legislators, and their own responsibilities onto Realtors (sales people). So at least they have a whipping boy for when public anger boils over again.

cbcwatcher Isn’t that akin to putting prayer mats inside the banks front door? Seriously. Why should/would the OSFI even consider this?

Amazing Zoltan While OSFI, is restricting mortgage lending. Our PM is providing a false hope that the stress test doesn’t make sense.

Malcolm Twizzle MapleLeaf1 Expensive housing is a double edged sword, made many rich. OSFI just made it a lot harder to borrow for investment properties, wasn't publicized but will damper buying. Policies are happening. Healthcare will improve. It's a bad time but a scorched earth mentality isn't helping.

Ian Runkle/Runkle of the Bailey @ YouTube For all intents and purposes, Canadian banks are an extension of the government. They will comply. They don't want OSFI breathing down their corporate necks.

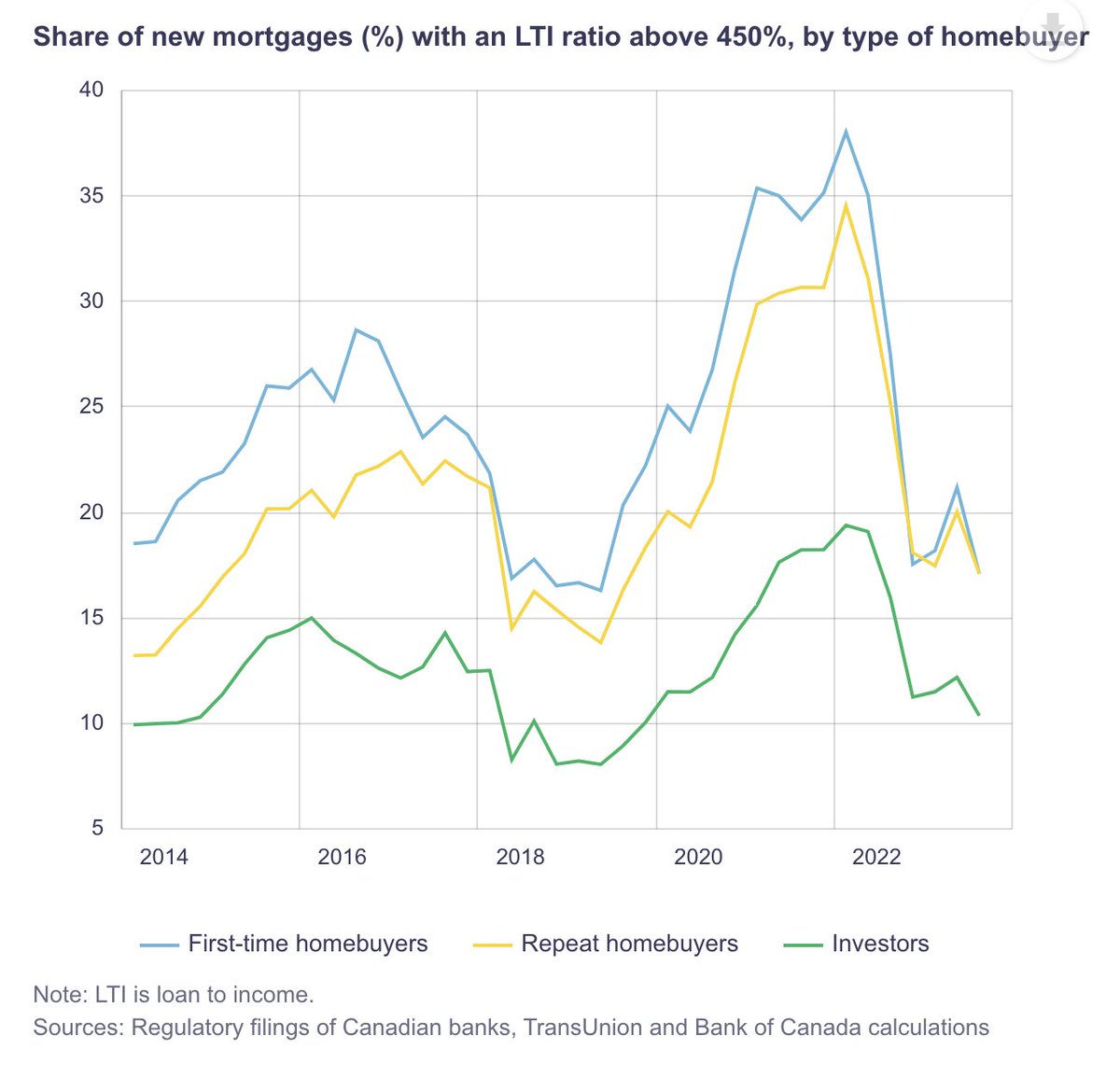

Daniel Foch OSFI said overall portfolio will be tested to ensure entire book is not > 4.5x income. You're comparing apples to oranges. There will still be people getting mortgages with > 4.5x income. There just will be (possibly) fewer of them.

The Chief Actuary Assia Billig presented scenario analyses on how #ClimateChange impacts the Canada Pension Plan.

Thank you to the Institute for governance of private and public organizations for having us!

#SocialSecurity

Martyupnorth®- Unacceptable Fact Checker BVCU outright refused to freeze any accounts regarding trucker donations. They were asked to , but disregarded it as they aren’t governed by OSFI which is the Feds. They report to CUDGC, here in Alberta, and The Feds have no oversight to them